Global Lighting Control System Market Overview

- The Global Lighting Control System Market is valued at USD 32 billion, based on a five?year historical analysis. This growth is primarily driven by the increasing demand for energy-efficient lighting solutions, widespread adoption of LED technologies, and the integration of IoT-enabled smart lighting systems. Growth is further supported by increased investments in smart city projects, the proliferation of connected homes and commercial buildings, and the implementation of stringent building codes mandating energy-efficient lighting in both residential and commercial sectors. Human-centric lighting, which adjusts intensity and color temperature to enhance well-being and productivity, is also emerging as a key innovation area in the market.

- Key players in this market include the United States, Germany, and China, which maintain leadership due to their advanced industrial base, significant investments in smart city and infrastructure initiatives, and strong presence of major lighting control system manufacturers. North America holds the largest market share, driven by rapid implementation of IoT-enabled lighting systems and supportive government policies, while Asia-Pacific is experiencing the fastest growth rate, fueled by urbanization and expanding commercial infrastructure.

- In 2023, the European Union implemented the Ecodesign Directive (Directive 2009/125/EC, consolidated and updated in 2023 by the European Commission), which mandates that all lighting products placed on the EU market must meet specific minimum energy efficiency standards. This regulation requires manufacturers to phase out inefficient lighting technologies and adopt advanced lighting control systems, driving innovation and sustainability within the sector. The directive covers requirements for energy consumption, product labelling, and lifecycle environmental impact, with compliance necessary for market access in the EU.

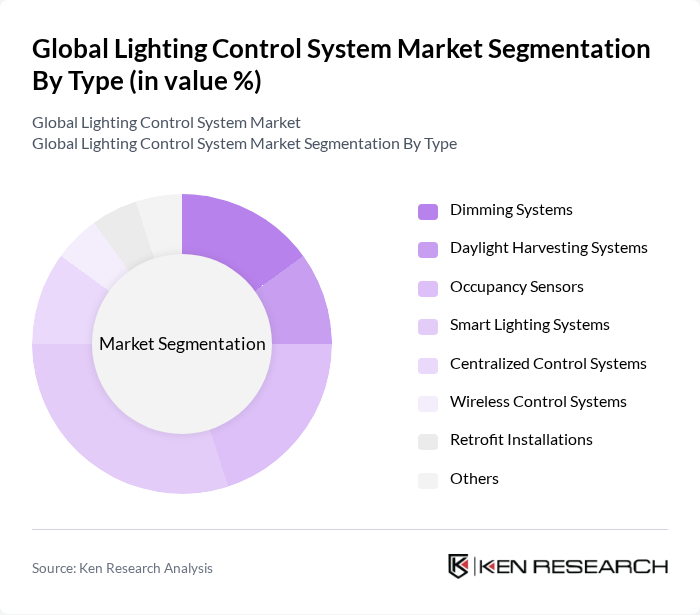

Global Lighting Control System Market Segmentation

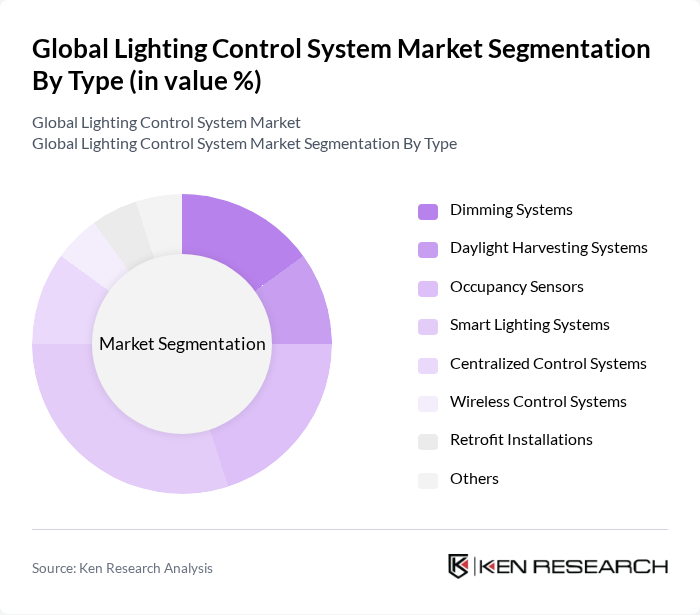

By Type:The market is segmented into Dimming Systems, Daylight Harvesting Systems, Occupancy Sensors, Smart Lighting Systems, Centralized Control Systems, Wireless Control Systems, Retrofit Installations, and Others. Among these,Smart Lighting Systemsare currently dominating the market, driven by their integration with IoT and cloud technologies, which enable automated, remote, and adaptive control for enhanced energy savings and user convenience. The growing consumer preference for automation, remote management, and personalized lighting experiences is accelerating demand for smart solutions, while wireless control systems are gaining traction due to their flexible installation and scalability.

