Region:Asia

Author(s):Geetanshi

Product Code:KRAA4755

Pages:81

Published On:September 2025

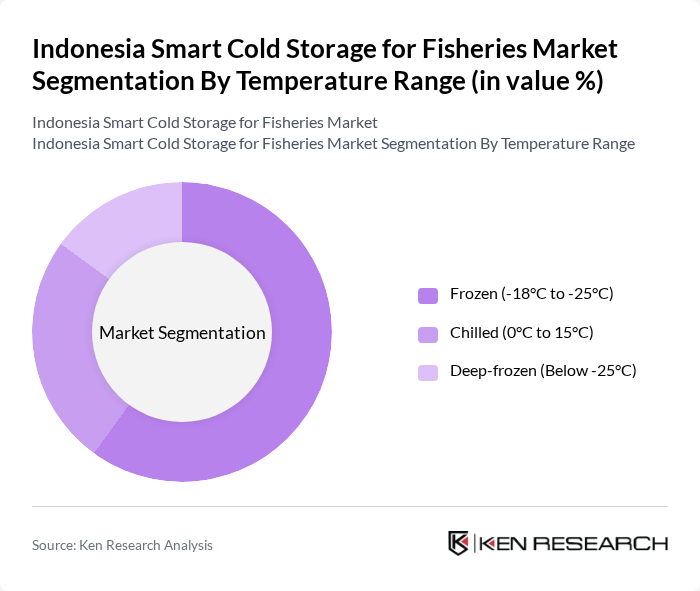

By Temperature Range:The temperature range for cold storage solutions is critical in determining the preservation quality of seafood products. The subsegments include Frozen (-18°C to -25°C), Chilled (0°C to 15°C), and Deep-frozen (Below -25°C). Among these, theFrozensegment is currently leading the market, accounting for the largest share due to its widespread application in seafood preservation, long shelf life, and ability to maintain product quality. The increasing demand for frozen seafood products, driven by both domestic consumption and export opportunities, further reinforces its market leadership.

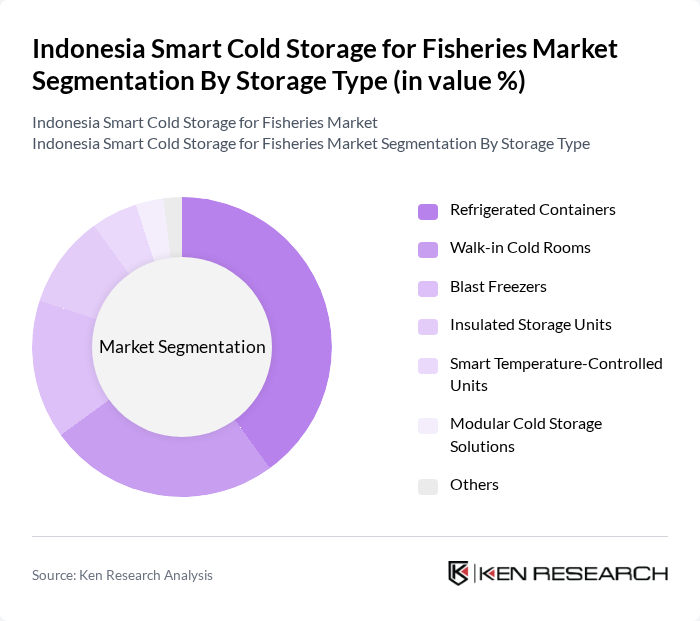

By Storage Type:The storage type segment covers Refrigerated Containers, Walk-in Cold Rooms, Blast Freezers, Insulated Storage Units, Smart Temperature-Controlled Units, Modular Cold Storage Solutions, and Others.Refrigerated Containersremain the most prominent subsegment, valued for their flexibility and efficiency in seafood transport. The rapid growth of e-commerce and food delivery has increased demand for mobile cold storage solutions, boosting the market position of refrigerated containers. Walk-in cold rooms and blast freezers are also widely adopted for large-scale processing and storage, supporting the sector’s operational needs.

