Region:Asia

Author(s):Rebecca

Product Code:KRAD6233

Pages:93

Published On:December 2025

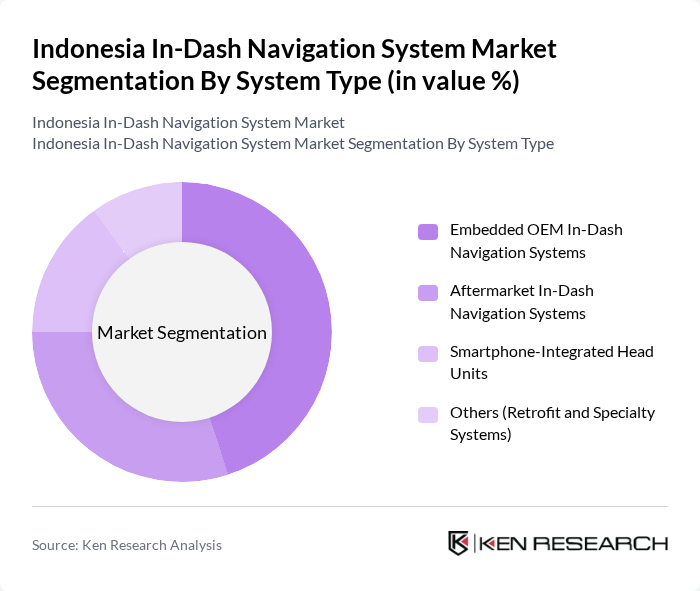

By System Type:The market is segmented into four main types: Embedded OEM In-Dash Navigation Systems, Aftermarket In-Dash Navigation Systems, Smartphone-Integrated Head Units, and Others (Retrofit and Specialty Systems). Among these, Embedded OEM In-Dash Navigation Systems are leading the market due to their seamless integration with vehicle systems and enhanced user experience. Consumers prefer these systems for their reliability and advanced features, which are often not available in aftermarket solutions. The trend towards smart vehicles and the increasing demand for integrated infotainment systems further bolster the growth of this segment.

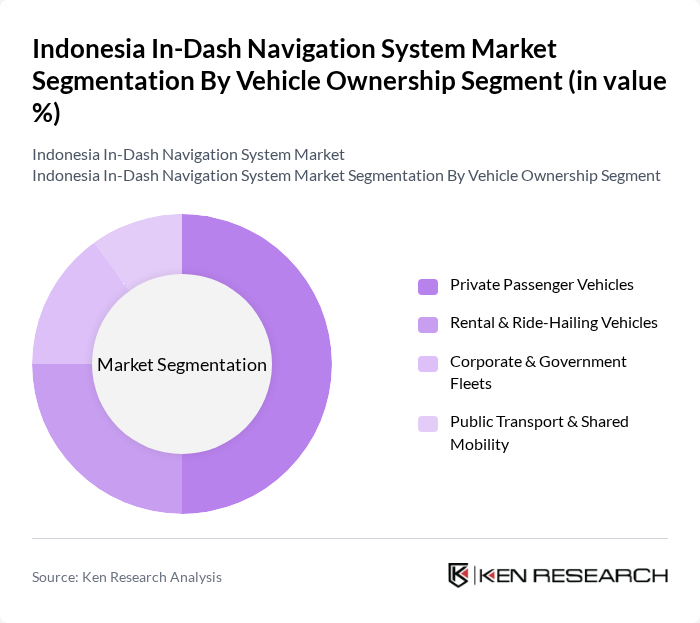

By Vehicle Ownership Segment:The market is categorized into Private Passenger Vehicles, Rental & Ride-Hailing Vehicles, Corporate & Government Fleets, and Public Transport & Shared Mobility. The Private Passenger Vehicles segment dominates the market, driven by the increasing number of personal vehicles and consumer preference for advanced navigation features. As urbanization continues and traffic congestion becomes a significant concern, consumers are increasingly investing in vehicles equipped with sophisticated navigation systems to enhance their driving experience and ensure efficient route planning.

The Indonesia In-Dash Navigation System Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT Garmin Indonesia, TomTom N.V., Pioneer Corporation, Panasonic Corporation, Sony Group Corporation, Hyundai Mobis Co., Ltd., Robert Bosch GmbH, Continental AG, DENSO Corporation, JVCKENWOOD Corporation, Mitsubishi Electric Corporation, Harman International (a Samsung Electronics subsidiary), Alps Alpine Co., Ltd., Aisin Corporation, and Valeo SA contribute to innovation, geographic expansion, and service delivery in this space.

The future of the in-dash navigation system market in Indonesia appears promising, driven by technological advancements and increasing consumer expectations. As the automotive industry embraces digital transformation, the integration of AI and real-time data analytics will enhance navigation accuracy and user experience. Furthermore, the collaboration between automotive manufacturers and tech companies is likely to foster innovation, leading to the development of more sophisticated navigation solutions that cater to the evolving needs of Indonesian consumers.

| Segment | Sub-Segments |

|---|---|

| By System Type | Embedded OEM In-Dash Navigation Systems Aftermarket In-Dash Navigation Systems Smartphone-Integrated Head Units Others (Retrofit and Specialty Systems) |

| By Vehicle Ownership Segment | Private Passenger Vehicles Rental & Ride-Hailing Vehicles Corporate & Government Fleets Public Transport & Shared Mobility |

| By Vehicle Type | Passenger Cars (A–C Segment) MPVs & SUVs Light Commercial Vehicles (LCVs) Medium & Heavy Commercial Vehicles (M&HCVs) |

| By Sales Channel | OEM Factory-Fitted Authorized Dealerships Independent Aftermarket Installers Online Marketplaces & E-Retailers |

| By Technology & Feature Set | D Map-Based Navigation D & Landmark-Based Navigation Connected & Cloud-Based Navigation Advanced Features (Voice, ADAS Integration, OTA Updates) |

| By Region | Java (Jakarta, West Java, Central Java, East Java) Sumatra Kalimantan & Sulawesi Bali & Nusa Tenggara |

| By Price Range (System Cost) | Entry-Level (Below IDR 4 Million) Mid-Range (IDR 4–8 Million) Premium (Above IDR 8 Million) OEM Integrated within Infotainment Package |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Manufacturers | 45 | Product Managers, R&D Engineers |

| End-User Consumers | 120 | Car Owners, Tech Enthusiasts |

| Automotive Aftermarket Suppliers | 60 | Sales Managers, Product Development Leads |

| Technology Providers | 50 | Software Engineers, Business Development Managers |

| Regulatory Bodies | 40 | Policy Makers, Transportation Analysts |

The Indonesia In-Dash Navigation System market is valued at approximately USD 1.1 billion, driven by the increasing adoption of advanced automotive technologies and consumer demand for enhanced navigation features.