Region:Asia

Author(s):Shubham

Product Code:KRAA1149

Pages:85

Published On:August 2025

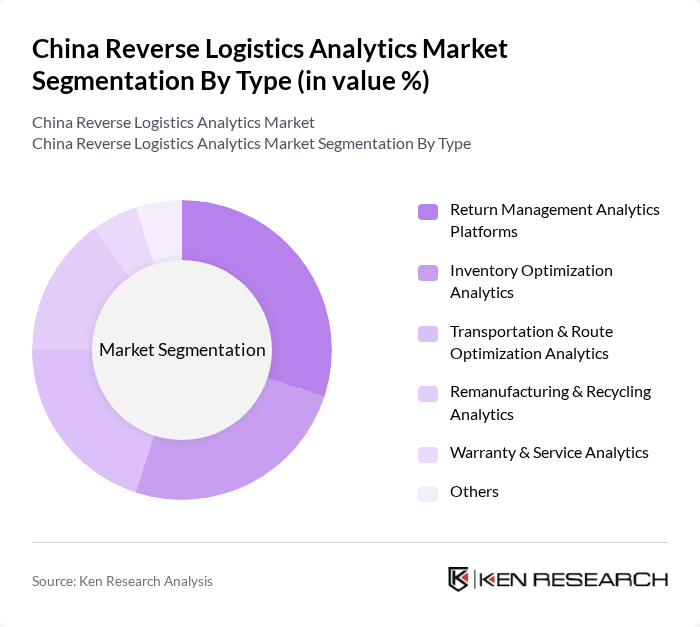

By Type:The market is segmented into Return Management Analytics Platforms, Inventory Optimization Analytics, Transportation & Route Optimization Analytics, Remanufacturing & Recycling Analytics, Warranty & Service Analytics, and Others. Return Management Analytics Platforms are critical for handling the high volume of product returns, especially in e-commerce, while Inventory Optimization Analytics help companies minimize excess stock and associated costs. Transportation & Route Optimization Analytics improve efficiency and reduce emissions, Remanufacturing & Recycling Analytics support sustainability goals, and Warranty & Service Analytics enhance after-sales service and customer loyalty .

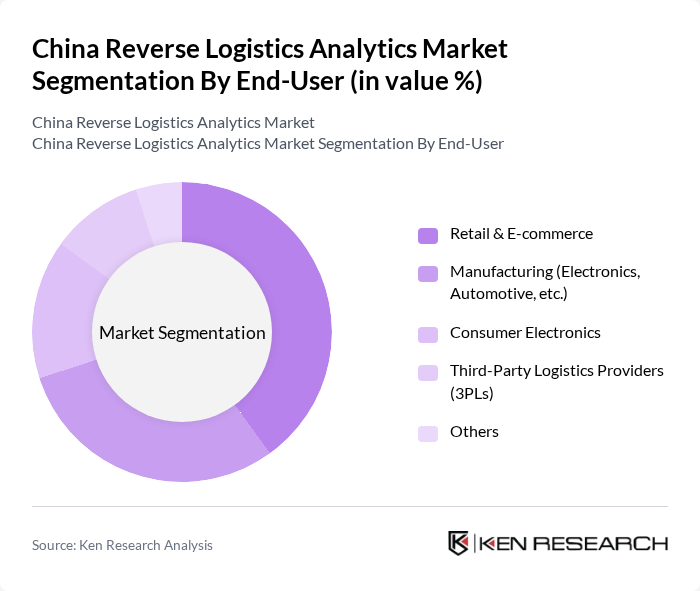

By End-User:The end-user segmentation includes Retail & E-commerce, Manufacturing (Electronics, Automotive, etc.), Consumer Electronics, Third-Party Logistics Providers (3PLs), and Others. Retail & E-commerce leads due to the high volume of returns and the need for efficient analytics to manage customer expectations and operational costs. Manufacturing, especially in electronics and automotive, relies on analytics for warranty management, recalls, and component recovery. Third-Party Logistics Providers (3PLs) use analytics to optimize reverse flows for multiple clients, while Consumer Electronics focuses on refurbishment and recycling .

