Region:Africa

Author(s):Geetanshi

Product Code:KRAA0242

Pages:87

Published On:August 2025

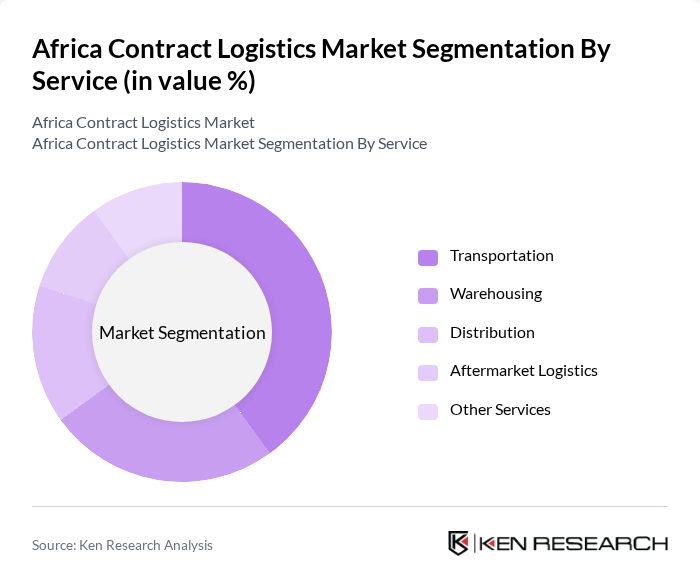

By Service:The service segment includes various offerings that cater to the logistics needs of businesses. The primary subsegments are Transportation, Warehousing, Distribution, Aftermarket Logistics, and Other Services. Transportation remains the largest segment, reflecting the continent's reliance on road, rail, air, and maritime movement of goods. Warehousing and distribution are also significant, driven by the need for efficient inventory management and last-mile delivery solutions. Aftermarket logistics, including reverse logistics and spare parts management, is growing rapidly as companies seek to enhance customer service and sustainability. Other services encompass value-added offerings such as packaging, labeling, and supply chain consulting .

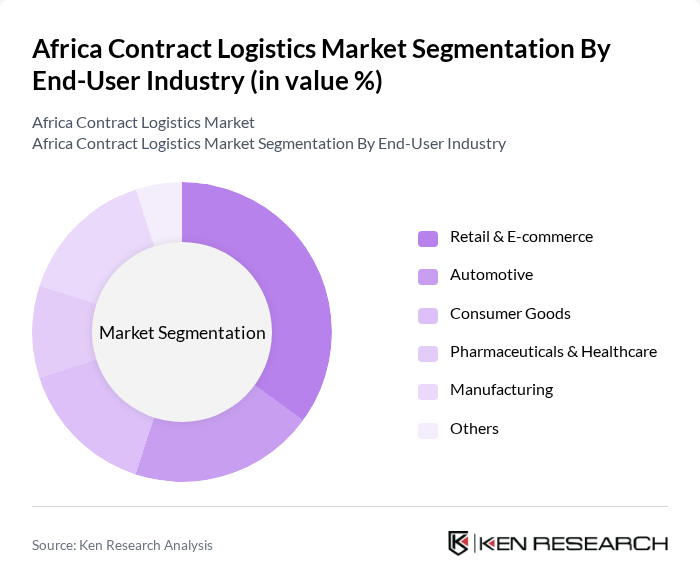

By End-User Industry:The end-user industry segment encompasses various sectors that utilize logistics services. The primary subsegments include Retail & E-commerce, Automotive, Consumer Goods, Pharmaceuticals & Healthcare, Manufacturing, and Others. Retail & e-commerce is the largest end-user, driven by the surge in online shopping and the need for rapid, reliable delivery networks. Automotive and manufacturing sectors require specialized logistics for inbound and outbound flows, while consumer goods and pharmaceuticals demand temperature-controlled and time-sensitive solutions. Other sectors include energy, mining, and agriculture, each with unique logistics requirements .

The Africa Contract Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, Kuehne + Nagel, DB Schenker, CEVA Logistics, Bolloré Logistics, Imperial Logistics, DSV, Agility Logistics, Bidvest International Logistics, Maersk Logistics & Services, Rhenus Logistics, Yusen Logistics, Hellmann Worldwide Logistics, UPS Supply Chain Solutions, and Transnet Freight Rail contribute to innovation, geographic expansion, and service delivery in this space .

The Africa contract logistics market is poised for significant transformation, driven by technological advancements and evolving consumer expectations. As digital transformation accelerates, logistics providers are increasingly adopting automation and data analytics to enhance operational efficiency. The emphasis on sustainable logistics practices is also gaining traction, with companies seeking eco-friendly solutions to meet regulatory requirements and consumer demand. This evolving landscape presents opportunities for innovative logistics solutions that can adapt to the dynamic market environment, ensuring competitiveness and growth.

| Segment | Sub-Segments |

|---|---|

| By Service | Transportation Warehousing Distribution Aftermarket Logistics Other Services |

| By End-User Industry | Retail & E-commerce Automotive Consumer Goods Pharmaceuticals & Healthcare Manufacturing Others |

| By Service Model | Insourcing Outsourcing (3PL/4PL) |

| By Country/Region | South Africa Nigeria Egypt Kenya Morocco Rest of Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Logistics Operations | 60 | Logistics Managers, Supply Chain Executives |

| Manufacturing Supply Chain | 50 | Operations Directors, Procurement Managers |

| Third-Party Logistics Providers | 40 | Business Development Managers, Account Executives |

| Transport and Freight Services | 45 | Fleet Managers, Logistics Coordinators |

| E-commerce Fulfillment Strategies | 50 | eCommerce Operations Managers, Warehouse Supervisors |

The Africa Contract Logistics Market is valued at approximately USD 14 billion, driven by the increasing demand for efficient supply chain solutions, e-commerce growth, infrastructure investments, and the expansion of manufacturing and retail sectors across the continent.