Region:Asia

Author(s):Rebecca

Product Code:KRAD2935

Pages:87

Published On:November 2025

By Type:The market is segmented into various types of instrument transformers, including Current Transformers, Voltage (Potential) Transformers, Combined Instrument Transformers, Rogowski Coils, and Others. Each type serves specific applications in power systems, contributing to the overall market dynamics. Current Transformers are widely used for current measurement and protection, Voltage Transformers for voltage measurement and safety, Combined Instrument Transformers for multifunctional applications, and Rogowski Coils for flexible, high-accuracy current sensing in modern grids.

TheCurrent Transformerssegment leads the market due to their essential role in measuring and monitoring electrical currents in power systems. Their widespread application in substations and industrial facilities drives demand, as industries increasingly focus on energy efficiency and reliability.Voltage Transformersalso hold a significant share, primarily used for voltage measurement and protection in electrical networks. The trend towards smart grids, digital substations, and renewable energy integration further supports the growth of these segments.

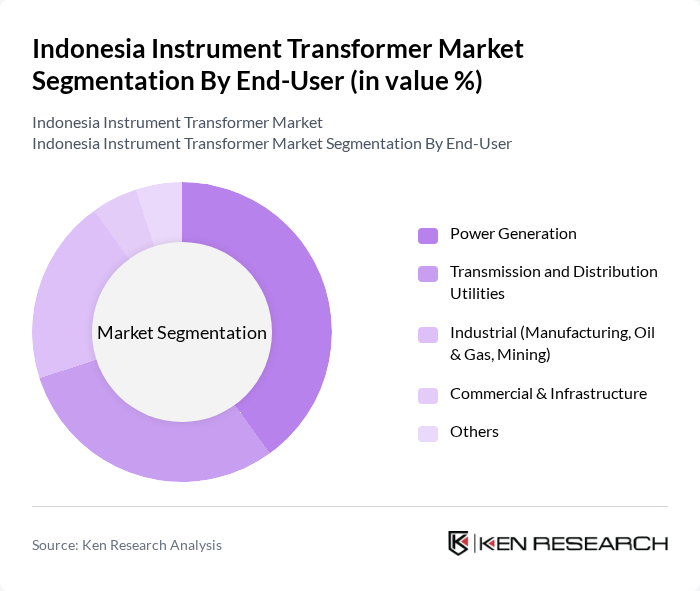

By End-User:The market is categorized based on end-users, including Power Generation, Transmission and Distribution Utilities, Industrial (Manufacturing, Oil & Gas, Mining), Commercial & Infrastructure, and Others. Each end-user segment has unique requirements and applications for instrument transformers. Power Generation and Utilities require high-reliability transformers for grid stability, while industrial and commercial users focus on advanced metering and energy management.

ThePower Generationsegment is the largest end-user, driven by the need for reliable energy supply and the integration of renewable energy sources.Transmission and Distribution Utilitiesalso play a crucial role, as they require instrument transformers for efficient energy distribution and monitoring. The industrial sector, particularly manufacturing and oil & gas, is increasingly adopting advanced metering solutions, contributing to the growth of the market. The rise of smart infrastructure and digital energy management is further accelerating adoption across all end-user categories.

The Indonesia Instrument Transformer Market is characterized by a dynamic mix of regional and international players. Leading participants such as Schneider Electric, Siemens AG, ABB Ltd., General Electric, Mitsubishi Electric, Eaton Corporation, Toshiba Corporation, Hitachi Ltd., Arteche Group, PT. Schneider Electric Indonesia, PT. ABB Sakti Industri, PT. Siemens Indonesia, PT. Trafoindo Prima Perkasa, PT. Unindo, PT. PLN Enjiniring, PT. Hitachi Asia Indonesia, PT. Toshiba Asia Pacific Indonesia, PT. General Electric Operations Indonesia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indonesia instrument transformer market appears promising, driven by the ongoing transition towards renewable energy and the modernization of the electrical grid. As the government continues to invest in infrastructure and smart grid technologies, the demand for efficient and reliable transformers is expected to rise. Furthermore, the integration of digital solutions and IoT technologies will enhance operational efficiency, paving the way for innovative applications in energy management and predictive maintenance.

| Segment | Sub-Segments |

|---|---|

| By Type | Current Transformers Voltage (Potential) Transformers Combined Instrument Transformers Rogowski Coils Others |

| By End-User | Power Generation Transmission and Distribution Utilities Industrial (Manufacturing, Oil & Gas, Mining) Commercial & Infrastructure Others |

| By Application | Power Quality Monitoring Protection Systems Measurement and Control Revenue Metering Others |

| By Voltage Level | Low Voltage (<1kV) Medium Voltage (1kV–36kV) High Voltage (>36kV) Extra High Voltage (>245kV) Others |

| By Material | Copper Aluminum Composite Materials Others |

| By Installation Type | Indoor Outdoor Others |

| By Region | Java Sumatra Kalimantan Sulawesi Bali & Nusa Tenggara Papua & Maluku Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Utility Companies | 100 | Energy Managers, Procurement Officers |

| Manufacturers of Instrument Transformers | 60 | Production Managers, Sales Directors |

| Engineering and Consulting Firms | 50 | Project Engineers, Technical Consultants |

| Government Regulatory Bodies | 40 | Policy Makers, Regulatory Analysts |

| End-Users in Industrial Sectors | 70 | Facility Managers, Operations Directors |

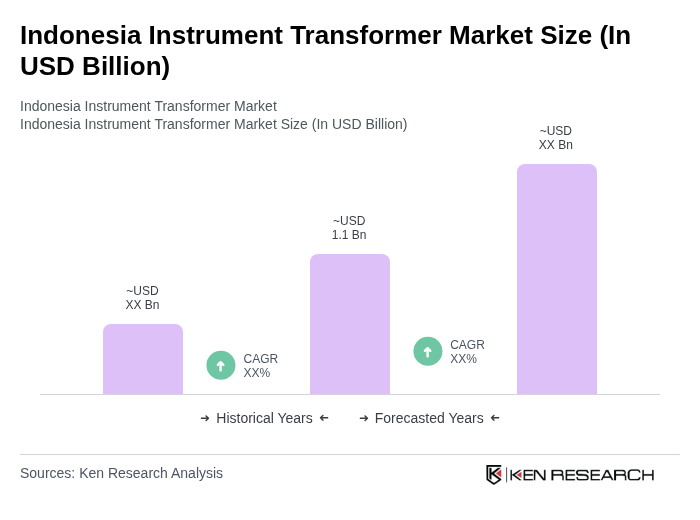

The Indonesia Instrument Transformer Market is valued at approximately USD 1.1 billion, driven by the increasing demand for reliable power supply and the expansion of renewable energy projects, along with investments in grid modernization and digitalization.