Region:Middle East

Author(s):Geetanshi

Product Code:KRAD1230

Pages:80

Published On:November 2025

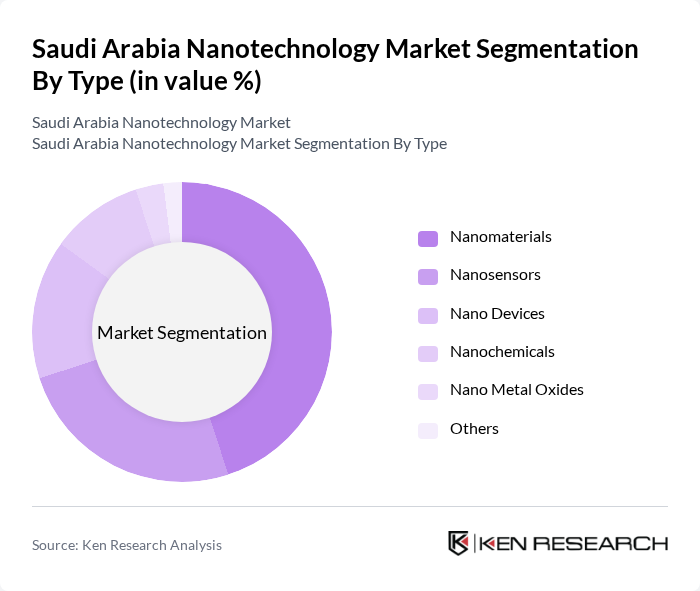

By Type:The segmentation by type includes various subsegments such as Nanomaterials, Nanosensors, Nano Devices, Nanochemicals, Nano Metal Oxides, and Others. Among these, Nanomaterials are currently leading the market due to their extensive applications in sectors like healthcare, electronics, and energy. The increasing demand for lightweight and high-performance materials is driving the growth of this subsegment. Nanosensors are also gaining traction, particularly in healthcare diagnostics and environmental monitoring, as they offer enhanced sensitivity and specificity.

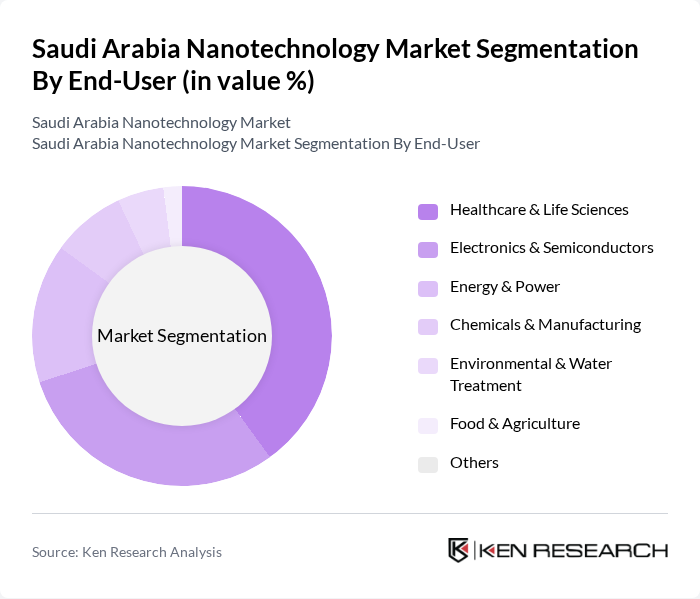

By End-User:The end-user segmentation includes Healthcare & Life Sciences, Electronics & Semiconductors, Energy & Power, Chemicals & Manufacturing, Environmental & Water Treatment, Food & Agriculture, and Others. The Healthcare & Life Sciences sector is the dominant end-user, driven by the increasing adoption of nanotechnology in drug delivery systems, diagnostics, and therapeutics. The Electronics & Semiconductors sector is also significant, as nanotechnology enhances the performance and efficiency of electronic devices.

The Saudi Arabia Nanotechnology Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Basic Industries Corporation (SABIC), King Abdulaziz City for Science and Technology (KACST), King Abdullah University of Science and Technology (KAUST), Saudi Arabian Oil Company (Saudi Aramco), National Industrialization Company (Tasnee), King Faisal Specialist Hospital & Research Centre (KFSH&RC), Saudi Food and Drug Authority (SFDA) Nanotechnology Center, Flashpoint Therapeutics – KAIMRC Center of Excellence for Structural Nanomedicine, Saudi Arabian Mining Company (Ma'aden), Advanced Petrochemical Company, Saudi Chevron Phillips Company, Saudi International Petrochemical Company (Sipchem), Saudi Technology Development and Investment Company (TAQNIA), Saudi Nanotechnology Society, Almarai Nanotechnology Research Division contribute to innovation, geographic expansion, and service delivery in this space.

The future of the nanotechnology market in Saudi Arabia appears promising, driven by increasing investments in R&D and a growing focus on sustainability. As the government continues to support innovation through funding and strategic initiatives, the integration of nanotechnology in various sectors, including healthcare and renewable energy, is expected to expand. Additionally, collaborations with international research institutions will enhance knowledge transfer and technological advancements, positioning Saudi Arabia as a regional leader in nanotechnology.

| Segment | Sub-Segments |

|---|---|

| By Type | Nanomaterials Nanosensors Nano Devices Nanochemicals Nano Metal Oxides Others |

| By End-User | Healthcare & Life Sciences Electronics & Semiconductors Energy & Power Chemicals & Manufacturing Environmental & Water Treatment Food & Agriculture Others |

| By Application | Drug Delivery & Nanomedicine Diagnostic Tools & Biosensors Coatings & Surface Treatments Sensors & Actuators Energy Storage & Conversion Water Purification Others |

| By Material | Metals (e.g., Aluminum Oxide, Titanium Dioxide) Polymers Ceramics Composites Carbon-based (e.g., Carbon Nanotubes, Graphene) Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Investment Source | Government Funding Private Investments International Collaborations Venture Capital Others |

| By Policy Support | Research Grants Tax Incentives Innovation Hubs Public-Private Partnerships Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Applications of Nanotechnology | 45 | Medical Researchers, Pharmaceutical Executives |

| Nanotechnology in Electronics | 38 | Product Development Managers, Electronics Engineers |

| Nanomaterials for Energy Sector | 42 | Energy Analysts, Renewable Energy Engineers |

| Aerospace and Defense Applications | 35 | Aerospace Engineers, Defense Technology Specialists |

| Environmental Applications of Nanotechnology | 40 | Environmental Scientists, Policy Makers |

The Saudi Arabia Nanotechnology Market is valued at approximately USD 105 million, driven by increased investments in research and development, government initiatives, and rising demand for advanced materials across various sectors, including healthcare, electronics, and energy.