Region:Central and South America

Author(s):Rebecca

Product Code:KRAA4848

Pages:90

Published On:September 2025

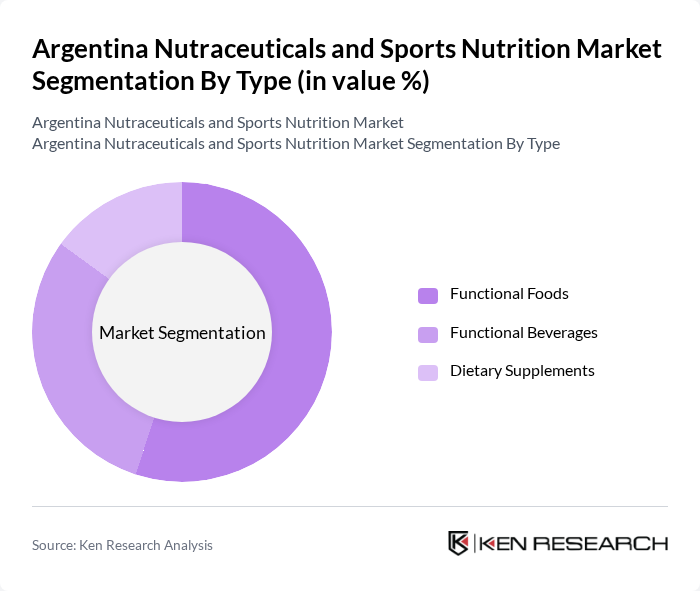

By Type:The market is segmented into Functional Foods, Functional Beverages, and Dietary Supplements. Among these, Functional Foods—especially Dairy Products, Snacks, and Cereals—lead the market due to their convenience, nutritional value, and alignment with on-the-go consumption trends. The popularity of fortified and protein-enriched products continues to rise as consumers seek accessible health benefits in everyday foods .

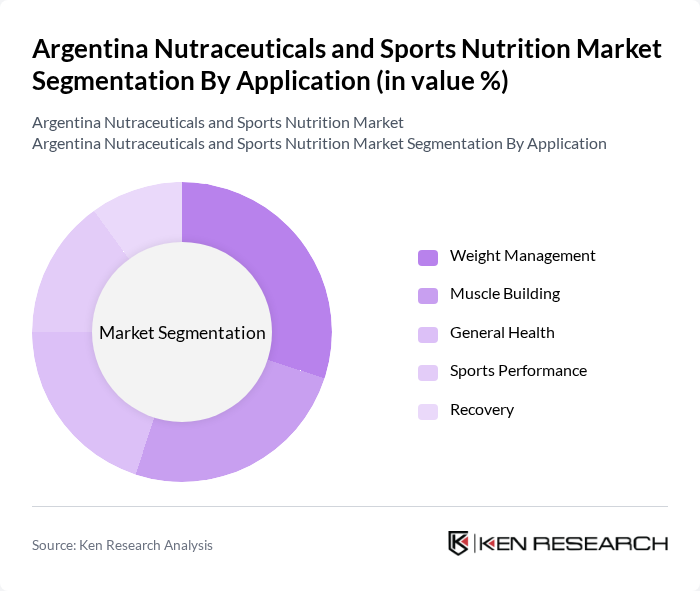

By Application:The applications of nutraceuticals and sports nutrition products include Weight Management, Muscle Building, General Health, Sports Performance, and Recovery. Weight Management remains the leading application, driven by the increasing prevalence of obesity and lifestyle-related diseases, as well as heightened consumer focus on preventive health and wellness solutions. Muscle Building and General Health also represent significant demand segments, reflecting the growing participation in fitness activities and broader adoption of wellness-oriented lifestyles .

The Argentina Nutraceuticals and Sports Nutrition Market is characterized by a dynamic mix of regional and international players. Leading participants such as Herbalife Nutrition Ltd., Amway Corporation, GNC Holdings, Inc., Nestlé S.A., Abbott Laboratories, Glanbia plc, The Coca-Cola Company, PepsiCo, Inc., Danone S.A., Kellogg Company, Red Bull GmbH, Reckitt Benckiser Group plc, Bagó Group (Laboratorios Bagó), Nutricia Bagó S.A., Arcor S.A.I.C. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Argentina nutraceuticals and sports nutrition market appears promising, driven by evolving consumer preferences and technological advancements. As health consciousness continues to rise, the demand for innovative products, particularly plant-based and personalized nutrition solutions, is expected to grow. Additionally, the expansion of e-commerce platforms will facilitate greater access to these products, allowing companies to reach a broader audience. The market is poised for dynamic growth, with opportunities for brands that can adapt to changing consumer needs and preferences.

| Segment | Sub-Segments |

|---|---|

| By Type | Functional Foods Cereal Bakery and Confectionery Snacks Dairy Products Others Functional Beverages Energy Drinks Fortified Juices Sports Drinks Dairy and Dairy Alternative Drinks Dietary Supplements Vitamins Minerals Botanicals Enzymes Fatty Acids Proteins |

| By Application | Weight Management Muscle Building General Health Sports Performance Recovery Others |

| By Distribution Channel | Pharmacies and Drugstores Supermarkets/Hypermarkets Online Retailers Health and Wellness Stores Direct Sales Others |

| By End-User | Adults Elderly Population Athletes and Fitness Enthusiasts General Consumers Others |

| By Ingredient Source | Natural Ingredients Synthetic Ingredients Organic Ingredients Others |

| By Price Range | Budget Mid-Range Premium Others |

| By Packaging Type | Bottles Sachets Tubs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Nutraceutical Product Users | 100 | Health-conscious consumers, Fitness enthusiasts |

| Sports Nutrition Product Users | 80 | Athletes, Personal trainers |

| Retailers of Nutraceuticals | 50 | Store managers, Product buyers |

| Health and Wellness Professionals | 40 | Nutritionists, Dietitians |

| Fitness Center Owners | 40 | Gym owners, Fitness program directors |

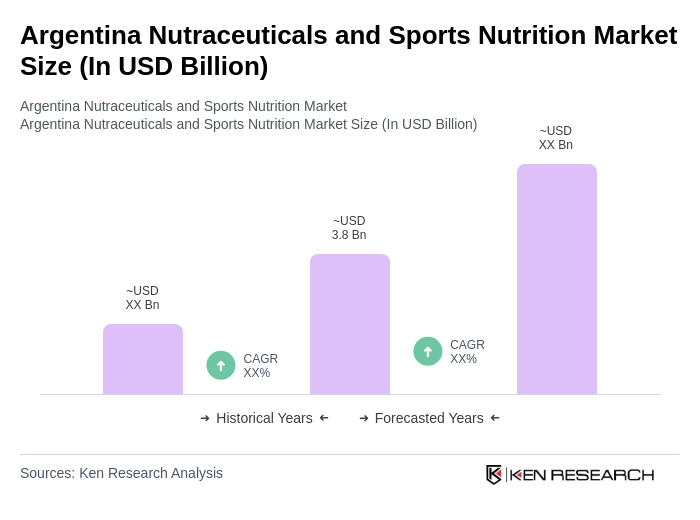

The Argentina Nutraceuticals and Sports Nutrition Market is valued at approximately USD 3.8 billion, reflecting a significant growth trend driven by increasing health consciousness and demand for dietary supplements among consumers.