Region:Asia

Author(s):Shubham

Product Code:KRAB4484

Pages:94

Published On:October 2025

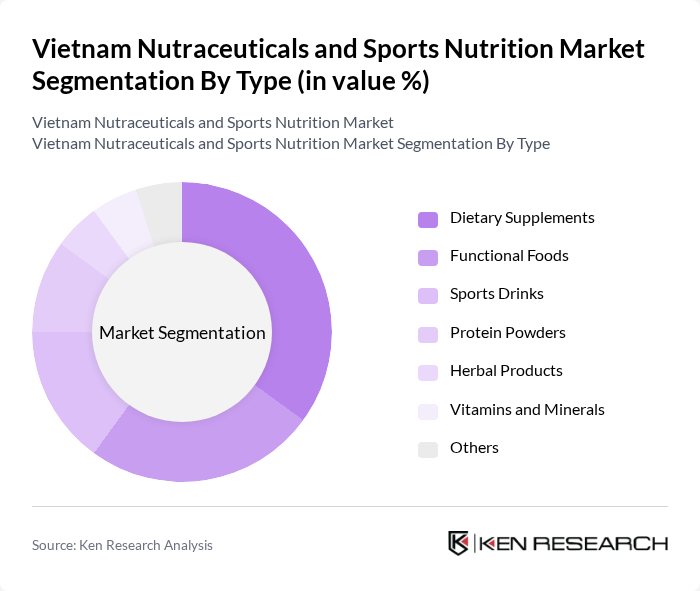

By Type:The market is segmented into various types, including Dietary Supplements, Functional Foods, Sports Drinks, Protein Powders, Herbal Products, Vitamins and Minerals, and Others. Among these, Dietary Supplements are leading the market due to their popularity among health-conscious consumers seeking to enhance their nutritional intake. The increasing trend of self-medication and preventive health measures has further propelled the demand for these products.

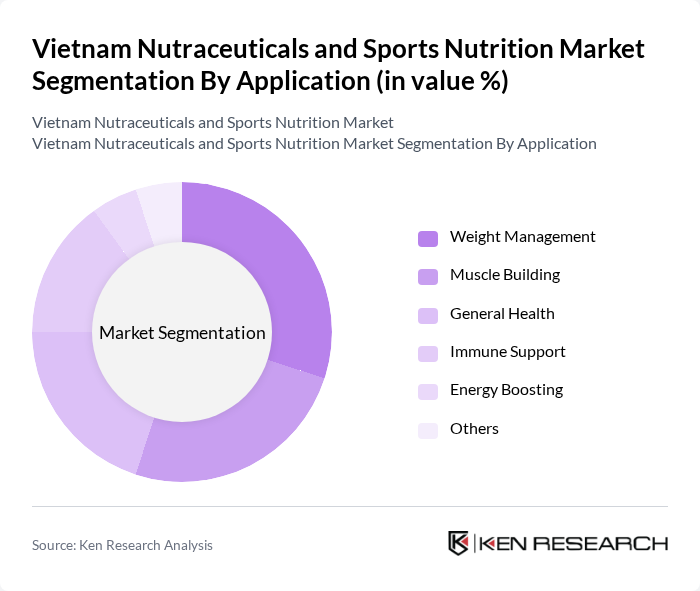

By Application:The applications of nutraceuticals and sports nutrition products include Weight Management, Muscle Building, General Health, Immune Support, Energy Boosting, and Others. Weight Management is currently the leading application segment, driven by the rising obesity rates and increasing awareness of healthy lifestyles among consumers. The growing trend of fitness and wellness has led to a surge in demand for products that aid in weight loss and muscle gain.

The Vietnam Nutraceuticals and Sports Nutrition Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nutifood, Herbalife Vietnam, Abbott Laboratories, Amway Vietnam, Unilever Vietnam, Nestlé Vietnam, GNC Vietnam, TH True Milk, Vinamilk, NutraBlast, FitFood, Vinasoy, NutraLife, Mega We Care, Nature's Way contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Vietnam nutraceuticals and sports nutrition market appears promising, driven by ongoing health trends and increasing consumer demand for personalized nutrition solutions. As e-commerce continues to expand, more consumers are expected to purchase health products online, enhancing accessibility. Additionally, the focus on sustainable sourcing and plant-based nutrition is likely to shape product development, aligning with global trends and consumer preferences for environmentally friendly options in the nutraceuticals sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Dietary Supplements Functional Foods Sports Drinks Protein Powders Herbal Products Vitamins and Minerals Others |

| By Application | Weight Management Muscle Building General Health Immune Support Energy Boosting Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Health Stores Pharmacies Direct Sales Others |

| By End-User | Athletes Fitness Enthusiasts General Consumers Elderly Population Others |

| By Price Range | Budget Mid-Range Premium Others |

| By Brand Type | Local Brands International Brands Private Labels Others |

| By Packaging Type | Bottles Sachets Tubs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Nutraceuticals | 150 | Health-conscious Consumers, Fitness Enthusiasts |

| Retail Insights on Sports Nutrition | 100 | Store Managers, Nutrition Product Buyers |

| Trends in Online Sales of Nutraceuticals | 80 | E-commerce Managers, Digital Marketing Specialists |

| Expert Opinions on Market Dynamics | 50 | Nutritionists, Health Coaches, Industry Analysts |

| Feedback from Fitness Centers and Gyms | 70 | Gym Owners, Personal Trainers, Nutrition Advisors |

The Vietnam Nutraceuticals and Sports Nutrition Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by increasing health consciousness, rising disposable incomes, and a shift towards preventive healthcare among consumers.