Region:Central and South America

Author(s):Geetanshi

Product Code:KRAA1995

Pages:99

Published On:August 2025

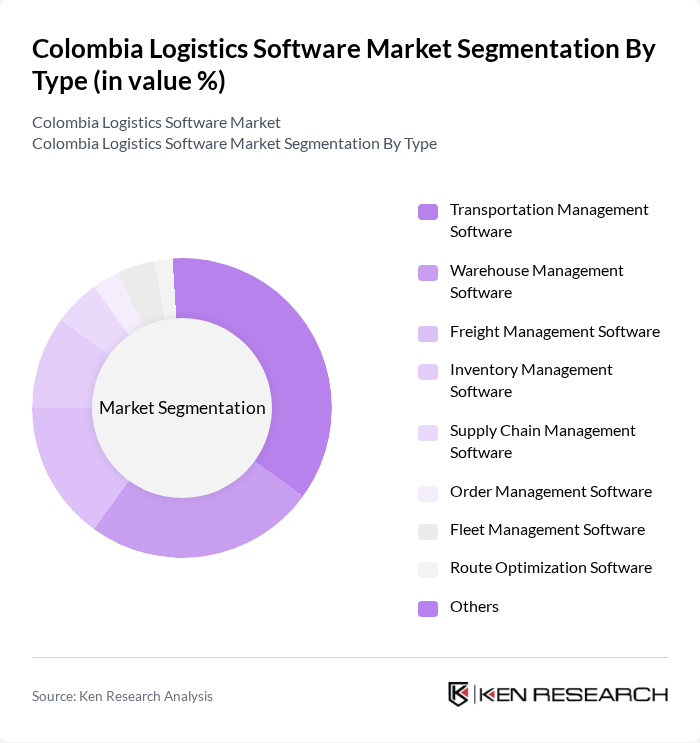

By Type:The logistics software market is segmented into various types, including Transportation Management Software, Warehouse Management Software, Freight Management Software, Inventory Management Software, Supply Chain Management Software, Order Management Software, Fleet Management Software, Route Optimization Software, and Others. Among these,Transportation Management Softwareis currently the leading segment due to the increasing need for efficient transportation solutions, real-time tracking, and route optimization, especially as logistics providers respond to the surge in e-commerce and demand for last-mile delivery solutions. The adoption of cloud-based and AI-powered logistics platforms is accelerating growth in this segment as businesses seek to optimize their logistics operations for speed and cost-effectiveness .

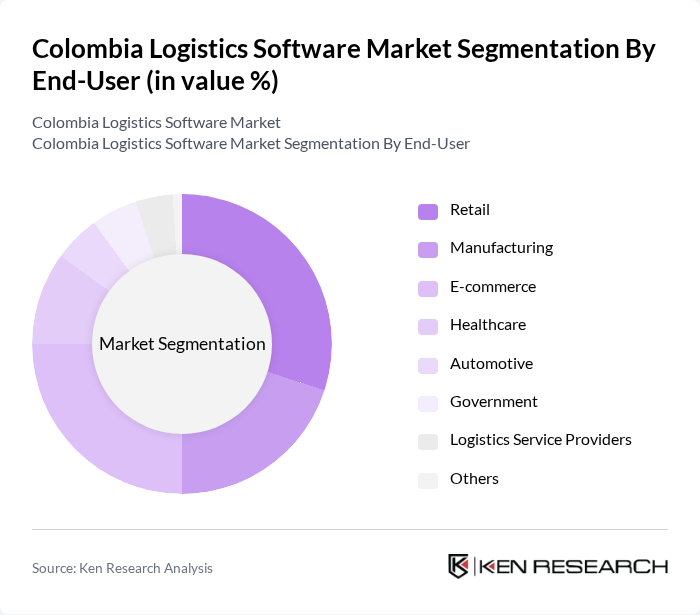

By End-User:The end-user segmentation includes Retail, Manufacturing, E-commerce, Healthcare, Automotive, Government, Logistics Service Providers, and Others. TheE-commercesector is currently the dominant end-user, driven by the rapid growth of online shopping and the need for efficient logistics solutions to manage increased order volumes. Retailers and logistics providers are increasingly adopting logistics software to streamline operations, improve delivery times, and enhance customer satisfaction. The expansion of digital payment systems and the emphasis on secure, transparent transactions are also supporting software adoption in this segment .

The Colombia Logistics Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SE, Oracle Corporation, Blue Yonder (formerly JDA Software Group, Inc.), Manhattan Associates, Inc., Infor, Inc., Descartes Systems Group Inc., C.H. Robinson Worldwide, Inc., Trimble Inc., Kuebix, a Trimble Company, Project44, FourKites, Locus.sh, Shipwell, Blu Logistics, CEVA Logistics, Coltanques, DHL, FedEx Corporation, Grupo TCC, Inter Rapidísimo S.A., Servientrega S.A., United Parcel Service (UPS), NAVIERA FLUVIAL COLOMBIANA S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the logistics software market in Colombia appears promising, driven by technological advancements and increasing demand for efficiency. As businesses continue to embrace automation and data analytics, the integration of AI and machine learning into logistics software will become more prevalent. Additionally, the expansion of logistics hubs and improvements in infrastructure will facilitate smoother operations, enabling companies to respond swiftly to market demands and enhance customer satisfaction in the evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Transportation Management Software Warehouse Management Software Freight Management Software Inventory Management Software Supply Chain Management Software Order Management Software Fleet Management Software Route Optimization Software Others |

| By End-User | Retail Manufacturing E-commerce Healthcare Automotive Government Logistics Service Providers Others |

| By Component | Software Services Hardware |

| By Deployment Mode | On-Premises Cloud-Based |

| By Sales Channel | Direct Sales Distributors Online Sales |

| By Industry Vertical | Transportation and Logistics Retail and E-commerce Manufacturing Healthcare Agriculture Others |

| By Pricing Model | Subscription-Based One-Time License Fee Pay-Per-Use |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Logistics Software Adoption in Retail | 100 | IT Managers, Supply Chain Directors |

| Warehouse Management Systems Usage | 60 | Warehouse Managers, Operations Supervisors |

| Transportation Management Systems Insights | 50 | Logistics Coordinators, Fleet Managers |

| ERP Integration in Logistics | 40 | IT Directors, Business Analysts |

| Impact of E-commerce on Logistics Software | 70 | E-commerce Managers, Digital Transformation Leads |

The Colombia Logistics Software Market is valued at approximately USD 1.1 billion, reflecting a significant growth driven by the demand for efficient supply chain management solutions, e-commerce expansion, and advancements in technology such as cloud computing and AI.