Region:Asia

Author(s):Dev

Product Code:KRAD7634

Pages:98

Published On:December 2025

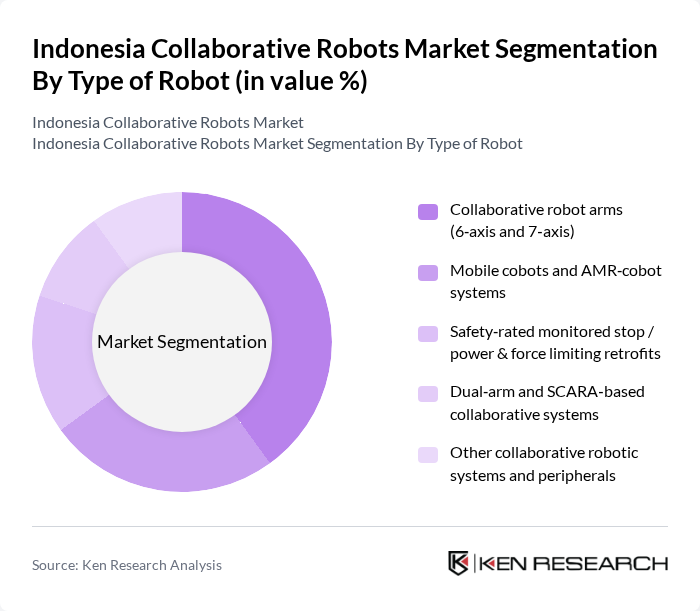

By Type of Robot:The collaborative robots market can be segmented into various types, including collaborative robot arms, mobile cobots, safety-rated systems, dual-arm systems, and other peripherals. Among these, collaborative robot arms (6-axis and 7-axis) are leading the market due to their versatility and ability to perform complex tasks in manufacturing environments. The demand for mobile cobots is also rising, driven by their flexibility in logistics and warehousing applications.

By End-User Industry:The collaborative robots market is segmented by end-user industries, including automotive, electronics, food and beverage, pharmaceuticals, and others. The automotive sector is the dominant segment, driven by the need for automation in assembly lines and quality control processes. The electronics industry follows closely, as manufacturers seek to enhance precision and efficiency in semiconductor assembly and electronic component production.

The Indonesia Collaborative Robots Market is characterized by a dynamic mix of regional and international players. Leading participants such as Universal Robots A/S, ABB Ltd (ABB Robotics), FANUC Corporation, Yaskawa Electric Corporation (Yaskawa Motoman), KUKA AG, Omron Corporation (Omron Robotics and Safety Technologies), Techman Robot Inc., AUBO (Beijing) Robotics Technology Co., Ltd., Doosan Robotics Inc., Hanwha Robotics (Hanwha Corporation/Momentum), Denso Wave Incorporated (Denso Robotics), Epson Robots (Seiko Epson Corporation), Kawasaki Heavy Industries, Ltd. (Kawasaki Robotics), Mitsubishi Electric Corporation (Mitsubishi Electric Factory Automation), SARI Teknologi (PT Sari Teknologi Indonesia) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the collaborative robots market in Indonesia appears promising, driven by ongoing technological advancements and increasing automation adoption across various sectors. As industries continue to embrace Industry 4.0 principles, the integration of AI and machine learning into cobots will enhance their functionality and efficiency. Furthermore, the government's support for automation initiatives is expected to facilitate market growth, creating a conducive environment for innovation and investment in robotics technology.

| Segment | Sub-Segments |

|---|---|

| By Type of Robot | Collaborative robot arms (6?axis and 7?axis) Mobile cobots and AMR?cobot systems Safety?rated monitored stop / power & force limiting retrofits Dual?arm and SCARA?based collaborative systems Other collaborative robotic systems and peripherals |

| By End-User Industry | Automotive and auto components manufacturing Electrical & electronics and semiconductor assembly Food, beverage, and FMCG processing & packaging Pharmaceuticals, medical devices, and cosmetics Metals, plastics, and general manufacturing SMEs E?commerce, warehousing, and logistics providers Others (education, research labs, services, etc.) |

| By Deployment Environment | Discrete manufacturing plants Process industries and packaging lines Warehouses, fulfillment centers, and distribution hubs Healthcare and laboratory environments Others |

| By Application | Pick & place and machine tending Assembly, screw?driving, and fastening Packaging, palletizing, and kitting Quality inspection, testing, and metrology Welding, dispensing, and surface finishing Material handling and intra?logistics Others (collaborative training, research, etc.) |

| By Payload Capacity | Up to 5 kg >5 kg to 10 kg >10 kg to 20 kg Above 20 kg |

| By Region | Java (Jakarta, West Java, Central Java, East Java, Banten) Sumatra Kalimantan Sulawesi Other regions (Bali & Nusa Tenggara, Papua & Maluku) |

| By Policy & Incentive Alignment | Adoption under “Making Indonesia 4.0” and industrial digitalization programs Fiscal incentives (tax holidays, super?deductions, import duty relief) Government and public–private grants for automation and R&D Financing schemes and vendor?backed leasing models |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Sector Adoption | 150 | Production Managers, Automation Engineers |

| Logistics and Warehousing Applications | 120 | Warehouse Managers, Operations Directors |

| Healthcare Robotics Integration | 90 | Healthcare Administrators, Robotics Specialists |

| Education and Training Programs | 60 | Training Coordinators, Educational Program Directors |

| Research and Development Insights | 70 | R&D Managers, Innovation Officers |

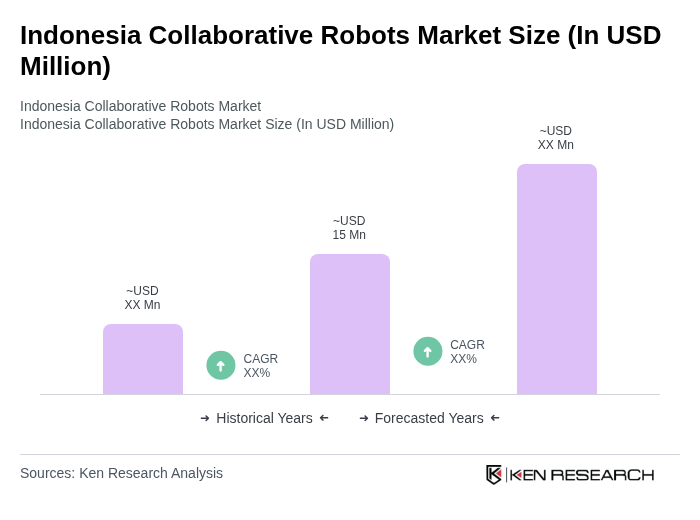

The Indonesia Collaborative Robots Market is valued at approximately USD 15 million, reflecting a significant growth trend driven by the increasing adoption of automation technologies across various industries and advancements in robotics technology.