Region:Middle East

Author(s):Geetanshi

Product Code:KRAC8371

Pages:99

Published On:November 2025

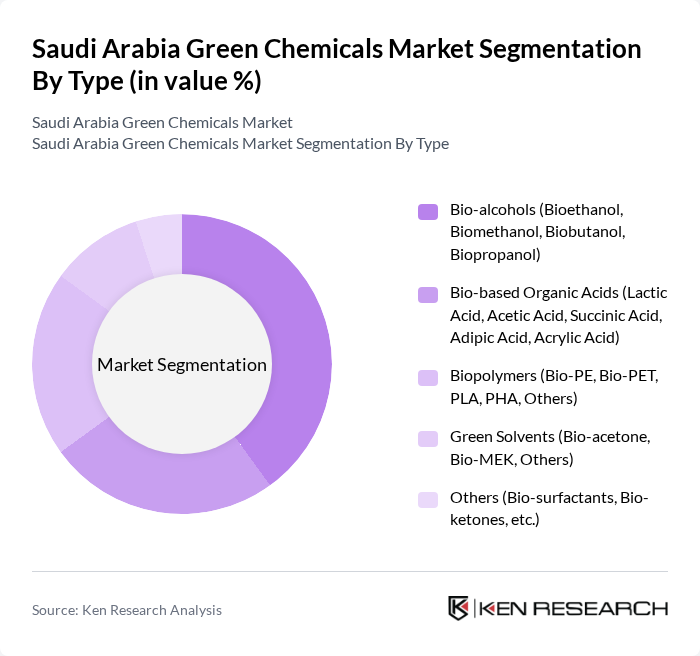

By Type:The market is segmented into various types of green chemicals, including bio-alcohols, bio-based organic acids, biopolymers, green solvents, and others. Each of these sub-segments plays a crucial role in addressing environmental concerns and meeting the demand for sustainable products. Among these, bio-alcohols are particularly prominent due to their versatility and application in various industries, including automotive, construction, and packaging. Saudi Arabia’s investments in bio-alcohols and biopolymers are driven by partnerships between local producers and global technology providers, fostering innovation in renewable feedstocks and sustainable product development .

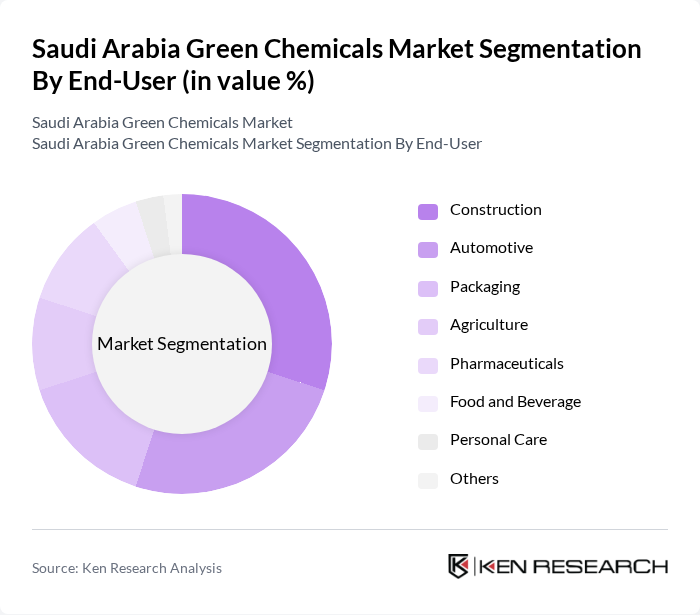

By End-User:The end-user segmentation includes construction, automotive, packaging, agriculture, pharmaceuticals, food and beverage, personal care, and others. The construction and automotive sectors are the largest consumers of green chemicals, driven by the need for sustainable materials and compliance with environmental regulations. Major infrastructure projects and the expansion of the electric vehicle sector are accelerating demand for green chemicals in these segments. Packaging and agriculture are also experiencing increased adoption due to circular economy initiatives and resource reuse mandates .

The Saudi Arabia Green Chemicals Market is characterized by a dynamic mix of regional and international players. Leading participants such as SABIC (Saudi Basic Industries Corporation), Sadara Chemical Company, Advanced Petrochemical Company, Saudi Aramco (Chemicals Division), Tasnee (National Industrialization Company), Sipchem (Saudi International Petrochemical Company), BASF, Dow Chemical, Evonik Industries, Solvay, LanzaTech, Genomatica, NatureWorks, Avantium, and Green Biologics contribute to innovation, geographic expansion, and service delivery in this space .

The future of the green chemicals market in Saudi Arabia appears promising, driven by increasing government support and a shift towards sustainable practices. By 2025, the market is expected to benefit from enhanced collaboration between local firms and international partners, fostering innovation. Additionally, the ongoing transition towards a circular economy will likely create new avenues for growth, as companies seek to minimize waste and maximize resource efficiency in their operations.

| Segment | Sub-Segments |

|---|---|

| By Type | Bio-alcohols (Bioethanol, Biomethanol, Biobutanol, Biopropanol) Bio-based Organic Acids (Lactic Acid, Acetic Acid, Succinic Acid, Adipic Acid, Acrylic Acid) Biopolymers (Bio-PE, Bio-PET, PLA, PHA, Others) Green Solvents (Bio-acetone, Bio-MEK, Others) Others (Bio-surfactants, Bio-ketones, etc.) |

| By End-User | Construction Automotive Packaging Agriculture Pharmaceuticals Food and Beverage Personal Care Others |

| By Application | Paints & Coatings Adhesives & Sealants Textiles Construction Materials Automotive Components Others |

| By Source | Plant-based Algae-based Bio-waste (Agricultural, Forestry, Municipal) Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Policy Support | Government Subsidies Tax Incentives Research Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Agricultural Chemicals | 60 | Farm Managers, Agronomists |

| Construction Materials | 50 | Project Managers, Procurement Officers |

| Personal Care Products | 40 | Product Development Managers, Brand Managers |

| Packaging Solutions | 50 | Supply Chain Managers, Sustainability Officers |

| Automotive Applications | 40 | R&D Engineers, Quality Assurance Managers |

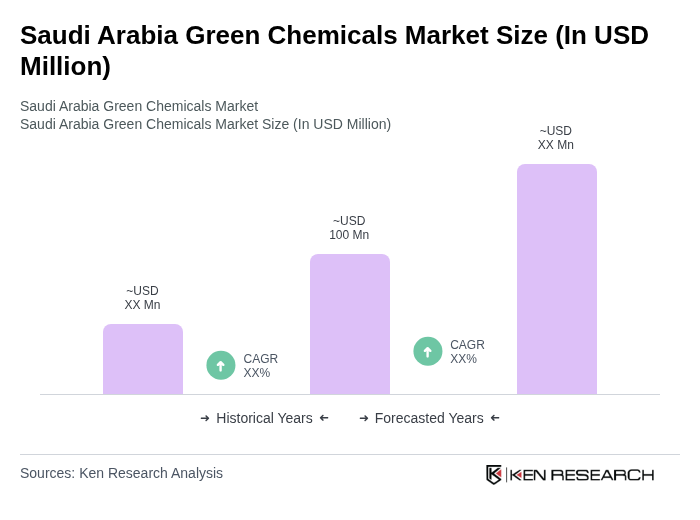

The Saudi Arabia Green Chemicals Market is valued at approximately USD 100 million, reflecting a significant growth trend driven by increasing environmental awareness and government initiatives promoting sustainable practices across various industries.