Region:Central and South America

Author(s):Geetanshi

Product Code:KRAA4788

Pages:91

Published On:September 2025

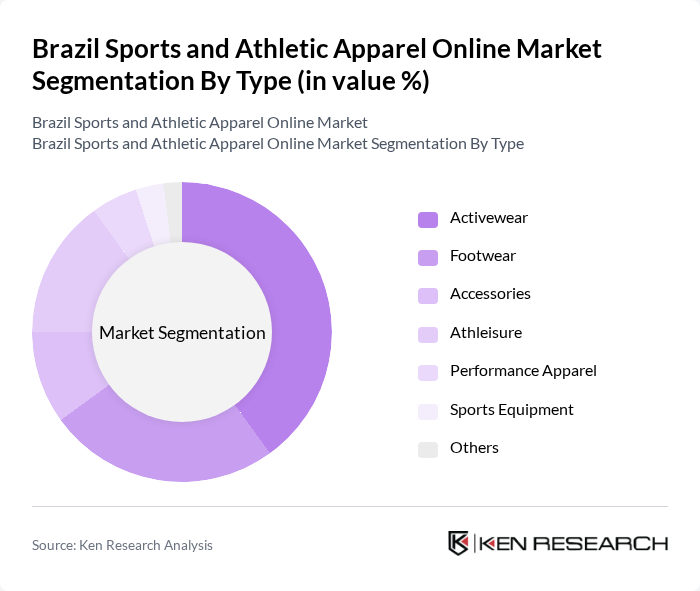

By Type:The market is segmented into Activewear, Footwear, Accessories, Athleisure, Performance Apparel, Sports Equipment, and Others. Activewear remains the leading sub-segment, propelled by the growing fitness and wellness movement and demand for versatile apparel suitable for both exercise and casual wear. Footwear and Athleisure also show robust performance, as Brazilian consumers increasingly seek comfort, style, and functional designs in their sportswear choices.

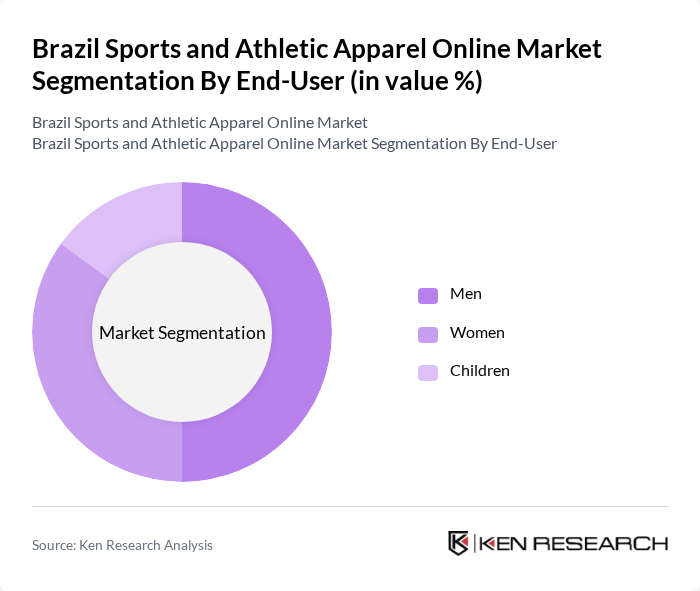

By End-User:The market is categorized into Men, Women, and Children. The Men's segment holds the largest share, driven by strong interest in fitness and sports among male consumers. Women’s participation in sports and fitness is rising, fueling demand for women-specific athletic apparel. The Children’s segment is expanding as parents increasingly prioritize quality and comfort in sportswear for their kids.

The Brazil Sports and Athletic Apparel Online Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nike, Inc., Adidas AG, Puma SE, Under Armour, Inc., Decathlon S.A., Lupo S.A., Track & Field, Alpargatas S.A., Hering S.A., Osklen, Reserva, Le Coq Sportif, Mizuno Corporation, Asics Corporation, New Balance Athletics, Inc., Netshoes (Grupo Magalu), Centauro (Grupo SBF), Fila Brasil, Olympikus (Vulcabras S.A.), Reebok Brasil contribute to innovation, geographic expansion, and service delivery in this space.

The future of Brazil's sports and athletic apparel online market appears promising, driven by increasing health awareness and the expansion of e-commerce. As more consumers embrace fitness, brands are likely to innovate in product offerings, focusing on sustainability and technology. Additionally, the integration of digital marketing strategies will enhance brand visibility. However, companies must navigate economic challenges and competition to capitalize on these trends effectively, ensuring they remain relevant in a dynamic market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Activewear Footwear Accessories Athleisure Performance Apparel Sports Equipment Others |

| By End-User | Men Women Children |

| By Sales Channel | Online Retail (Brand-owned E-commerce) Direct-to-Consumer (Brand Websites & Apps) Third-Party E-commerce Platforms (e.g., Mercado Livre, Netshoes, Amazon Brasil) |

| By Price Range | Budget Mid-Range Premium |

| By Brand Loyalty | Brand Loyal Customers Price-Sensitive Customers |

| By Material | Synthetic Fabrics Natural Fabrics Blended Fabrics |

| By Occasion | Casual Wear Sports Events Gym and Fitness Outdoor Activities |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Online Sports Apparel Purchasers | 120 | Active Consumers, Fitness Enthusiasts |

| Brand Managers in Athletic Apparel | 60 | Brand Managers, Product Managers |

| E-commerce Platform Analysts | 50 | Data Analysts, Business Development Managers |

| Fitness Influencers and Bloggers | 40 | Content Creators, Social Media Managers |

| Retail Buyers for Sports Apparel | 45 | Purchasing Agents, Category Managers |

The Brazil Sports and Athletic Apparel Online Market is valued at approximately USD 4.6 billion, reflecting a significant growth trend driven by increased health awareness, the rise of athleisure fashion, and the expansion of e-commerce platforms.