Region:Asia

Author(s):Dev

Product Code:KRAD3444

Pages:85

Published On:November 2025

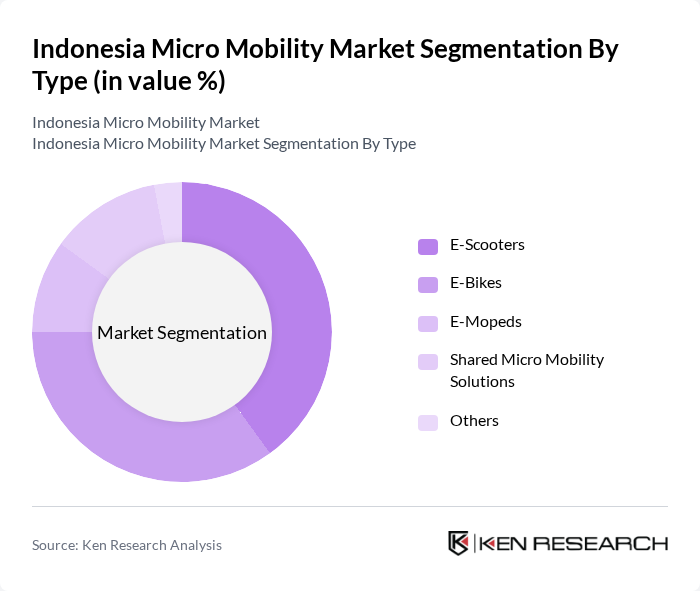

By Type:The micro mobility market can be segmented into various types, including e-scooters, e-bikes, e-mopeds, shared micro mobility solutions, and others. Among these, e-scooters and e-bikes are the most popular due to their convenience and ease of use. E-scooters are particularly favored for short commutes, while e-bikes cater to a broader audience, including those looking for a more sustainable mode of transport. The shared micro mobility solutions segment is also gaining traction, especially in urban areas where users prefer renting over ownership.

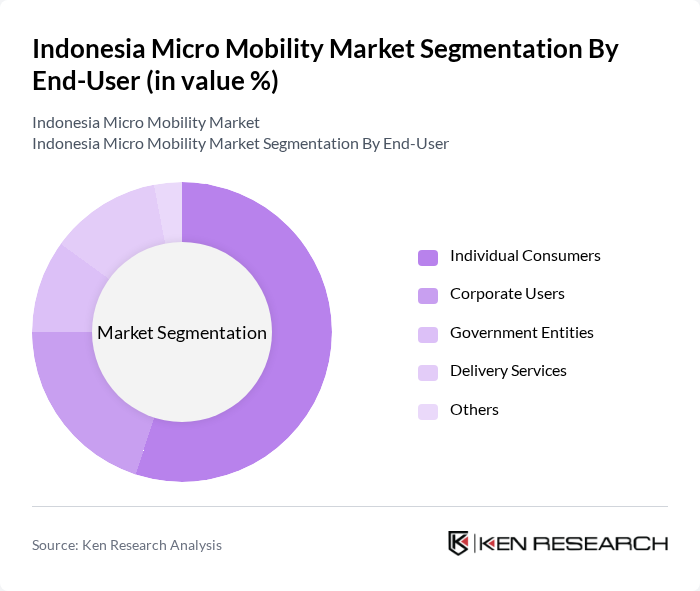

By End-User:The end-user segmentation includes individual consumers, corporate users, government entities, delivery services, and others. Individual consumers dominate the market, driven by the need for convenient and cost-effective transportation options. Corporate users are increasingly adopting micro mobility solutions for employee commuting, while delivery services leverage e-bikes and e-scooters for last-mile logistics. Government entities are also becoming significant users, promoting micro mobility as part of urban transport initiatives.

The Indonesia Micro Mobility Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gojek, Grab, Blue Gogo, OVO, Anteraja, Migo, E-scooter Indonesia, E-bike Indonesia, Wavelo, Tern, Niu Technologies, Xiaomi, Gogoro, Lime, and Bird contribute to innovation, geographic expansion, and service delivery in this space.

The future of the micro mobility market in Indonesia appears promising, driven by increasing urbanization and a growing emphasis on sustainable transport solutions. In the future, the integration of micro mobility with public transport systems is expected to enhance accessibility and convenience for users. Additionally, the rise of Mobility-as-a-Service (MaaS) platforms will facilitate seamless travel experiences, further encouraging the adoption of e-scooters and e-bikes as viable alternatives to traditional transport methods.

| Segment | Sub-Segments |

|---|---|

| By Type | E-Scooters E-Bikes E-Mopeds Shared Micro Mobility Solutions Others |

| By End-User | Individual Consumers Corporate Users Government Entities Delivery Services Others |

| By Region | Java Sumatra Bali Kalimantan Others |

| By Application | Commuting Leisure Delivery Services Tourism Others |

| By Charging Infrastructure | Public Charging Stations Private Charging Solutions Battery Swapping Stations Others |

| By Business Model | B2C (Business to Consumer) B2B (Business to Business) B2G (Business to Government) Others |

| By Ownership Model | Owned Shared Subscription-Based Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Commuter Insights | 150 | Daily commuters, university students, working professionals |

| Micro-Mobility Operators | 100 | Business owners, fleet managers, service operators |

| Government Policy Makers | 80 | Transport officials, urban planners, sustainability coordinators |

| Consumer Behavior Analysis | 120 | Casual users, eco-conscious individuals, tech-savvy commuters |

| Industry Experts and Analysts | 50 | Market analysts, academic researchers, industry consultants |

The Indonesia Micro Mobility Market is valued at approximately USD 1.2 billion, driven by urbanization, rising fuel prices, and a growing demand for sustainable transportation solutions like e-scooters and e-bikes.