Region:Europe

Author(s):Shubham

Product Code:KRAA1752

Pages:88

Published On:August 2025

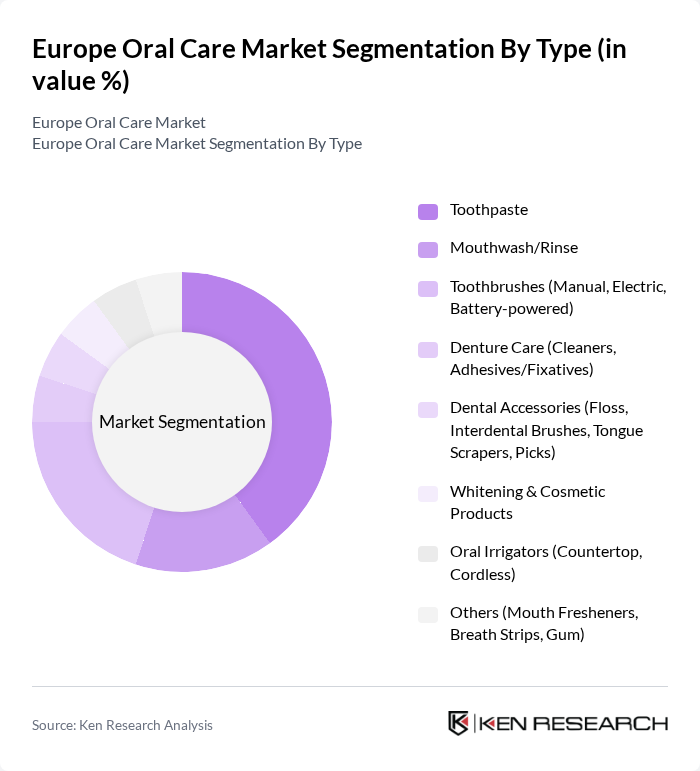

By Type:The oral care market is segmented into various types, including toothpaste, mouthwash/rinse, toothbrushes (manual, electric, battery-powered), denture care (cleaners, adhesives/fixatives), dental accessories (floss, interdental brushes, tongue scrapers, picks), whitening & cosmetic products, oral irrigators (countertop, cordless), and others (mouth fresheners, breath strips, gum). Among these, toothpaste is the leading sub-segment due to its essential role in daily oral hygiene routines and the increasing demand for specialized formulations such as sensitivity, enamel repair, whitening, and natural/clean-label variants.

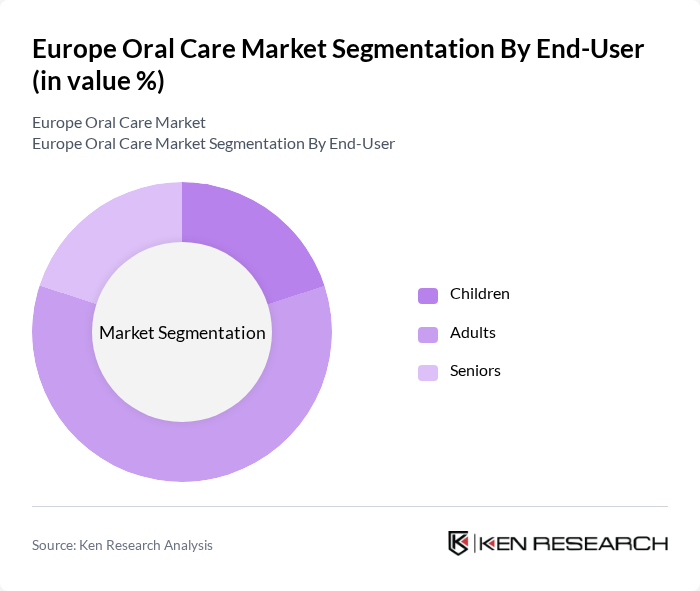

By End-User:The end-user segmentation includes children, adults, and seniors. Adults represent the largest segment due to their heightened awareness of oral health, higher purchasing power, and the increasing prevalence of dental issues, which supports uptake of premium solutions such as electric toothbrushes, sensitivity toothpaste, and whitening products.

The Europe Oral Care Market is characterized by a dynamic mix of regional and international players. Leading participants such as Procter & Gamble Co. (Oral-B, Blend-a-med), Colgate-Palmolive Company (Colgate, Elmex, Meridol), Unilever PLC (Signal, Zendium), Haleon plc (Sensodyne, Parodontax, Polident/Poligrip), Johnson & Johnson (Listerine), Henkel AG & Co. KGaA (Vademecum), Church & Dwight Co., Inc. (Arm & Hammer, Spinbrush), Reckitt Benckiser Group plc (Dentyl, Strepsils Oral Care), Pierre Fabre S.A. (Elgydium, Eludril), Sunstar Suisse S.A. (GUM), Johnson & Johnson Consumer Health GmbH (Germany), Laboratoires Pierre Fabre Oral Care (France), Perrigo Company plc (Oral care private label, EU), TePe Munhygienprodukter AB (TePe), Curaden AG (Curaprox), Straumann Group (Waterpik Europe), Philips Domestic Appliances Netherlands B.V. (Philips Sonicare), Beiersdorf AG (Dental care under Labello/Nivea oral accessories), Laboratoires Inava (Pierre Fabre Group), Ivoclar Vivadent AG (Liechtenstein) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Europe oral care market appears promising, driven by increasing consumer awareness and technological advancements. The trend towards personalized oral care solutions is expected to gain momentum, with consumers seeking products tailored to their specific needs. Additionally, the rise of e-commerce platforms will facilitate broader access to innovative oral care products, enhancing market penetration. As sustainability becomes a priority, companies will likely focus on eco-friendly packaging and natural ingredients, aligning with consumer preferences for environmentally responsible products.

| Segment | Sub-Segments |

|---|---|

| By Type | Toothpaste Mouthwash/Rinse Toothbrushes (Manual, Electric, Battery-powered) Denture Care (Cleaners, Adhesives/Fixatives) Dental Accessories (Floss, Interdental Brushes, Tongue Scrapers, Picks) Whitening & Cosmetic Products Oral Irrigators (Countertop, Cordless) Others (Mouth Fresheners, Breath Strips, Gum) |

| By End-User | Children Adults Seniors |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Pharmacies and Drug Stores Online Retail Stores (Including D2C) Dental Clinics/Professional Channels Others |

| By Price Range | Economy Mid-Range Premium |

| By Product Formulation | Fluoride-based Non-fluoride Herbal/Natural Medicated/Therapeutic |

| By Packaging Type | Tube Bottle Pump Refill/Cartridge |

| By Brand Loyalty | Brand Loyal Customers Price-sensitive Customers New Customers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Oral Care Product Usage | 150 | General Consumers, Health-Conscious Individuals |

| Dental Professional Insights | 100 | Dentists, Dental Hygienists |

| Retail Market Trends | 90 | Retail Managers, Category Buyers |

| Market Entry Strategies | 60 | Marketing Directors, Brand Managers |

| Consumer Preferences in Oral Care | 120 | Parents, Young Adults |

The Europe Oral Care Market is valued at approximately USD 14.7 billion, driven by increasing consumer awareness of oral hygiene, rising dental problems, and demand for innovative products, including premium offerings like whitening and sensitivity-relief formulations.