Region:Asia

Author(s):Dev

Product Code:KRAC3337

Pages:85

Published On:October 2025

By Type:The market is segmented into various types, including equity funds, fixed income funds, real estate investments, green bonds, sustainability bonds, sustainability-linked bonds, ESG index funds, impact funds, and others. Among these, equity funds and green bonds are particularly prominent, driven by investor preferences for high-growth potential and environmentally focused projects. The growth in sustainable bonds—including green, sustainability, and sustainability-linked bonds—has been especially notable, with diversification in issuance types and increased participation from both corporate and government issuers .

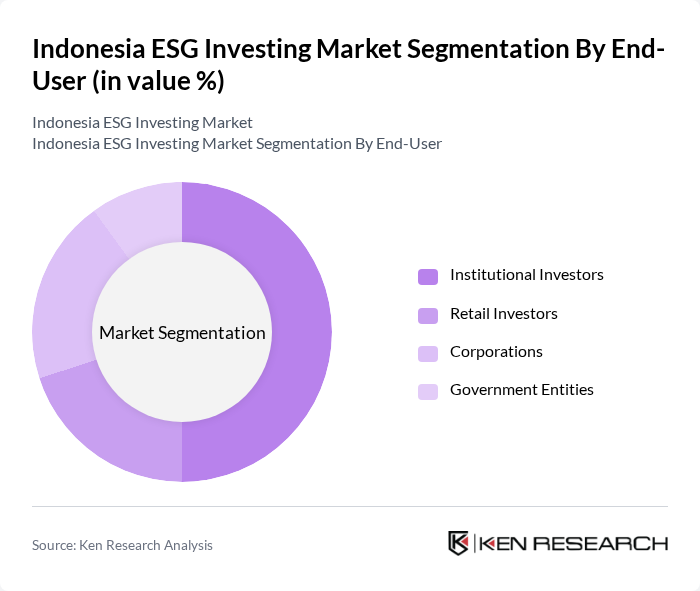

By End-User:The end-user segmentation includes institutional investors, retail investors, corporations, and government entities. Institutional investors are leading the market, driven by their growing commitment to sustainable investing and the integration of ESG criteria into their investment strategies. Local institutional investors, in particular, are increasingly incorporating ESG metrics into portfolio management, supported by regulatory guidance and the introduction of ESG indices such as IDX ESG Leaders and SRI-KEHATI .

The Indonesia ESG investing market is characterized by a dynamic mix of regional and international players. Leading participants such as Mandiri Investasi (Mandiri Investment Management), Danareksa Investment Management, Bahana TCW Investment Management, Schroders Indonesia, BNP Paribas Asset Management Indonesia, Principal Asset Management Indonesia, Manulife Aset Manajemen Indonesia, Allianz Global Investors, RHB Asset Management Indonesia, Eastspring Investments Indonesia, Trimegah Asset Management, Sucorinvest Asset Management, Batavia Prosperindo Aset Manajemen, MNC Asset Management, Ashmore Asset Management Indonesia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the ESG investing market in Indonesia appears promising, driven by increasing regulatory support and a growing emphasis on sustainability among corporations. As the government enhances its commitment to green initiatives, more companies are expected to adopt ESG practices. Additionally, the rise of impact investing will likely attract a new wave of investors focused on social and environmental outcomes. This evolving landscape will create a fertile ground for innovative financial products and services tailored to meet the demands of conscious investors.

| Segment | Sub-Segments |

|---|---|

| By Type | Equity Funds Fixed Income Funds Real Estate Investments Green Bonds Sustainability Bonds Sustainability-Linked Bonds ESG Index Funds Impact Funds Others |

| By End-User | Institutional Investors Retail Investors Corporations Government Entities |

| By Investment Source | Domestic Investments Foreign Direct Investments (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Application | Sustainable Agriculture Renewable Energy Projects Waste Management Initiatives Water Conservation Projects Eco-Tourism |

| By Policy Support | Subsidies for Green Projects Tax Exemptions for ESG Investments Renewable Energy Certificates (RECs) |

| By Risk Profile | Low-Risk Investments Medium-Risk Investments High-Risk Investments |

| By Investment Horizon | Short-Term Investments Medium-Term Investments Long-Term Investments |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Institutional Investors | 60 | Pension Fund Managers, Insurance Executives |

| Asset Management Firms | 50 | Portfolio Managers, ESG Analysts |

| Retail Investors | 100 | Individual Investors, Financial Advisors |

| Corporate Sustainability Officers | 40 | CSR Managers, Sustainability Directors |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

The Indonesia ESG investing market is valued at approximately USD 6.1 billion, reflecting significant growth driven by increased awareness of environmental, social, and governance factors among investors and a rising demand for sustainable investment options.