Italy Furniture and Home Retail Market Overview

- The Italy Furniture and Home Retail Market is valued at USD 17.6 billion, based on a five-year historical analysis. This growth is primarily driven by increasing consumer spending on home improvement and interior design, alongside a rising trend of urbanization and a growing middle class. The market has seen a significant shift towards online shopping, which has further fueled demand for furniture and home decor products .

- Key cities such as Milan, Rome, and Florence dominate the market due to their rich cultural heritage and status as design hubs. Milan, in particular, is renowned for its design fairs and exhibitions, attracting both local and international brands. The concentration of affluent consumers and a vibrant tourism sector in these cities also contribute to their dominance in the furniture and home retail market .

- In 2023, the Italian government implemented regulations aimed at promoting sustainable practices in the furniture industry. This includes mandatory compliance with eco-labeling standards for furniture products, encouraging manufacturers to adopt environmentally friendly materials and production processes. The initiative is governed by the "Minimum Environmental Criteria for Furniture" (Criteri Ambientali Minimi per l’Arredo), issued by the Ministry of Ecological Transition in 2022, which requires public procurement and manufacturers to adhere to specific environmental and eco-labeling standards for furniture products .

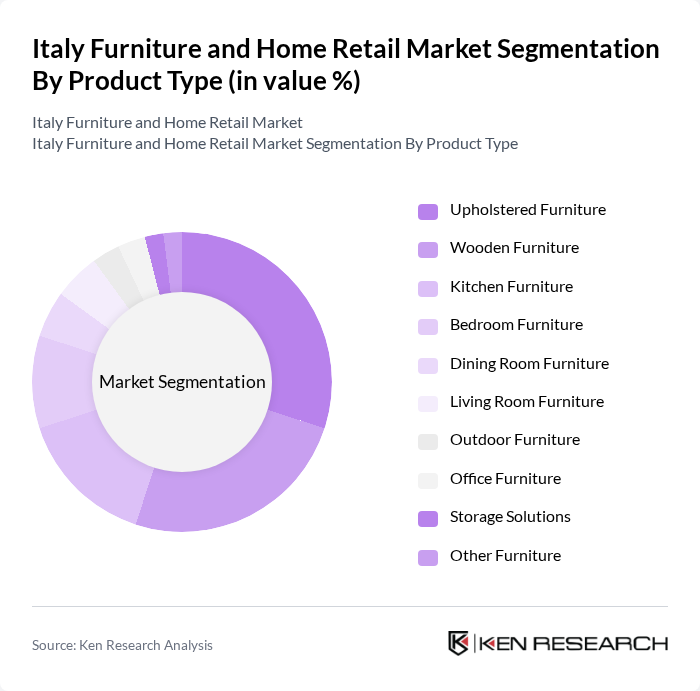

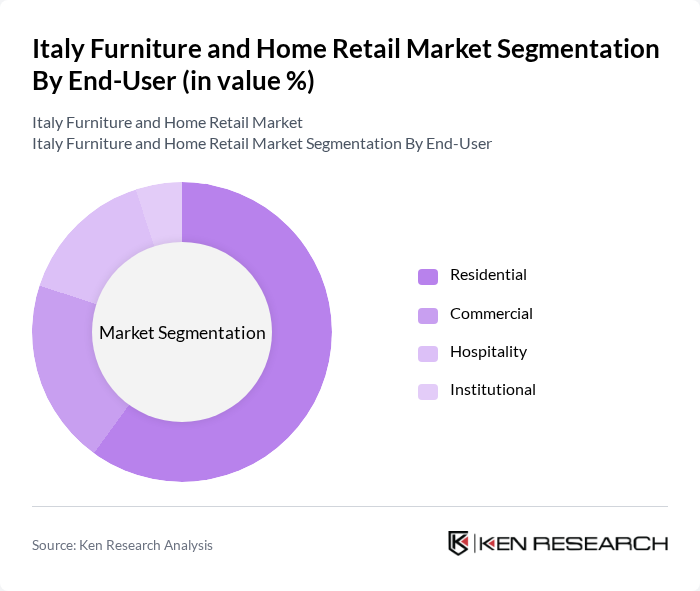

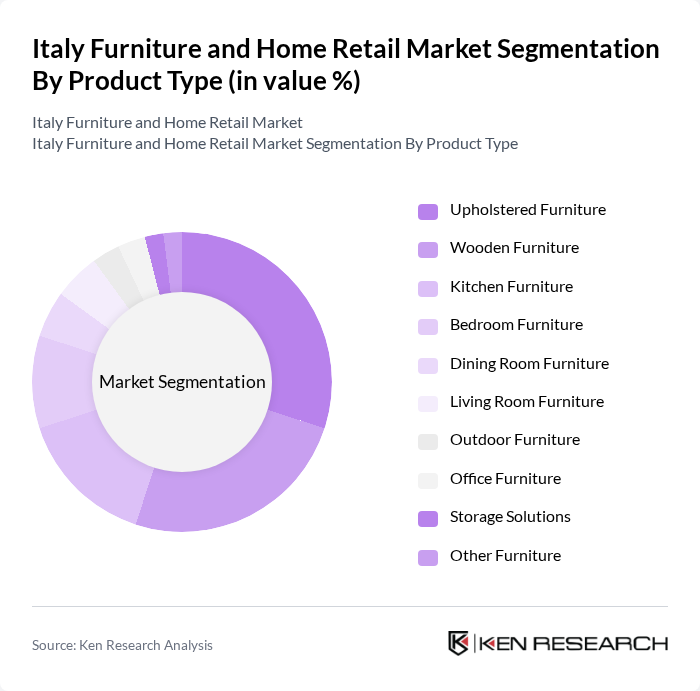

Italy Furniture and Home Retail Market Segmentation

By Product Type:The product type segmentation includes various categories such as upholstered furniture, wooden furniture, kitchen furniture, bedroom furniture, dining room furniture, living room furniture, outdoor furniture, office furniture, storage solutions, and other furniture. Among these, upholstered furniture is currently leading the market due to its versatility and comfort, appealing to a wide range of consumers. The trend towards home comfort and aesthetics has driven demand for stylish and functional upholstered pieces, making it a preferred choice for many households .

By End-User:The end-user segmentation encompasses residential, commercial, hospitality, and institutional categories. The residential segment is the largest, driven by increasing home ownership and renovation activities. Consumers are investing in furniture that enhances their living spaces, reflecting personal style and comfort. The commercial segment is also growing, fueled by the expansion of businesses and the need for functional office spaces, while the hospitality sector continues to demand high-quality furnishings to enhance guest experiences .

Italy Furniture and Home Retail Market Competitive Landscape

The Italy Furniture and Home Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as IKEA, Mondo Convenienza, Poltronesofà, B&B Italia, Natuzzi, Calligaris, Lema, Cattelan Italia, Arper, Molteni&C, Fiam Italia, Sangiacomo, Bontempi Casa, Gervasoni, Desalto, JYSK, Conforama Italia, Arredissima, Ricci Casa, Dotolo Mobili contribute to innovation, geographic expansion, and service delivery in this space.

Italy Furniture and Home Retail Market Industry Analysis

Growth Drivers

- Increasing Urbanization:Urbanization in Italy is projected to reach 71% in future, with cities like Milan and Rome experiencing significant population growth. This trend drives demand for furniture as urban dwellers seek to optimize smaller living spaces. The Italian National Institute of Statistics (ISTAT) reported that urban areas are expanding, leading to a surge in housing developments, which in turn fuels the need for modern and functional furniture solutions tailored to urban lifestyles.

