Region:Middle East

Author(s):Dev

Product Code:KRAB4230

Pages:85

Published On:October 2025

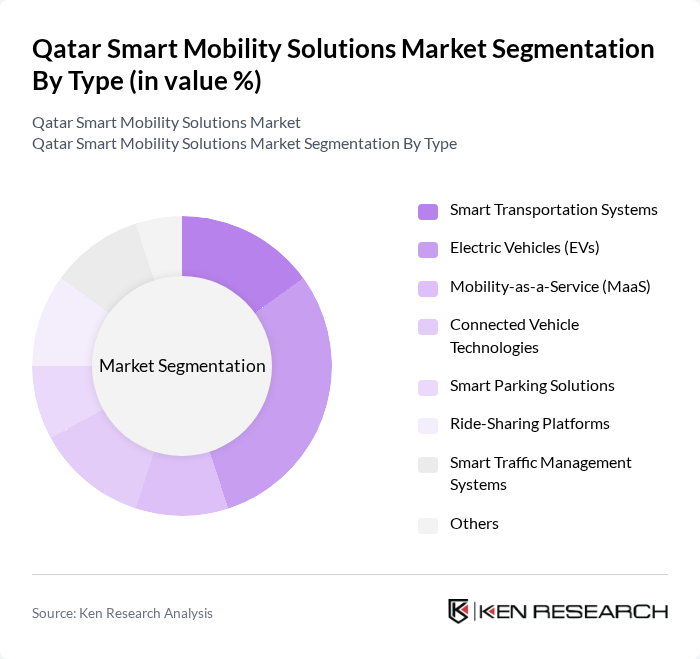

By Type:The market is segmented into various types, including Smart Transportation Systems, Electric Vehicles (EVs), Mobility-as-a-Service (MaaS), Connected Vehicle Technologies, Smart Parking Solutions, Ride-Sharing Platforms, Smart Traffic Management Systems, and Others. Among these,Electric Vehicles (EVs)are currently leading the market due to rising consumer awareness about environmental issues, robust government incentives, and rapid expansion of charging infrastructure. The increasing integration of smart transportation systems, supported by government-led digital transformation initiatives, is also contributing to the growth of the market.

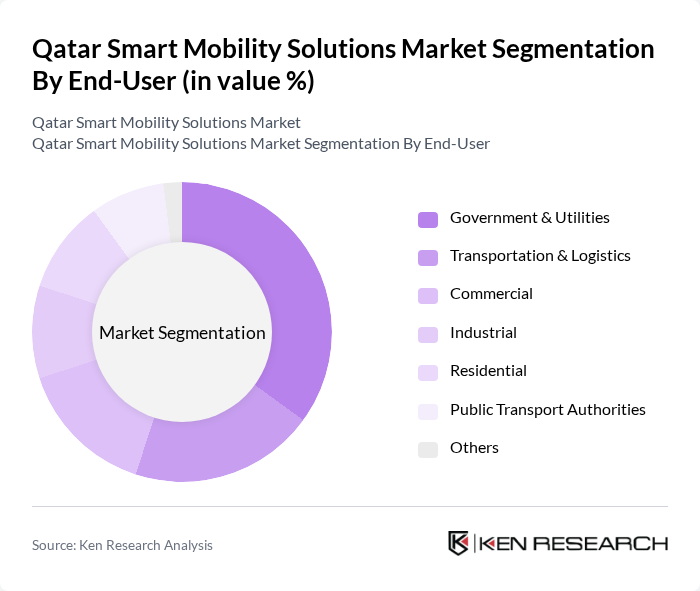

By End-User:The end-user segmentation includes Government & Utilities, Transportation & Logistics, Commercial, Industrial, Residential, Public Transport Authorities, and Others. TheGovernment & Utilitiessegment is currently the dominant player, driven by significant investments in smart infrastructure, public transportation systems, and the implementation of national strategies such as the Ministry of Transport's 2025–2030 roadmap. The increasing focus on sustainability and efficient urban mobility solutions has led to a surge in demand from government entities.

The Qatar Smart Mobility Solutions Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mowasalat (Karwa), Qatar Railways Company (Qatar Rail), Ooredoo Q.P.S.C., Vodafone Qatar P.Q.S.C., Labeeb IoT (Qatar Mobility Innovations Center), Siemens Qatar, Huawei Technologies Qatar, Qatar National Broadband Network (Qnbn), Ashghal (Public Works Authority), Qatar Science and Technology Park (QSTP), Ministry of Communications and Information Technology (MCIT), Qatar Free Zones Authority (QFZA), Qatar Electricity and Water Company (QEWC), Qatari Diar Real Estate Investment Company, Cisco Systems Qatar contribute to innovation, geographic expansion, and service delivery in this space.

The future of smart mobility solutions in Qatar appears promising, driven by ongoing urbanization and government support for sustainable initiatives. As the population grows, the demand for efficient transportation systems will intensify, prompting further investments in smart technologies. Additionally, the integration of artificial intelligence and the Internet of Things into mobility solutions is expected to enhance operational efficiency and user experience, paving the way for innovative transport models that align with Qatar's vision for a sustainable future.

| Segment | Sub-Segments |

|---|---|

| By Type | Smart Transportation Systems Electric Vehicles (EVs) Mobility-as-a-Service (MaaS) Connected Vehicle Technologies Smart Parking Solutions Ride-Sharing Platforms Smart Traffic Management Systems Others |

| By End-User | Government & Utilities Transportation & Logistics Commercial Industrial Residential Public Transport Authorities Others |

| By Application | Urban Mobility Solutions Freight and Logistics Public Transport Systems Smart Buildings Integration Emergency Services Others |

| By Distribution Channel | Direct Sales Online Platforms Distributors Partnerships with Local Authorities Retail Outlets Others |

| By Investment Source | Government Funding Private Investments Public-Private Partnerships (PPP) Foreign Direct Investment (FDI) International Aid and Grants Others |

| By Policy Support | Subsidies for Electric Vehicles Tax Exemptions for Smart Mobility Solutions Regulatory Credits Grants for Research and Development Regulatory Support for Startups Others |

| By User Demographics | Age Groups Income Levels Urban vs Rural Users Corporate vs Individual Users Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public Transportation Innovations | 60 | Transport Authorities, City Planners |

| Electric Vehicle Adoption | 50 | Fleet Managers, EV Charging Infrastructure Providers |

| Smart Traffic Management Systems | 40 | Traffic Engineers, IT Managers in Transportation |

| Mobility-as-a-Service Platforms | 45 | Startup Founders, Product Managers |

| Urban Mobility Research | 40 | Academics, Research Analysts |

The Qatar Smart Mobility Solutions Market is valued at approximately USD 900 million, driven by the demand for efficient transportation systems, urbanization, and government initiatives focused on smart city infrastructure.