Region:Asia

Author(s):Geetanshi

Product Code:KRAD1206

Pages:94

Published On:November 2025

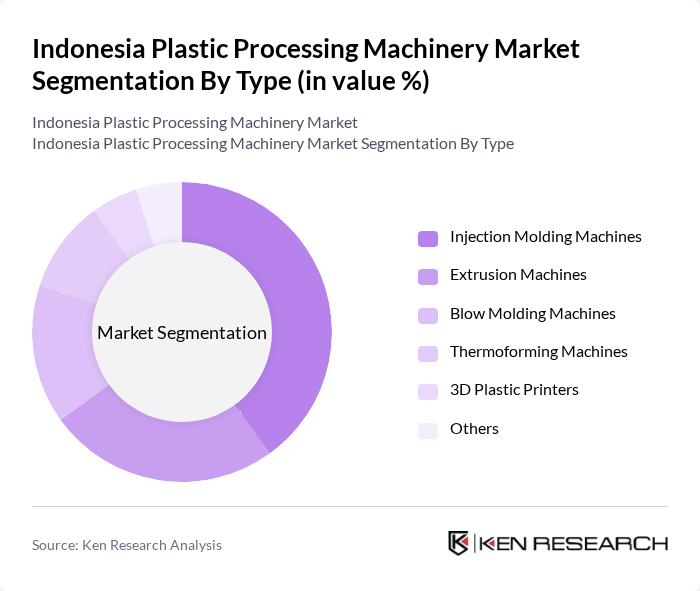

By Type:The market is segmented into Injection Molding Machines, Extrusion Machines, Blow Molding Machines, Thermoforming Machines, 3D Plastic Printers, and Others. Injection Molding Machines remain the most widely used due to their versatility and efficiency in producing complex shapes and high-volume parts. The demand for these machines is driven by the packaging and automotive industries, which require precision, speed, and the ability to process both commodity and engineering plastics. Automation and robotics integration are increasingly adopted to enhance productivity and reduce waste .

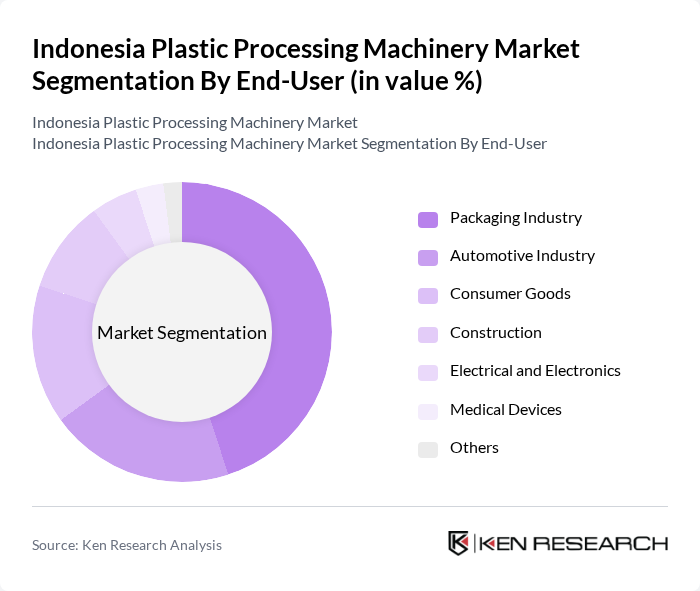

By End-User:The end-user segmentation includes Packaging, Automotive, Consumer Goods, Construction, Electrical and Electronics, Medical Devices, and Others. The Packaging Industry leads, driven by the growing demand for packaged goods, e-commerce logistics, and the need for efficient production processes. The sector’s growth is closely linked to evolving consumer behavior, with an increasing preference for convenience and ready-to-use products. The automotive and construction sectors are also significant, supported by rising vehicle production and infrastructure development .

The Indonesia Plastic Processing Machinery Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT. Chandra Asri Petrochemical Tbk, PT. Indoplas Karya Energi, PT. Pura Barutama, PT. Sanko Machinery Indonesia, PT. Sumber Djaja Perkasa, PT. Sinar Mas Agro Resources and Technology Tbk (SMART Tbk), PT. Tetra Pak Indonesia, PT. Dynaplast Tbk, PT. Astra Otoparts Tbk, PT. Trimitra Chitrahasta, PT. Indofood Sukses Makmur Tbk, PT. Unilever Indonesia Tbk, PT. Mayora Indah Tbk, PT. Indofood CBP Sukses Makmur Tbk, and PT. Asahimas Chemical contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indonesian plastic processing machinery market appears promising, driven by technological advancements and a growing emphasis on sustainability. As manufacturers increasingly adopt automation and IoT technologies, production efficiency is expected to improve significantly. Additionally, the rising demand for biodegradable plastics will likely spur innovation in machinery design, enabling producers to meet evolving consumer preferences. Overall, the market is poised for growth as it adapts to these emerging trends and challenges.

| Segment | Sub-Segments |

|---|---|

| By Type | Injection Molding Machines Extrusion Machines Blow Molding Machines Thermoforming Machines D Plastic Printers Others |

| By End-User | Packaging Industry Automotive Industry Consumer Goods Construction Electrical and Electronics Medical Devices Others |

| By Application | Food Packaging Industrial Packaging Household Products Medical Packaging Automotive Components Building and Construction Products Others |

| By Material Type | Polyethylene (PE) Polypropylene (PP) Polyvinyl Chloride (PVC) Polystyrene (PS) Polyethylene Terephthalate (PET) Polyurethane (PUR) Engineering Plastics (e.g., ABS, PC, PA) Bioplastics Others |

| By Technology | Conventional Technology Advanced Technology (e.g., 3D Printing, Automation, Robotics) Hybrid Technology Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | Java Sumatra Kalimantan Sulawesi Maluku Papua Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Injection Molding Machinery | 100 | Production Managers, Technical Directors |

| Blow Molding Equipment | 60 | Operations Managers, Plant Supervisors |

| Extrusion Machinery | 50 | Process Engineers, R&D Managers |

| Recycling Machinery | 40 | Sustainability Managers, Procurement Officers |

| Market Trends and Innovations | 70 | Industry Analysts, Business Development Managers |

The Indonesia Plastic Processing Machinery Market is valued at approximately USD 1.1 billion, driven by increasing demand for plastic products in various sectors such as packaging, automotive, and consumer goods, along with advancements in manufacturing capabilities and recycling technologies.