The Indonesia Smart Cold Storage for Fisheries Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT. Kiat Ananda Cold Storage, PT. Mega Internasional Sejahtera, PT. Wahana Cold Storage, PT. Bonicom Servistama Compindo, PT. Bumi Menara Internusa, PT. Sumber Daya Manunggal, PT. Sari Segar Husada, PT. Indoguna Utama, Fresh Factory, TITAN Containers (Indonesia), PT. Enseval Putra Megatrading Tbk, PT. DS Solutions Internationals, PT. Sinar Mas Agro Resources and Technology Tbk (SMART Tbk), PT. Pelabuhan Indonesia (Pelindo), PT. Pangan Lestari contribute to innovation, geographic expansion, and service delivery in this space.

**Sources:** - - - -

The future of the smart cold storage market in Indonesia appears promising, driven by increasing seafood demand and government support for sustainable practices. As technological advancements continue to evolve, the integration of IoT and energy-efficient systems will likely enhance operational efficiencies. Furthermore, the growing emphasis on food safety and quality assurance will push stakeholders to adopt modern cold storage solutions, ensuring that Indonesia remains competitive in the global seafood market while addressing environmental concerns.

| Segment | Sub-Segments |

|---|---|

| By Temperature Range | Frozen (-18°C to -25°C) Chilled (0°C to 15°C) Deep-frozen (Below -25°C) |

| By Storage Type | Refrigerated Containers Walk-in Cold Rooms Blast Freezers Insulated Storage Units Smart Temperature-Controlled Units Modular Cold Storage Solutions Others |

| By End-User | Fish Processing Companies Seafood Distributors Aquaculture Farms Retail Chains Restaurants and Food Services Government Agencies Others |

| By Application | Fresh Fish Storage Frozen Fish Storage Seafood Processing Distribution and Logistics Retail Display Others |

| By Distribution Mode | Direct Sales Online Sales Distributors Retail Outlets Others |

| By Price Range | Budget Mid-Range Premium Others |

| By Component | Cooling Systems Insulation Materials Control Systems Monitoring Devices Others |

| By Policy Support | Government Subsidies Tax Incentives Grants for Technology Adoption Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cold Storage Facility Operators | 100 | Facility Managers, Operations Directors |

| Fisheries and Aquaculture Producers | 80 | Fishery Owners, Aquaculture Managers |

| Logistics and Supply Chain Experts | 70 | Logistics Managers, Cold Chain Specialists |

| Government Regulatory Bodies | 40 | Policy Makers, Regulatory Officers |

| Retail Seafood Distributors | 50 | Distribution Managers, Procurement Officers |

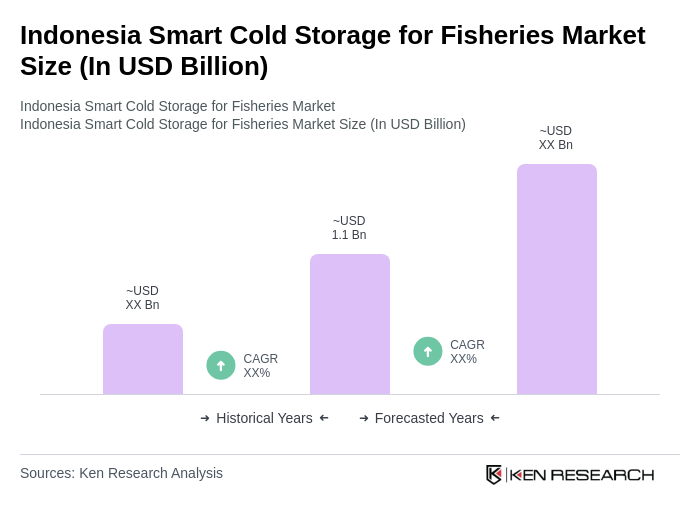

The Indonesia Smart Cold Storage for Fisheries Market is valued at approximately USD 1.1 billion, reflecting the significant role of fisheries in the broader cold chain market, which totals around USD 3 billion across all segments.