Region:Middle East

Author(s):Shubham

Product Code:KRAA8495

Pages:89

Published On:November 2025

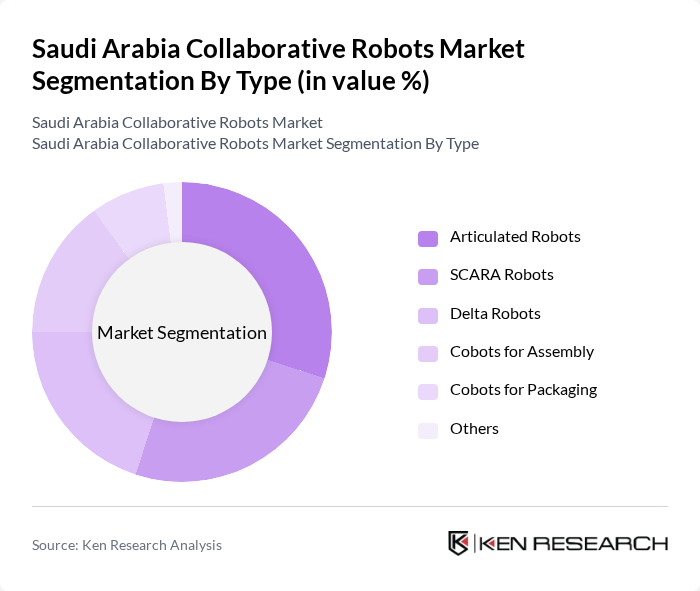

By Type:The collaborative robots market can be segmented into various types, including articulated robots, SCARA robots, delta robots, cobots for assembly, cobots for packaging, and others. Articulated robots are widely used due to their flexibility and range of motion, making them suitable for diverse applications such as assembly, material handling, and welding. SCARA robots are preferred for assembly and pick-and-place tasks due to their speed and precision. Delta robots are gaining traction in packaging and high-speed sorting applications. Cobots for assembly and packaging are increasingly adopted as they enhance productivity while ensuring safety in human-robot collaboration .

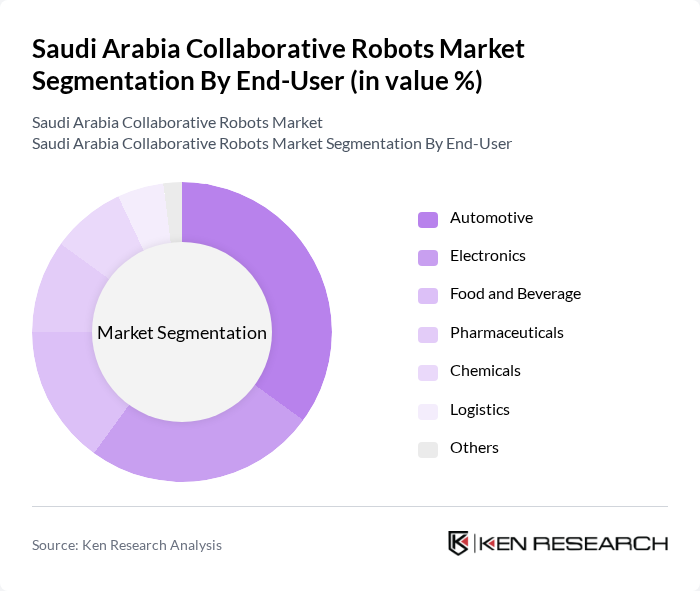

By End-User:The end-user segmentation includes automotive, electronics, food and beverage, pharmaceuticals, chemicals, logistics, and others. The automotive sector is the largest consumer of collaborative robots, driven by the need for automation in assembly lines and material handling. The electronics industry follows closely, utilizing robots for precision assembly and inspection tasks. The food and beverage sector is increasingly adopting cobots for packaging, sorting, and handling, while pharmaceuticals leverage automation for quality control, packaging, and sterile operations. Logistics is also a growing segment, with robots enhancing efficiency in warehousing, distribution, and order fulfillment .

The Saudi Arabia Collaborative Robots Market is characterized by a dynamic mix of regional and international players. Leading participants such as Universal Robots, KUKA AG, ABB Robotics, FANUC Corporation, Yaskawa Electric Corporation, Rethink Robotics, Omron Adept Technologies, Techman Robot Inc., AUBO Robotics, Denso Robotics, Epson Robots, Nachi Robotic Systems, Mitsubishi Electric Corporation, Stäubli Robotics, Doosan Robotics, GMT Robotics, Comau S.p.A., Robert Bosch Engineering & Business Solutions, Seiko Epson Corporation, Beijing DWIN Technology Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the collaborative robots market in Saudi Arabia appears promising, driven by ongoing technological advancements and increasing integration of artificial intelligence. As industries continue to embrace automation, the demand for flexible and efficient robotic solutions is expected to rise. Furthermore, the government's commitment to diversifying the economy and enhancing the manufacturing sector will likely create a conducive environment for collaborative robots, fostering innovation and growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Articulated Robots SCARA Robots Delta Robots Cobots for Assembly Cobots for Packaging Others |

| By End-User | Automotive Electronics Food and Beverage Pharmaceuticals Chemicals Logistics Others |

| By Industry Application | Material Handling Pick and Place Assembly Palletizing and De-Palletizing Quality Inspection Others |

| By Payload Capacity | Up to 5 kg kg to 10 kg Above 10 kg Others |

| By Deployment Type | On-Premise Cloud-Based Hybrid Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Policy Support | Government Grants Tax Incentives Research Funding Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Sector Adoption | 120 | Production Managers, Automation Engineers |

| Healthcare Robotics Integration | 60 | Healthcare Administrators, Robotics Technicians |

| Logistics and Warehousing Automation | 80 | Logistics Managers, Supply Chain Analysts |

| Retail Sector Robotics Usage | 50 | Store Managers, Operations Directors |

| Research and Development in Robotics | 40 | R&D Managers, Robotics Researchers |

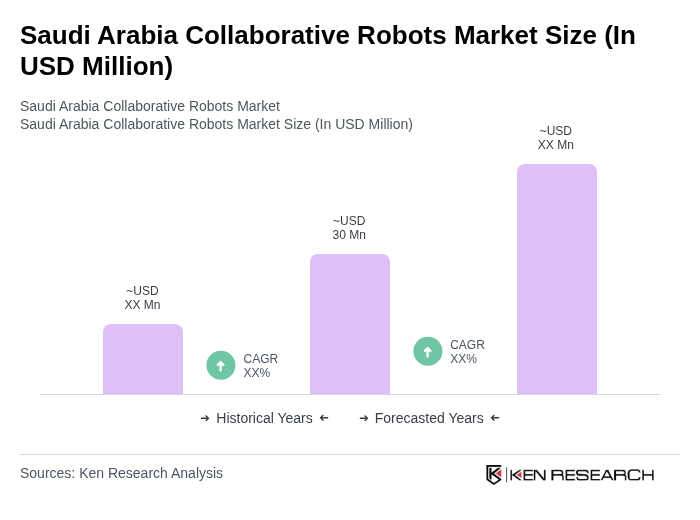

The Saudi Arabia Collaborative Robots Market is valued at approximately USD 30 million, reflecting a significant growth trend driven by increased automation in sectors like manufacturing, logistics, and oil & gas.