Region:Asia

Author(s):Shubham

Product Code:KRAB6231

Pages:91

Published On:October 2025

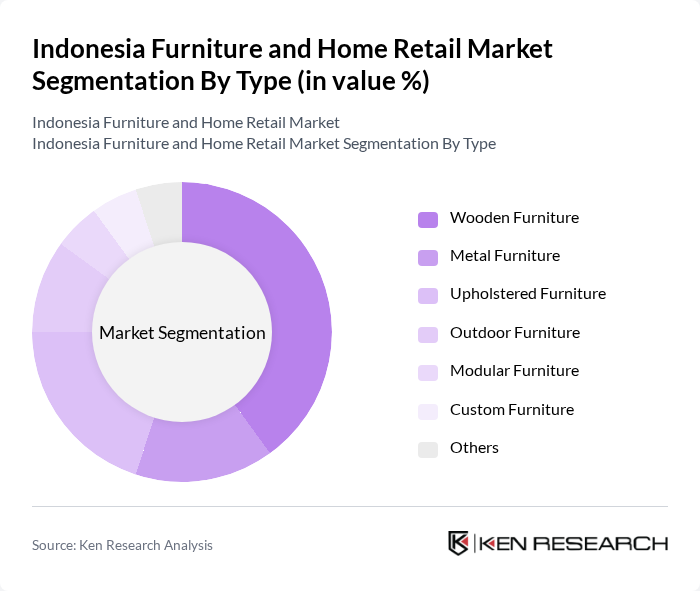

By Type:The furniture market is segmented into various types, including Wooden Furniture, Metal Furniture, Upholstered Furniture, Outdoor Furniture, Modular Furniture, Custom Furniture, and Others. Among these, Wooden Furniture is the most dominant segment due to its traditional appeal and durability. The preference for wooden furniture is driven by its aesthetic value and the cultural significance associated with wood in Indonesian households. Additionally, the rise in eco-conscious consumers has further bolstered the demand for sustainably sourced wooden products.

By End-User:The market is segmented by end-users, including Residential, Commercial, Hospitality, Government, Educational Institutions, and Others. The Residential segment leads the market, driven by the increasing number of households and the trend of home renovations. Consumers are investing in quality furniture to enhance their living spaces, reflecting a shift towards more personalized and comfortable home environments. The growing trend of remote work has also contributed to the demand for home office furniture.

The Indonesia Furniture and Home Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as IKEA Indonesia, Fabelio, Informa, Ace Hardware Indonesia, Toko Furniture, Lotte Mart, Kawan Lama Group, Hometown Furniture, Daya Furniture, Djarum Group, Sinar Mas Land, Mitra10, Bhinneka, Taman Anggrek Mall, Karya Cipta contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indonesian furniture and home retail market appears promising, driven by urbanization and rising disposable incomes. As consumers increasingly prioritize home aesthetics, the demand for innovative and sustainable furniture solutions is expected to grow. Retailers are likely to enhance their online presence, leveraging technology to improve customer experiences. Additionally, the integration of smart furniture into homes will likely gain traction, reflecting changing consumer preferences and technological advancements in the industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Wooden Furniture Metal Furniture Upholstered Furniture Outdoor Furniture Modular Furniture Custom Furniture Others |

| By End-User | Residential Commercial Hospitality Government Educational Institutions Others |

| By Sales Channel | Online Retail Brick-and-Mortar Stores Wholesale Distributors Direct Sales Others |

| By Price Range | Budget Mid-Range Premium Luxury |

| By Material | Solid Wood Engineered Wood Metal Plastic Fabric Others |

| By Design Style | Contemporary Traditional Rustic Industrial Minimalist Others |

| By Distribution Mode | Direct Distribution Indirect Distribution Franchise Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Furniture Retailers | 150 | Store Managers, Sales Executives |

| Home Decor Manufacturers | 100 | Product Development Managers, Marketing Heads |

| Consumer Insights on Furniture Purchases | 200 | Homeowners, Interior Designers |

| Online Furniture Retailers | 80 | E-commerce Managers, Digital Marketing Specialists |

| Logistics and Supply Chain in Furniture | 70 | Logistics Coordinators, Supply Chain Analysts |

The Indonesia Furniture and Home Retail Market is valued at approximately USD 10 billion, driven by urbanization, rising disposable incomes, and a growing middle class seeking quality home furnishings.