Region:Asia

Author(s):Geetanshi

Product Code:KRAD4185

Pages:97

Published On:December 2025

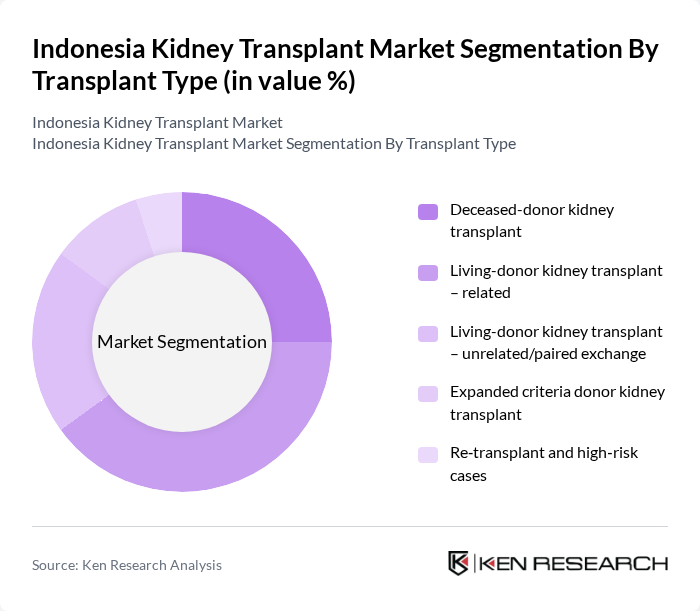

By Transplant Type:The market is segmented into various transplant types, including deceased-donor kidney transplants, living-donor kidney transplants (related and unrelated), expanded criteria donor kidney transplants, and re-transplant and high-risk cases. In Indonesia and across Asia-Pacific, living-donor kidney transplants currently account for the majority of procedures because of limited deceased donor availability, family-based donation patterns, and cultural factors, and they are supported by evidence of generally better graft survival and patient outcomes compared with many deceased-donor procedures. Among these, living-donor kidney transplants are gaining traction due to the increasing awareness of organ donation, improvements in donor evaluation and minimally invasive nephrectomy techniques, and the preference for living donations, which generally result in better outcomes.

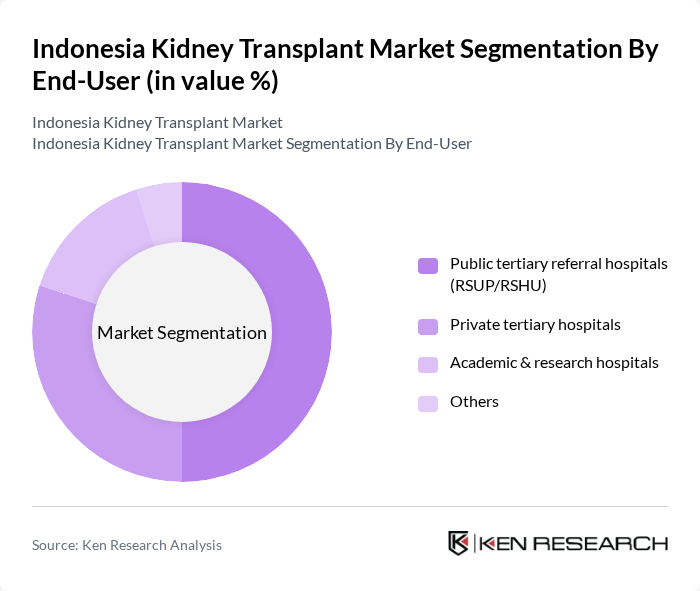

By End-User:The end-user segmentation includes public tertiary referral hospitals, private tertiary hospitals, academic and research hospitals, and others. Public tertiary referral hospitals dominate the market due to their role as national and provincial referral centers, comprehensive transplant services, multidisciplinary teams, and government support through JKN/BPJS, which facilitates access to advanced transplant procedures and post-operative care for insured patients.

The Indonesia Kidney Transplant Market is characterized by a dynamic mix of regional and international players. Leading participants such as RSUPN Dr. Cipto Mangunkusumo, Jakarta, RSUP Dr. Hasan Sadikin, Bandung, RSUD Dr. Soetomo, Surabaya, RSUP Dr. Sardjito, Yogyakarta, RSUP Dr. Wahidin Sudirohusodo, Makassar, RSUP Dr. Kariadi, Semarang, RSUP Dr. M. Djamil, Padang, RSUD Dr. Zainoel Abidin, Banda Aceh, RSUP Fatmawati, Jakarta, RS Pondok Indah Group (RSPI Jakarta), Siloam Hospitals Group, RSUPN Dr. Harapan Kita, Jakarta, RSUP Sanglah, Denpasar, RSUP Dr. Kariadi – Kidney Transplant Center, Semarang, Universitas Indonesia – Faculty of Medicine & transplant program contribute to innovation, geographic expansion, and service delivery in this space.

The future of the kidney transplant market in Indonesia appears promising, driven by increasing public awareness and advancements in medical technology. As healthcare infrastructure continues to expand, more patients will gain access to transplant services. Additionally, the integration of telemedicine for post-transplant care is expected to enhance patient management and follow-up, improving overall outcomes. Collaborative efforts with international transplant centers will further bolster the capabilities of local facilities, ensuring better care for patients in need.

| Segment | Sub-Segments |

|---|---|

| By Transplant Type | Deceased-donor kidney transplant Living-donor kidney transplant – related Living-donor kidney transplant – unrelated/paired exchange Expanded criteria donor kidney transplant Re?transplant and high?risk cases |

| By End-User | Public tertiary referral hospitals (RSUP/RSHU) Private tertiary hospitals Academic & research hospitals Others |

| By Patient Demographics | Age group (pediatric, adult, geriatric) Gender Insurance coverage (JKN/BPJS vs private/self?pay) Socioeconomic status & region |

| By Geographic Distribution | Java (Jakarta, West Java, Central Java, East Java, Yogyakarta) Sumatra Kalimantan, Sulawesi & Eastern Indonesia Cross?island referral flows |

| By Care Pathway | Pre-transplant evaluation & waiting list management Surgical procedure Post-transplant acute care (0–12 months) Long-term follow-up & graft surveillance |

| By Payer & Funding Source | National Health Insurance (JKN/BPJS Kesehatan) Central & local government programs Private insurance & corporate schemes Out-of-pocket payments |

| By Clinical Indication | Diabetic nephropathy Hypertensive & cardiovascular-related nephropathy Glomerulonephritis and autoimmune causes Congenital & hereditary kidney diseases |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Nephrologist Insights | 100 | Nephrologists, Kidney Specialists |

| Patient Experiences | 120 | Kidney Transplant Recipients, Caregivers |

| Healthcare Administrator Feedback | 60 | Hospital Administrators, Transplant Program Coordinators |

| Policy Maker Perspectives | 50 | Health Policy Makers, Government Officials |

| Transplant Surgeons' Opinions | 70 | Transplant Surgeons, Surgical Team Leaders |

The Indonesia Kidney Transplant Market is valued at approximately USD 1.1 billion, reflecting a significant growth driven by the increasing prevalence of chronic kidney diseases and advancements in healthcare infrastructure and transplant technologies.