Region:Middle East

Author(s):Shubham

Product Code:KRAB7437

Pages:89

Published On:October 2025

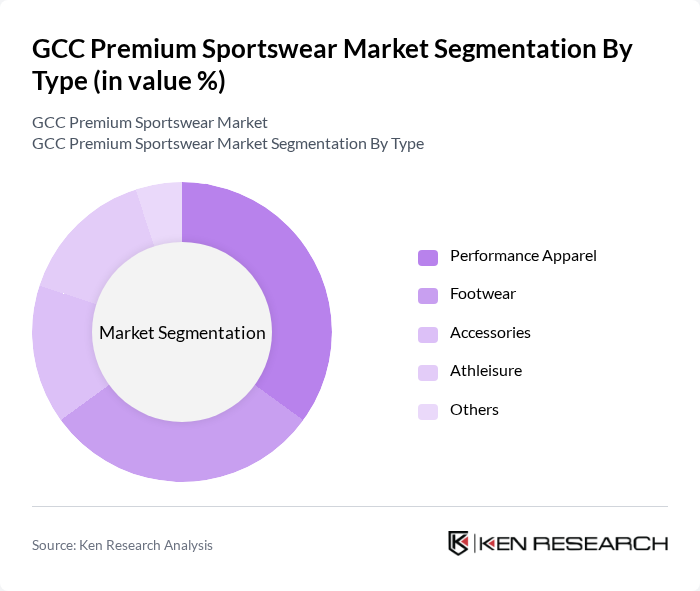

By Type:The market is segmented into various types, including Performance Apparel, Footwear, Accessories, Athleisure, and Others. Performance Apparel is gaining traction due to the increasing participation in sports and fitness activities, while Athleisure is becoming popular among consumers seeking comfort and style in everyday wear. Footwear also plays a crucial role, driven by innovations in technology and design that enhance performance and comfort.

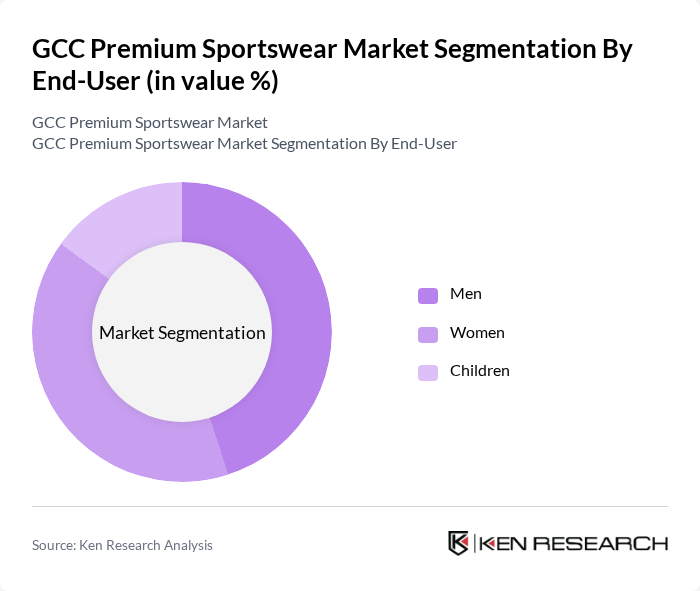

By End-User:The segmentation by end-user includes Men, Women, and Children. The men's segment is currently the largest due to the increasing focus on fitness and sports among male consumers. However, the women's segment is rapidly growing, driven by the rising participation of women in sports and fitness activities. The children's segment is also witnessing growth as parents increasingly invest in quality sportswear for their kids.

The GCC Premium Sportswear Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nike, Inc., Adidas AG, Puma SE, Under Armour, Inc., Lululemon Athletica Inc., ASICS Corporation, New Balance Athletics, Inc., Reebok International Ltd., Columbia Sportswear Company, The North Face, Inc., Fila Holdings Corp., Skechers USA, Inc., Gymshark Ltd., Decathlon S.A., Champion Athleticwear contribute to innovation, geographic expansion, and service delivery in this space.

The GCC premium sportswear market is poised for continued growth, driven by evolving consumer preferences towards health and fitness. As the region embraces a more active lifestyle, brands are likely to innovate in product offerings, focusing on performance-enhancing features and sustainable materials. Additionally, the integration of technology in sportswear, such as smart fabrics, will attract tech-savvy consumers. The market will also benefit from increased collaboration with fitness influencers, enhancing brand visibility and consumer engagement in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Performance Apparel Footwear Accessories Athleisure Others |

| By End-User | Men Women Children |

| By Distribution Channel | Online Retail Offline Retail Specialty Stores |

| By Price Range | Premium Mid-Range Budget |

| By Material | Synthetic Fabrics Natural Fabrics Blended Fabrics |

| By Occasion | Casual Wear Sports Activities Outdoor Activities |

| By Brand Loyalty | Brand Loyal Customers Price-Sensitive Customers Trend-Focused Customers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Premium Sportswear Retailers | 100 | Store Managers, Regional Sales Directors |

| Fitness Enthusiasts | 150 | Gym Members, Sports Club Participants |

| Online Shoppers of Sportswear | 120 | E-commerce Managers, Digital Marketing Specialists |

| Brand Influencers and Athletes | 80 | Social Media Influencers, Professional Athletes |

| Market Analysts and Experts | 50 | Industry Analysts, Market Research Professionals |

The GCC Premium Sportswear Market is valued at approximately USD 8 billion, reflecting a significant growth trend driven by increasing health consciousness, fitness activities, and the popularity of athleisure wear among consumers in the region.