Region:Asia

Author(s):Rebecca

Product Code:KRAD1571

Pages:100

Published On:November 2025

By Type:The market is segmented into various types of food service equipment, including cooking equipment, refrigeration & freezing equipment, food preparation equipment, beverage equipment, serving & holding equipment, warewashing & cleaning equipment, storage & handling equipment, and others. Each segment plays a critical role in optimizing operational efficiency, food safety, and service quality in commercial kitchens and hospitality venues. Cooking equipment and refrigeration systems are particularly vital for quick-service and full-service restaurants, while warewashing and beverage equipment are increasingly adopted in cafes, hotels, and cloud kitchens to meet evolving consumer expectations.

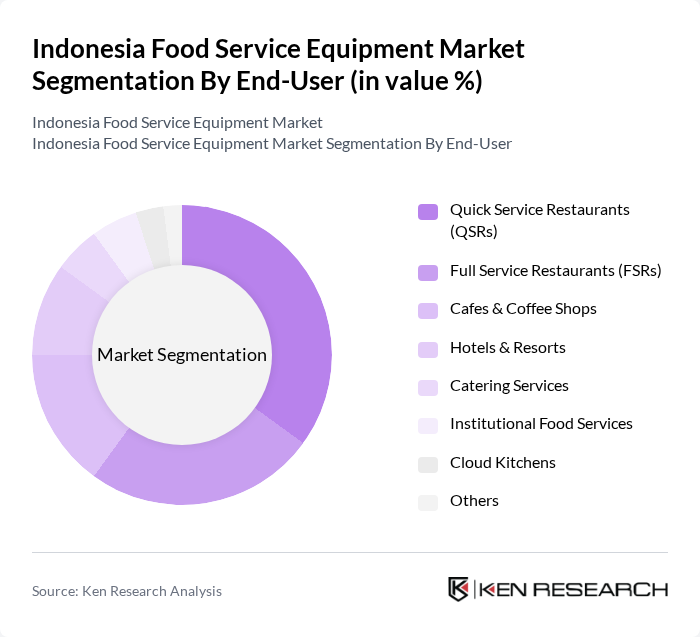

By End-User:The end-user segmentation includes Quick Service Restaurants (QSRs), Full Service Restaurants (FSRs), Cafes & Coffee Shops, Hotels & Resorts, Catering Services, Institutional Food Services (Hospitals, Schools, etc.), Cloud Kitchens, and others. Each segment has distinct operational needs: QSRs and cloud kitchens prioritize speed and automation, FSRs focus on quality and menu diversity, while hotels and resorts require scalable, multifunctional equipment for high-volume service. Institutional food services emphasize compliance and durability, and catering services demand mobility and flexibility.

The Indonesia Food Service Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT. Ramesia Mesin Indonesia, PT. Mitra Sinar Abadi, PT. Tunas Sumber Berkat, PT. Sinar Mas, PT. Cipta Rasa Abadi, PT. Sumber Rejeki, PT. Multi Utama, PT. Duta Cita Abadi, PT. Anugerah Abadi, PT. Bina Karya, PT. Karya Abadi, PT. Sukses Abadi, PT. Citra Mandiri, PT. Sumber Makmur, PT. Jaya Abadi, PT. Tritunggal Prima Food Machinery, PT. Indotara Persada, PT. Sukses Sejahtera Bersama, PT. Mesin Maksindo, PT. Restomart Cipta Usaha contribute to innovation, geographic expansion, and service delivery in this space.

The Indonesia food service equipment market is poised for significant growth, driven by urbanization, rising incomes, and a booming hospitality sector. As consumer preferences shift towards quality dining experiences, the demand for advanced and energy-efficient equipment will increase. Additionally, the integration of smart technologies in kitchens will enhance operational efficiency. The market will likely see innovations that cater to local tastes and preferences, ensuring that equipment meets the diverse needs of Indonesian consumers and businesses alike.

| Segment | Sub-Segments |

|---|---|

| By Type | Cooking Equipment Refrigeration & Freezing Equipment Food Preparation Equipment Beverage Equipment Serving & Holding Equipment Warewashing & Cleaning Equipment Storage & Handling Equipment Others |

| By End-User | Quick Service Restaurants (QSRs) Full Service Restaurants (FSRs) Cafes & Coffee Shops Hotels & Resorts Catering Services Institutional Food Services (Hospitals, Schools, etc.) Cloud Kitchens Others |

| By Application | Commercial Kitchens Food Processing Plants Bakery & Confectionery Fast Food Chains Bars & Pubs Others |

| By Material | Stainless Steel Aluminum Plastic Glass Others |

| By Distribution Channel | Direct Sales Online Retail Distributors Wholesalers Others |

| By Price Range | Budget Mid-Range Premium Others |

| By Brand Preference | Local Brands International Brands Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Restaurant Equipment Usage | 100 | Restaurant Owners, Head Chefs |

| Catering Services Equipment Needs | 60 | Catering Managers, Event Planners |

| Hospitality Sector Equipment Trends | 50 | Hotel Managers, Kitchen Supervisors |

| Food Truck Equipment Preferences | 40 | Food Truck Owners, Operators |

| Institutional Food Service Equipment | 45 | Facility Managers, Procurement Officers |

The Indonesia Food Service Equipment Market is valued at approximately USD 145 million, driven by urbanization, the growth of restaurants, and increased disposable income among the rising middle class.