- Rising Disposable Income:Italy's disposable income is expected to increase by approximately €5,000 per capita in future, reaching around €30,000. This rise in income allows consumers to invest more in home furnishings, enhancing their living environments. According to the Bank of Italy, higher disposable income correlates with increased spending on home improvement and furniture, as consumers prioritize comfort and aesthetics in their living spaces, driving market growth.

- Growing E-commerce Adoption:E-commerce sales in Italy's furniture sector are projected to exceed €2 billion in future, reflecting a 20% increase from previous years. The COVID-19 pandemic accelerated online shopping trends, with consumers increasingly preferring the convenience of purchasing furniture online. According to the Italian E-commerce Association, 50% of consumers now shop for home goods online, prompting traditional retailers to enhance their digital presence and adapt to changing shopping behaviors.

Market Challenges

- Intense Competition:The Italian furniture market is characterized by over 20,000 companies, leading to fierce competition among local and international brands. This saturation makes it challenging for new entrants to gain market share. According to the Italian Furniture Manufacturers Association, the top 10 companies account for only about 30% of the market, indicating a fragmented landscape where differentiation and innovation are crucial for survival and growth.

- Supply Chain Disruptions:The ongoing global supply chain disruptions have significantly impacted the Italian furniture industry, with lead times for raw materials increasing by up to 30% in future. The war in Ukraine and COVID-19 aftermath have exacerbated these issues, leading to shortages and delays. The Italian Trade Agency reported that approximately 70% of manufacturers are facing challenges in sourcing materials, which affects production schedules and ultimately impacts sales and profitability.

Italy Furniture and Home Retail Market Future Outlook

The future of the Italian furniture market appears promising, driven by evolving consumer preferences and technological advancements. As urbanization continues, the demand for space-efficient and multifunctional furniture will rise. Additionally, the integration of smart technology into furniture design is expected to gain traction, appealing to tech-savvy consumers. Sustainability will remain a key focus, with eco-friendly materials becoming increasingly popular, aligning with global trends towards responsible consumption and environmental stewardship.

Market Opportunities

- Expansion of Online Retail:The shift towards online retail presents a significant opportunity for furniture brands to reach a broader audience. With e-commerce projected to grow by over 10% annually in future, companies can leverage digital marketing strategies to enhance visibility and sales. Investing in user-friendly websites and virtual showrooms can attract tech-savvy consumers looking for convenience and variety in their furniture shopping experience.

- Customization Trends:The demand for personalized furniture solutions is on the rise, with approximately 30%–40% of consumers expressing interest in customized products. This trend allows brands to differentiate themselves by offering tailored designs that meet individual preferences. By incorporating customization options, companies can enhance customer satisfaction and loyalty, ultimately driving sales and fostering long-term relationships with consumers seeking unique home furnishings.