Region:Asia

Author(s):Dev

Product Code:KRAA8344

Pages:90

Published On:November 2025

By Type:The market is segmented into various types of wine, including Still Red Wine, Still White Wine, Rosé Wine, Sparkling Wine, Fortified Wine, Non-Grape Fruit Wine, Dessert Wine, and Others. Among these, Still Red Wine is the most popular choice among tourists, driven by its rich flavors, versatility in pairing with local cuisine, and the growing trend of wine tasting events and vineyard tours. There is also a rising interest in premium and organic wine offerings, reflecting evolving consumer preferences .

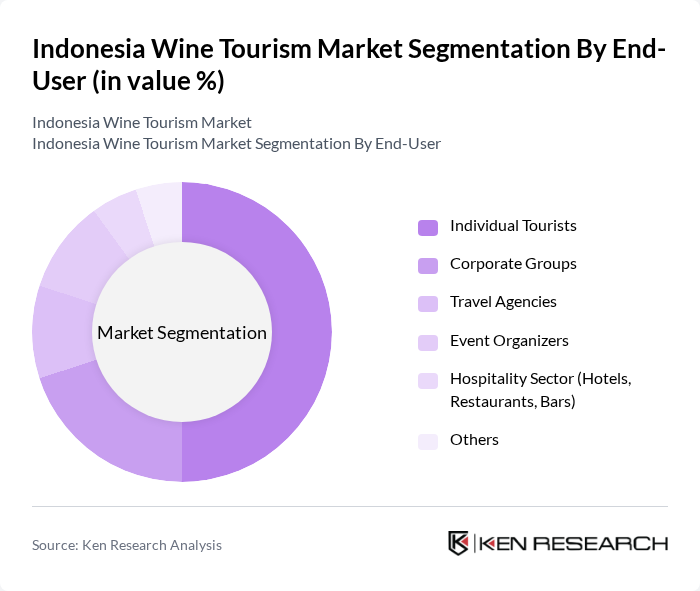

By End-User:The end-user segmentation includes Individual Tourists, Corporate Groups, Travel Agencies, Event Organizers, the Hospitality Sector, and Others. Individual Tourists dominate the market, as the growing interest in wine tourism among leisure travelers drives demand for personalized experiences such as vineyard tours and wine tastings. This segment is characterized by a diverse demographic, including both local and international visitors. The hospitality sector and event organizers are also increasingly incorporating wine tourism into their offerings to attract premium clientele .

The Indonesia Wine Tourism Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hatten Wines, Sababay Winery, Plaga Wine, Two Islands Wine, Bali Wine Company, Adinda Winery, Vin de Bali, Puri Winery, Bodega de Bali, Sari Amerta, The Wine House Bali, Canggu Wine, Grape Garden Bali, Taman Nusa (Wine Tourism Venue), and Kura Kura Brewery (Wine Tourism Partner) contribute to innovation, geographic expansion, and service delivery in this space.

The future of Indonesia's wine tourism market appears promising, driven by increasing consumer interest and the expansion of local vineyards. As the government continues to support the industry through favorable policies, the market is likely to see enhanced collaboration between wineries and tourism boards. Additionally, the integration of technology in marketing and booking processes will streamline consumer access to wine tourism experiences, making it more appealing to both domestic and international travelers.

| Segment | Sub-Segments |

|---|---|

| By Type | Still Red Wine Still White Wine Rosé Wine Sparkling Wine (Champagne, Other Sparkling) Fortified Wine (Port, Sherry, Vermouth) Non-Grape Fruit Wine (Apple, Other) Dessert Wine Others |

| By End-User | Individual Tourists Corporate Groups Travel Agencies Event Organizers Hospitality Sector (Hotels, Restaurants, Bars) Others |

| By Region | Bali Java Sumatra Sulawesi Other Islands |

| By Occasion | Weddings Corporate Events Wine Tastings Festivals Culinary Tourism Others |

| By Distribution Channel | Online Sales (E-commerce) Travel Agencies Direct Sales from Wineries Retail Outlets (Supermarkets, Wine Shops) On-Trade (Hotels, Restaurants, Bars) Others |

| By Consumer Demographics | Age Group (18-25, 26-35, 36-50, 51+) Income Level (Low, Middle, High) Gender Tourist Origin (Domestic, International) Others |

| By Experience Type | Guided Vineyard Tours Self-Guided Tours Wine and Food Pairing Experiences Educational Workshops & Wine Classes Wine Festivals & Events Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Vineyard Visitor Experience | 120 | Tourists, Wine Enthusiasts |

| Wine Tour Operators | 60 | Business Owners, Tour Guides |

| Local Wine Producers | 50 | Winemakers, Vineyard Managers |

| Hospitality Sector Insights | 40 | Hotel Managers, Restaurant Owners |

| Consumer Preferences in Wine Tourism | 80 | Travel Bloggers, Social Media Influencers |

The Indonesia Wine Tourism Market is valued at approximately USD 1.3 billion, reflecting a significant growth trend driven by increasing interest in wine culture, a growing middle class, and the rise of wine production in regions like Bali and Java.