Region:Global

Author(s):Geetanshi

Product Code:KRAA2755

Pages:89

Published On:August 2025

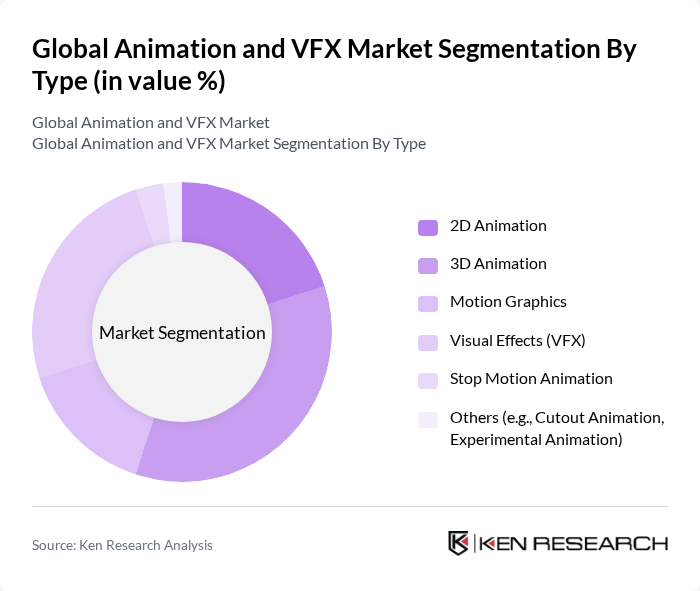

By Type:This segmentation includes various forms of animation and visual effects that cater to different creative needs and preferences.

The 3D Animation sub-segment is currently dominating the market due to its extensive application in film, gaming, and advertising. The increasing demand for realistic graphics and immersive experiences has led to a surge in 3D content creation. Additionally, advancements in technology, such as real-time rendering, virtual production, and AI-driven animation, have further propelled the growth of this segment. As consumers increasingly seek high-quality visual experiences, 3D Animation is expected to maintain its leadership position in the market .

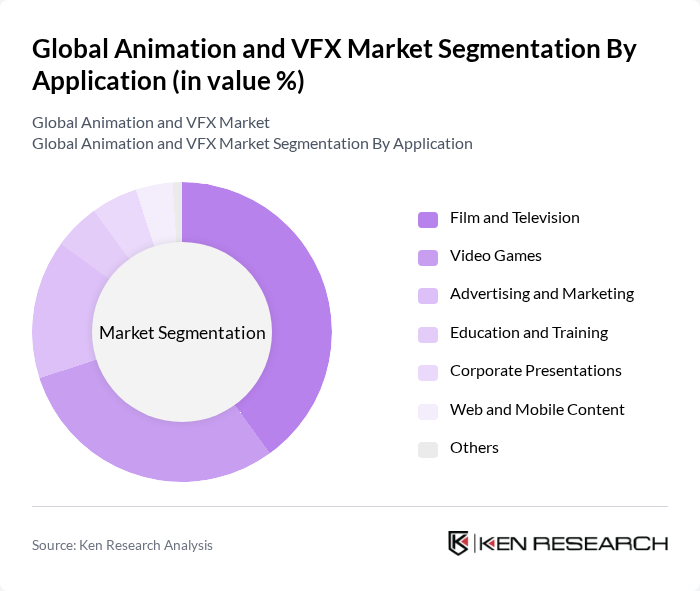

By Application:This segmentation highlights the various sectors where animation and VFX are utilized, showcasing their versatility and importance.

The Film and Television application segment is the largest contributor to the market, driven by the continuous demand for high-quality content in cinema and streaming platforms. The rise of original programming on streaming services and the integration of advanced VFX in both live-action and animated productions have led to increased investments in animation and VFX, as creators seek to enhance storytelling through visual effects. This trend is expected to continue, solidifying the Film and Television segment's dominance in the market .

The Global Animation and VFX Market is characterized by a dynamic mix of regional and international players. Leading participants such as Pixar Animation Studios, DreamWorks Animation, Industrial Light & Magic, Blue Sky Studios, Sony Pictures Animation, Weta Digital, Framestore, DNEG (Double Negative), Aardman Animations, Studio Ghibli, Illumination Entertainment, Laika, The Mill, Method Studios, Blur Studio, Animal Logic, Digital Domain, Rodeo FX, Scanline VFX, Technicolor Creative Studios contribute to innovation, geographic expansion, and service delivery in this space.

The future of the animation and VFX market appears promising, driven by technological advancements and evolving consumer preferences. As streaming platforms continue to invest in original content, the demand for high-quality animation will likely increase. Additionally, the integration of AI in production processes is expected to streamline workflows, enhancing creativity and efficiency. The industry's focus on sustainability will also shape future practices, as studios adopt eco-friendly technologies and methods to meet consumer expectations and regulatory requirements.

| Segment | Sub-Segments |

|---|---|

| By Type | D Animation D Animation Motion Graphics Visual Effects (VFX) Stop Motion Animation Others (e.g., Cutout Animation, Experimental Animation) |

| By Application | Film and Television Video Games Advertising and Marketing Education and Training Corporate Presentations Web and Mobile Content Others |

| By End-User | Media & Entertainment Industry Education Sector Corporate Sector Government Agencies Healthcare and Medical Visualization Others |

| By Distribution Channel | Direct Sales Online Platforms/Streaming Services Distributors/Resellers Partnerships with OTT Platforms Others |

| By Pricing Model | Project-Based Pricing Subscription-Based Pricing Hourly Rate Pricing Retainer Agreements Licensing/Revenue Sharing Others |

| By Content Type | Original IP Content Adaptations/Franchise Content Educational Content Promotional/Commercial Content User-Generated Content Others |

| By Region | North America (U.S., Canada) Europe (UK, Germany, France, Rest of Europe) Asia-Pacific (China, Japan, India, South Korea, Rest of APAC) Latin America (Brazil, Mexico, Rest of LATAM) Middle East and Africa (UAE, South Africa, Rest of MEA) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Animation Production Studios | 100 | Creative Directors, Producers |

| VFX Companies in Film | 80 | VFX Supervisors, Technical Directors |

| Gaming Industry VFX Teams | 60 | Game Developers, Art Directors |

| Streaming Services Content Creators | 70 | Content Managers, Production Heads |

| Educational Institutions Offering Animation Courses | 50 | Program Coordinators, Faculty Members |

The Global Animation and VFX Market is valued at approximately USD 197 billion, reflecting significant growth driven by the demand for high-quality visual content across various platforms, including film, television, and gaming.