Region:Asia

Author(s):Shubham

Product Code:KRAB5645

Pages:83

Published On:October 2025

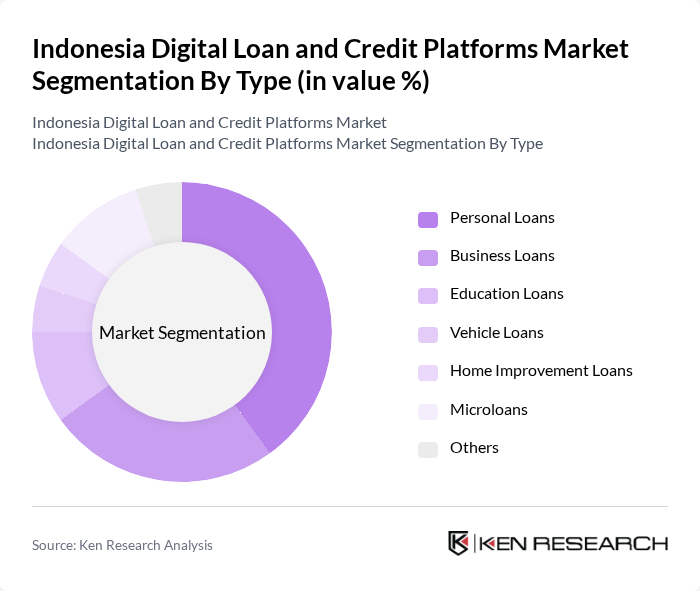

By Type:The market is segmented into various types of loans, including personal loans, business loans, education loans, vehicle loans, home improvement loans, microloans, and others. Personal loans are currently the most dominant segment, driven by consumer demand for quick access to funds for personal expenses, emergencies, and lifestyle needs. Business loans are also significant, as SMEs seek financing for growth and operational needs.

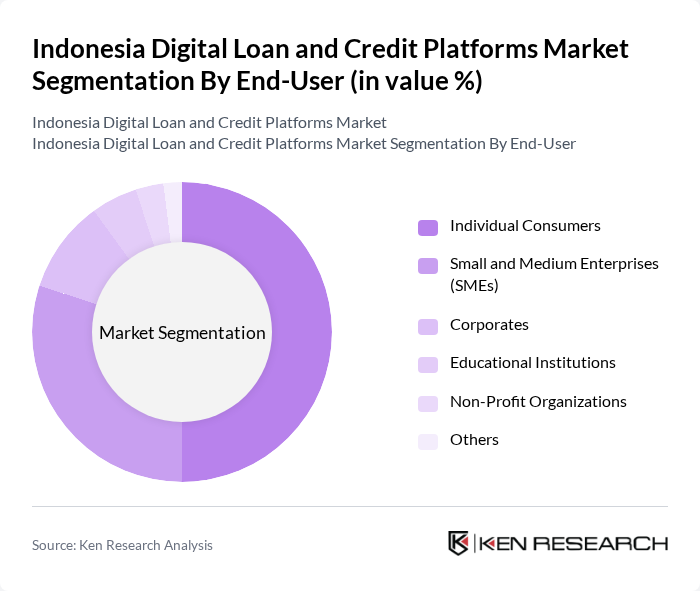

By End-User:The end-user segmentation includes individual consumers, small and medium enterprises (SMEs), corporates, educational institutions, non-profit organizations, and others. Individual consumers represent the largest segment, as they frequently seek loans for personal use, while SMEs are also significant contributors, requiring financing for business operations and expansion. The increasing entrepreneurial spirit among the youth further fuels the demand from SMEs.

The Indonesia Digital Loan and Credit Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bank Negara Indonesia, Kredit Pintar, Akulaku, Tunaiku, UangTeman, Investree, Modalku, Bank Rakyat Indonesia, OVO, JULO, KoinWorks, Danamas, KreditGo, Pinhome, Bank Mandiri contribute to innovation, geographic expansion, and service delivery in this space.

The future of Indonesia's digital loan and credit platforms appears promising, driven by technological advancements and evolving consumer preferences. As the market matures, we expect a shift towards more personalized lending solutions, leveraging alternative data for credit assessments. Additionally, the integration of AI and blockchain technology will enhance transparency and efficiency in lending processes. These trends will likely foster greater financial inclusion, particularly among underserved populations, while also addressing existing challenges in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Loans Business Loans Education Loans Vehicle Loans Home Improvement Loans Microloans Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Corporates Educational Institutions Non-Profit Organizations Others |

| By Application | Emergency Funding Business Expansion Debt Consolidation Home Renovation Education Financing Others |

| By Distribution Channel | Online Platforms Mobile Applications Financial Institutions Direct Sales Others |

| By Customer Segment | Millennials Gen Z Working Professionals Retirees Others |

| By Loan Amount | Small Loans (up to IDR 5 million) Medium Loans (IDR 5 million to IDR 50 million) Large Loans (above IDR 50 million) Others |

| By Loan Tenure | Short-term Loans (up to 1 year) Medium-term Loans (1 to 3 years) Long-term Loans (above 3 years) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Digital Loan Users | 150 | Individuals aged 18-45, recent loan applicants |

| Small Business Owners | 100 | Entrepreneurs utilizing digital credit for business expansion |

| Fintech Industry Experts | 50 | Consultants, analysts, and academics in digital finance |

| Regulatory Bodies | 30 | Officials from financial regulatory authorities in Indonesia |

| Digital Loan Platform Executives | 40 | CEOs, CTOs, and product managers from fintech companies |

The Indonesia Digital Loan and Credit Platforms Market is valued at approximately USD 15 billion, driven by the increasing adoption of digital financial services and the demand for quick and accessible credit solutions.