Region:Asia

Author(s):Geetanshi

Product Code:KRAC3804

Pages:92

Published On:October 2025

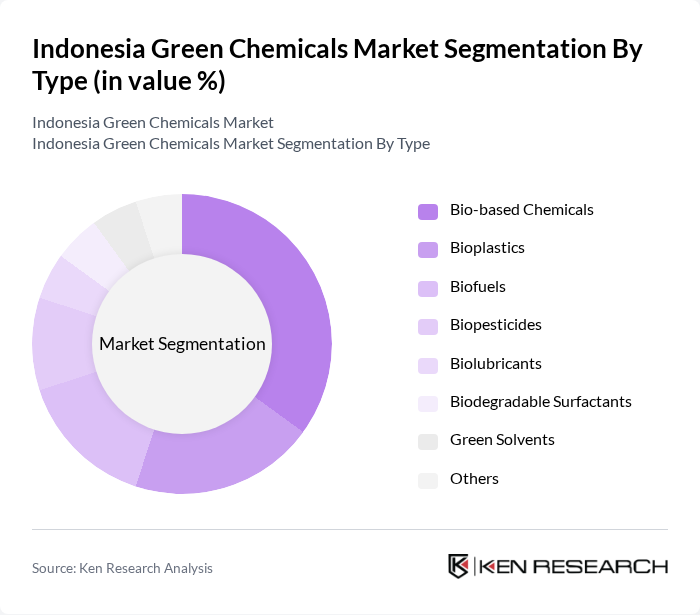

By Type:The market is segmented into various types of green chemicals, including bio-based chemicals, bioplastics, biofuels, biopesticides, biolubricants, biodegradable surfactants, green solvents, and others. Among these, bio-based chemicals are leading the market due to their versatility and increasing application across multiple industries. The growing consumer preference for sustainable products and the regulatory push for eco-friendly alternatives are driving the demand for bio-based chemicals, making them a dominant force in the market.

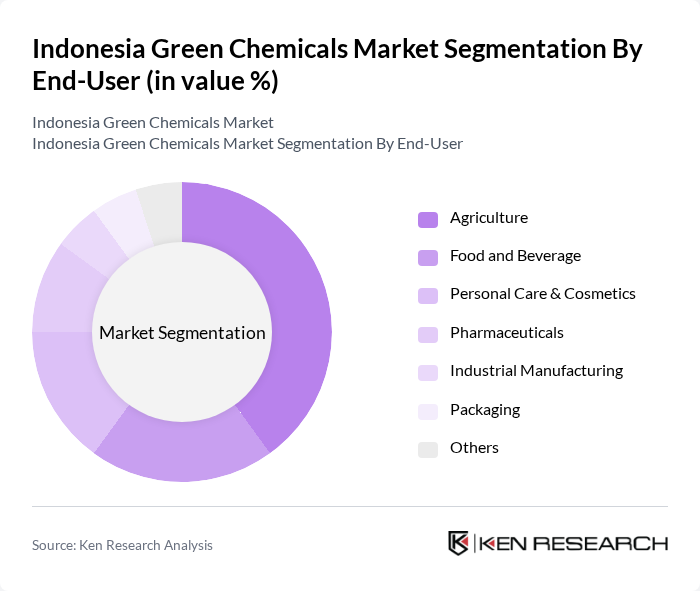

By End-User:The end-user segmentation includes agriculture, food and beverage, personal care & cosmetics, pharmaceuticals, industrial manufacturing, packaging, and others. The agriculture sector is the leading end-user of green chemicals, driven by the increasing adoption of sustainable farming practices and the demand for organic products. The shift towards eco-friendly agricultural inputs is significantly influencing the market, as consumers and regulatory bodies push for reduced chemical usage in food production.

The Indonesia Green Chemicals Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT. Pupuk Kalimantan Timur (Pupuk Kaltim), PT. Kimia Farma Tbk, PT. Indorama Ventures Indonesia, PT. Chandra Asri Petrochemical Tbk, PT. Astra Agro Lestari Tbk, PT. Sinar Mas Agro Resources and Technology Tbk (SMART Tbk), PT. Tunas Baru Lampung Tbk, PT. Wilmar Nabati Indonesia, PT. Lautan Luas Tbk, PT. Asahimas Chemical, PT. Dow Indonesia, PT. Polychem Indonesia Tbk, PT. Mega Chemical Pratama, PT. Indonesia Acids Industry, PT. BASF Indonesia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indonesian green chemicals market appears promising, driven by increasing government support and consumer demand for sustainable products. As the country aims to enhance its renewable energy share, investments in green technologies are expected to rise significantly. Additionally, the trend towards biodegradable materials and circular economy practices will likely shape the market landscape, encouraging innovation and collaboration among industry stakeholders. This evolving environment presents a unique opportunity for growth and development in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Bio-based Chemicals Bioplastics Biofuels Biopesticides Biolubricants Biodegradable Surfactants Green Solvents Others |

| By End-User | Agriculture Food and Beverage Personal Care & Cosmetics Pharmaceuticals Industrial Manufacturing Packaging Others |

| By Application | Packaging Coatings & Paints Adhesives & Sealants Textiles & Fibers Cleaning Products Energy & Fuels Others |

| By Distribution Channel | Direct Sales Online Retail Distributors Wholesalers Others |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing Others |

| By Region | Java Sumatra Kalimantan Sulawesi Bali Others |

| By Policy Support | Subsidies Tax Exemptions Grants Green Procurement Mandates Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Green Chemical Producers | 100 | Production Managers, Sustainability Officers |

| End-Users in Agriculture | 60 | Agronomists, Farm Managers |

| Pharmaceutical Manufacturers | 50 | Quality Control Managers, R&D Managers |

| Consumer Goods Companies | 70 | Product Development Managers, Marketing Directors |

| Regulatory Bodies and NGOs | 40 | Policy Analysts, Environmental Advocates |

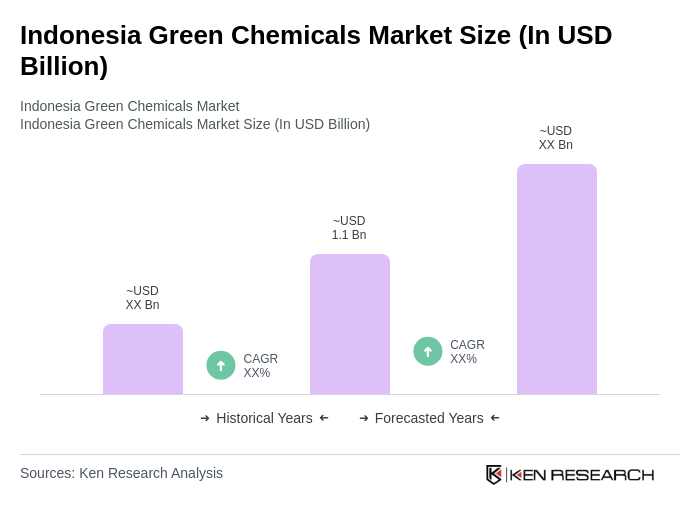

The Indonesia Green Chemicals Market is valued at approximately USD 1.1 billion, reflecting a significant growth trend driven by increasing environmental awareness and demand for sustainable products across various industries.