Region:Asia

Author(s):Dev

Product Code:KRAD1766

Pages:91

Published On:November 2025

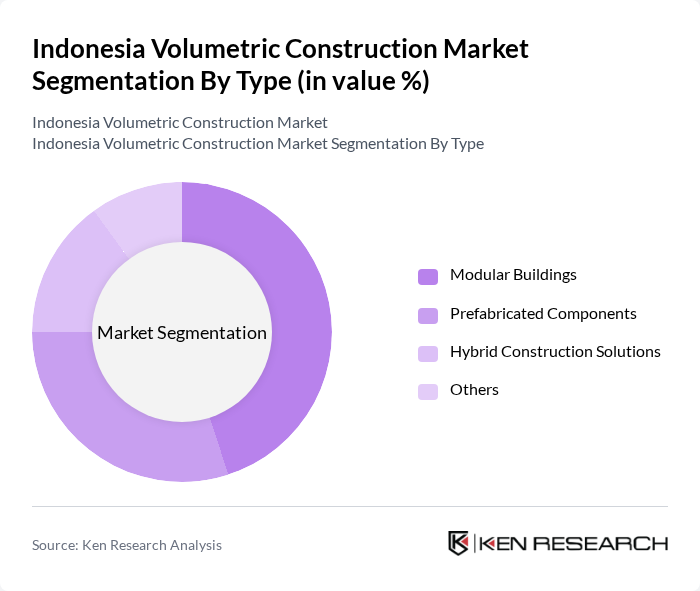

By Type:The volumetric construction market can be segmented into Modular Buildings, Prefabricated Components, Hybrid Construction Solutions, and Others. Among these, Modular Buildings are gaining significant traction due to their efficiency, speed of construction, and ability to support large-scale housing and commercial projects. Prefabricated Components are also popular, as they allow for customization, improved quality control, and reduced on-site labor. Hybrid Construction Solutions combine traditional and modern methods, appealing to a broader range of projects, especially those requiring flexibility in design and phased development. The "Others" segment includes specialized volumetric solutions such as container-based structures and temporary facilities, which are increasingly used for disaster relief and rapid deployment needs .

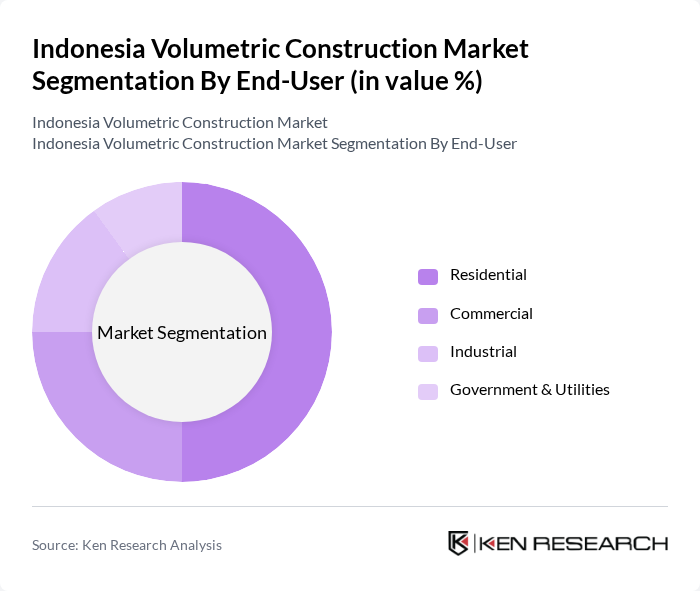

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, and Government & Utilities. The Residential segment is the largest, driven by the increasing need for affordable housing solutions and government-backed mass housing programs. The Commercial segment follows closely, fueled by urban development, expansion of retail and office spaces, and the rise of mixed-use developments. Industrial applications are also on the rise, particularly in manufacturing, logistics, and warehousing, where speed and scalability are critical. Government & Utilities projects are supported by public funding, infrastructure initiatives, and the implementation of sustainable construction standards for public buildings and utilities .

The Indonesia Volumetric Construction Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT Wijaya Karya (Persero) Tbk, PT Adhi Karya (Persero) Tbk, PT Pembangunan Perumahan (Persero) Tbk, PT Waskita Karya (Persero) Tbk, PT Total Bangun Persada Tbk, PT Nusa Raya Cipta Tbk, PT Hutama Karya (Persero), PT Citra Marga Nusaphala Persada Tbk, PT Jaya Konstruksi Manggala Pratama Tbk, PT Surya Semesta Internusa Tbk, PT Bina Puri Versatile Tbk, PT PP (Persero) Tbk, PT Ciptadana Capital, PT Bumi Serpong Damai Tbk, PT Sumber Alfaria Trijaya Tbk contribute to innovation, geographic expansion, and service delivery in this space.

The future of the volumetric construction market in Indonesia appears promising, driven by urbanization and government initiatives. As cities expand, the demand for efficient and sustainable construction methods will likely increase. Technological advancements, such as the integration of IoT and smart building solutions, will enhance construction efficiency. Furthermore, collaboration between private sectors and local governments is expected to foster innovation and investment, paving the way for a more robust volumetric construction landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Modular Buildings Prefabricated Components Hybrid Construction Solutions Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Region | Java Sumatra Kalimantan Sulawesi |

| By Technology | D Printing Modular Construction Technology Advanced Robotics Others |

| By Application | Residential Projects Commercial Developments Infrastructure Projects Others |

| By Investment Source | Domestic Investments Foreign Direct Investments (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Volumetric Projects | 100 | Project Managers, Architects |

| Commercial Building Developments | 80 | Construction Supervisors, Engineers |

| Infrastructure Projects | 70 | Government Officials, Urban Planners |

| Prefabricated Housing Initiatives | 50 | Manufacturers, Supply Chain Managers |

| Green Building Projects | 60 | Sustainability Consultants, Developers |

The Indonesia Volumetric Construction Market is valued at approximately USD 1.0 billion, driven by urbanization, demand for affordable housing, and government infrastructure initiatives. This market is expected to grow as innovative construction methods gain traction.