Region:Middle East

Author(s):Rebecca

Product Code:KRAC3261

Pages:86

Published On:October 2025

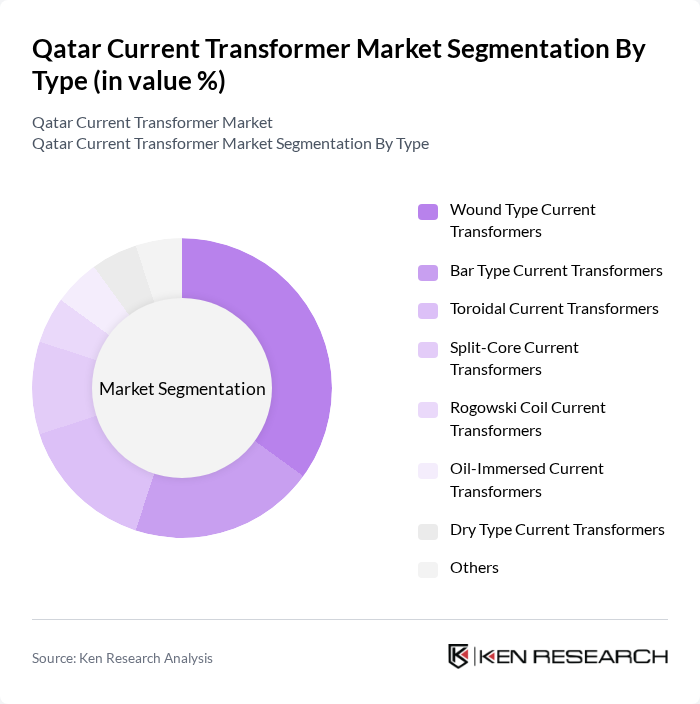

By Type:The current transformer market can be segmented into Wound Type Current Transformers, Bar Type Current Transformers, Toroidal Current Transformers, Split-Core Current Transformers, Rogowski Coil Current Transformers, Oil-Immersed Current Transformers, Dry Type Current Transformers, and Others. Wound Type Current Transformers are the leading segment, attributed to their high accuracy and reliability in metering and protection applications, especially in utility and industrial sectors .

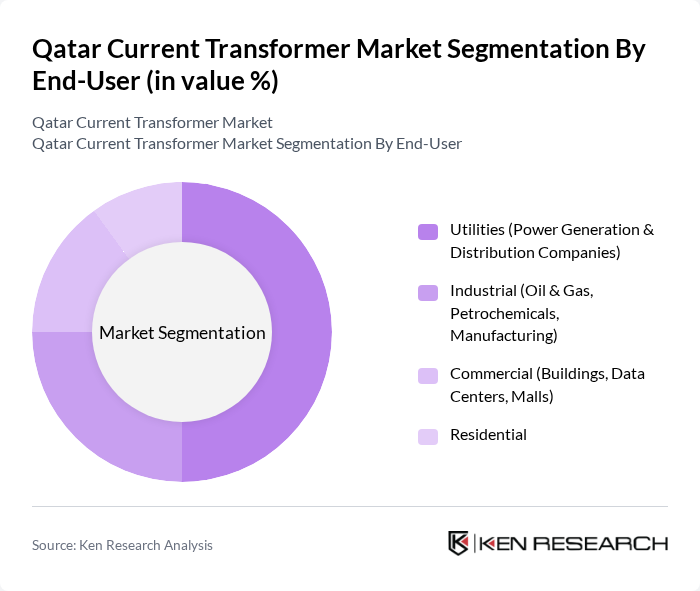

By End-User:The end-user segmentation includes Utilities (Power Generation & Distribution Companies), Industrial (Oil & Gas, Petrochemicals, Manufacturing), Commercial (Buildings, Data Centers, Malls), and Residential. Utilities remain the dominant end-user segment, driven by the need for reliable power supply, grid modernization, and increased adoption of smart grid technologies to support Qatar’s infrastructure and energy diversification goals .

The Qatar Current Transformer Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens AG, Schneider Electric SE, ABB Ltd., General Electric Company, Eaton Corporation plc, Mitsubishi Electric Corporation, Arteche Group, CG Power and Industrial Solutions Limited, LEM Holding SA, Instrument Transformers Limited (ITL), Alfanar Company, Arabian Transformers Co., Alstom SA, Toshiba Corporation, and Hitachi Energy Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The Qatar current transformer market is poised for significant growth, driven by increasing investments in renewable energy and infrastructure development. As the country progresses towards its 2030 energy efficiency goals, the integration of smart grid technologies will become essential. Additionally, the rising focus on sustainability will likely accelerate the adoption of innovative current transformer solutions, enhancing operational efficiency and reducing environmental impact. Stakeholders must adapt to these trends to capitalize on emerging opportunities in the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Wound Type Current Transformers Bar Type Current Transformers Toroidal Current Transformers Split-Core Current Transformers Rogowski Coil Current Transformers Oil-Immersed Current Transformers Dry Type Current Transformers Others |

| By End-User | Utilities (Power Generation & Distribution Companies) Industrial (Oil & Gas, Petrochemicals, Manufacturing) Commercial (Buildings, Data Centers, Malls) Residential |

| By Application | Metering Protection Power Distribution Power Generation Renewable Energy Integration Others |

| By Sales Channel | Direct Sales Distributors Online Sales Others |

| By Cooling Type | Oil-Immersed Dry Type |

| By Price Range | Low Price Mid Price High Price |

| By Policy Support | Subsidies Tax Exemptions Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Power Generation Sector | 100 | Plant Managers, Electrical Engineers |

| Utility Distribution Networks | 80 | Distribution Managers, Operations Supervisors |

| Construction Projects | 60 | Project Managers, Procurement Specialists |

| Renewable Energy Installations | 50 | Renewable Energy Engineers, Sustainability Managers |

| Maintenance and Repair Services | 70 | Maintenance Technicians, Service Managers |

The Qatar Current Transformer Market is valued at approximately USD 22 million, driven by increasing electricity demand, infrastructure development, and the expansion of power generation and distribution networks in the region.