Region:Asia

Author(s):Shubham

Product Code:KRAB3274

Pages:80

Published On:October 2025

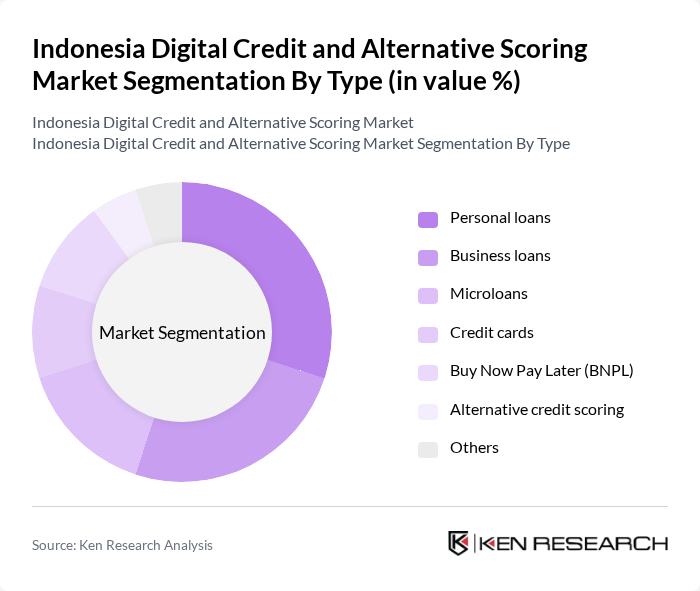

By Type:The market is segmented into various types, including personal loans, business loans, microloans, credit cards, Buy Now Pay Later (BNPL), alternative credit scoring, and others. Each of these sub-segments caters to different consumer needs and preferences, with personal loans and BNPL emerging as the most popular options due to their flexibility and ease of access.

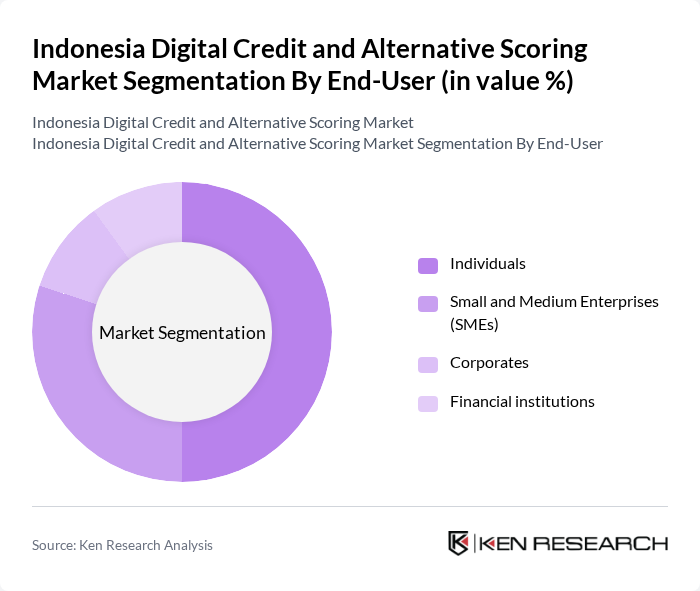

By End-User:The market is segmented by end-user into individuals, small and medium enterprises (SMEs), corporates, and financial institutions. Each segment has distinct requirements, with individuals and SMEs being the primary consumers of digital credit services, driven by their need for accessible financing options.

The Indonesia Digital Credit and Alternative Scoring Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bank Negara Indonesia, Kredit Pintar, Akulaku, Bank Rakyat Indonesia, Modalku, Investree, KoinWorks, JULO, Home Credit Indonesia, Bank Mandiri, KreditGo, Tunaiku, Pinhome, Bank Central Asia, DANA contribute to innovation, geographic expansion, and service delivery in this space.

The future of Indonesia's digital credit and alternative scoring market appears promising, driven by technological advancements and evolving consumer preferences. As fintech companies increasingly leverage artificial intelligence and machine learning, the accuracy of credit assessments is expected to improve significantly. Additionally, the ongoing push for financial inclusion will likely lead to innovative credit products tailored to diverse consumer needs, fostering a more inclusive financial ecosystem. The collaboration between traditional banks and fintech firms will also enhance service delivery and customer experience.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal loans Business loans Microloans Credit cards Buy Now Pay Later (BNPL) Alternative credit scoring Others |

| By End-User | Individuals Small and Medium Enterprises (SMEs) Corporates Financial institutions |

| By Application | Consumer financing Business financing E-commerce financing Education financing |

| By Distribution Channel | Online platforms Mobile applications Traditional banks Fintech partnerships |

| By Customer Segment | Low-income individuals Middle-income individuals High-income individuals Small business owners |

| By Credit Score Range | Low credit score Medium credit score High credit score |

| By Policy Support | Government subsidies Tax incentives Regulatory support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Credit Users | 150 | Consumers who have used digital credit platforms |

| Fintech Executives | 100 | CEOs, CTOs, and Product Managers from fintech companies |

| Regulatory Bodies | 50 | Officials from Bank Indonesia and OJK |

| Credit Risk Analysts | 80 | Analysts from banks and alternative lending institutions |

| Consumer Advocacy Groups | 40 | Representatives from organizations focused on financial literacy |

The Indonesia Digital Credit and Alternative Scoring Market is valued at approximately USD 15 billion, driven by the increasing adoption of digital financial services, smartphone penetration, and a growing unbanked population seeking credit access.