The China Reverse Logistics Analytics Market is characterized by a dynamic mix of regional and international players. Leading participants such as JD Logistics, Alibaba Group (Cainiao Network), SF Express, ZTO Express, YTO Express, Best Inc., Cainiao Network, Meituan, Suning Logistics, DHL Supply Chain (China), XPO Logistics (Asia-Pacific), Kuehne + Nagel (China), CEVA Logistics (China), DB Schenker (China), Geodis (China), Yunda Express, and Deppon Logistics contribute to innovation, geographic expansion, and service delivery in this space .

The future of the reverse logistics analytics market in China appears promising, driven by the increasing integration of technology and sustainability initiatives. As e-commerce continues to expand, companies will increasingly rely on data-driven insights to enhance their reverse logistics operations. The focus on environmental sustainability will further push businesses to adopt innovative solutions that minimize waste and improve efficiency. Overall, the market is poised for significant growth as organizations recognize the value of effective reverse logistics strategies in a competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Return Management Analytics Platforms Inventory Optimization Analytics Transportation & Route Optimization Analytics Remanufacturing & Recycling Analytics Warranty & Service Analytics Others |

| By End-User | Retail & E-commerce Manufacturing (Electronics, Automotive, etc.) Consumer Electronics Third-Party Logistics Providers (3PLs) Others |

| By Application | Returns Forecasting & Optimization Remanufacturing & Refurbishment Planning Recycling & Waste Stream Analytics Asset Recovery & Value Maximization Warranty Claims Analysis Others |

| By Distribution Mode | Direct Sales Online Platforms & SaaS Third-Party Integrators Others |

| By Pricing Strategy | Subscription-Based Pricing Usage-Based Pricing Tiered/Enterprise Pricing Others |

| By Customer Segment | Small and Medium Enterprises (SMEs) Large Enterprises Government & Public Sector Others |

| By Policy Support | Subsidies for Green Logistics Analytics Tax Incentives for Digital Transformation Grants for Technology Adoption Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sector Reverse Logistics | 100 | Logistics Managers, Supply Chain Directors |

| Electronics Returns Management | 60 | Operations Managers, Customer Service Managers |

| Automotive Parts Recovery | 50 | Procurement Officers, Warehouse Managers |

| Textile Recycling Initiatives | 40 | Sustainability Officers, Product Development Managers |

| E-commerce Returns Processes | 70 | eCommerce Managers, Fulfillment Center Supervisors |

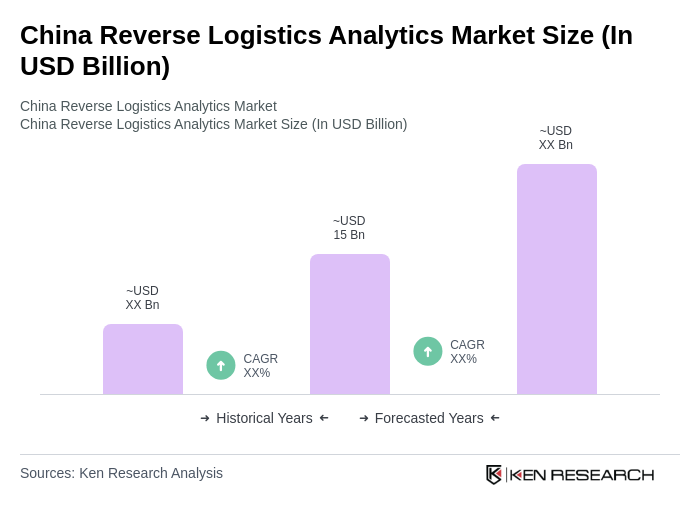

The China Reverse Logistics Analytics Market is valued at approximately USD 15 billion, driven by the demand for efficient supply chain management, e-commerce growth, and sustainability practices. This market is a significant part of the Asia Pacific reverse logistics sector.