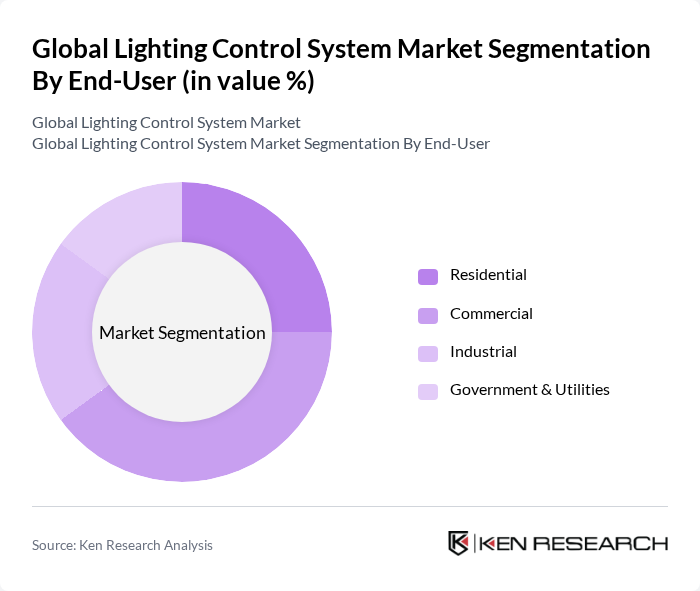

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, and Government & Utilities. TheCommercial sectorleads the market, driven by the widespread adoption of energy-efficient lighting solutions in offices, retail spaces, and public buildings. The push for smart buildings and integration of lighting control systems with building management systems are key factors supporting growth in this segment. Industrial and government sectors are also increasingly adopting advanced lighting controls to meet sustainability targets and regulatory requirements, while residential adoption is rising due to smart home trends and consumer demand for convenience and energy savings.

Global Lighting Control System Market Competitive Landscape

The Global Lighting Control System Market is characterized by a dynamic mix of regional and international players. Leading participants such as Signify (formerly Philips Lighting), Schneider Electric, Lutron Electronics, Honeywell International Inc., Siemens AG, Legrand, Eaton Corporation, Crestron Electronics, Acuity Brands Lighting, Inc., GE Lighting (a Savant company), Osram Licht AG, Hubbell Lighting, Cooper Lighting Solutions, Zumtobel Group, Toshiba Corporation, Rockwell Automation contribute to innovation, geographic expansion, and service delivery in this space.

Global Lighting Control System Market Industry Analysis

Growth Drivers

- Increasing Demand for Energy Efficiency:The global push for energy efficiency is a significant driver for the lighting control system market. In future, energy consumption in buildings is projected to reach 80 trillion BTUs, with lighting accounting for approximately 15–20% of this total. Governments and organizations are increasingly adopting energy-efficient technologies, leading to a projected reduction of 20% in energy costs for businesses that implement advanced lighting control systems. This trend is supported by the International Energy Agency's report indicating a potential savings of $1 trillion globally by 2030 through energy-efficient practices.

- Technological Advancements in Smart Lighting:The integration of smart technologies in lighting systems is transforming the market landscape. In future, the global smart lighting market is expected to reach $30 billion, driven by innovations such as IoT-enabled devices and advanced sensors. These technologies enhance user experience and operational efficiency, with studies showing that smart lighting can reduce energy consumption by up to 50%. The rapid adoption of smart home devices, projected to exceed 500 million units globally, further fuels this growth, creating a robust demand for sophisticated lighting control systems.

- Government Initiatives for Sustainable Lighting:Governments worldwide are implementing initiatives to promote sustainable lighting solutions. In future, over 50 countries are expected to have adopted energy efficiency regulations, mandating the use of advanced lighting technologies. For instance, the U.S. Department of Energy's Better Buildings Initiative aims to reduce energy consumption in commercial buildings by 20% in future. Such policies not only encourage the adoption of lighting control systems but also provide financial incentives, with an estimated $2 billion allocated for energy efficiency programs in the U.S. alone.

Market Challenges

- High Initial Investment Costs:One of the primary challenges facing the lighting control system market is the high initial investment required for installation. In future, the average cost of implementing a comprehensive lighting control system is estimated to be around $15,000 for a medium-sized commercial building. This upfront cost can deter potential adopters, especially small and medium enterprises, from investing in advanced lighting solutions. Additionally, the return on investment may take several years, further complicating decision-making for budget-conscious organizations.

- Complexity of Integration with Existing Systems:Integrating new lighting control systems with existing infrastructure poses significant challenges. Many facilities have legacy systems that are not compatible with modern technologies, leading to increased costs and extended implementation timelines. In future, approximately 40% of businesses report difficulties in achieving seamless integration, which can result in operational disruptions. This complexity can hinder the adoption of advanced lighting solutions, as organizations may prefer to avoid the risks associated with system incompatibility and potential downtime.

Global Lighting Control System Market Future Outlook

The future of the lighting control system market appears promising, driven by ongoing technological advancements and increasing urbanization. As cities evolve into smart environments, the demand for integrated lighting solutions will rise, with a projected increase in smart city initiatives globally. Furthermore, the growing emphasis on sustainability will likely lead to more stringent regulations, pushing businesses to adopt energy-efficient lighting systems. This evolving landscape presents significant opportunities for innovation and growth, particularly in the development of user-friendly interfaces and enhanced connectivity features.

Market Opportunities

- Growth in Smart City Projects:The expansion of smart city projects worldwide presents a lucrative opportunity for lighting control systems. In future, investments in smart city initiatives are expected to exceed $1 trillion, with a significant portion allocated to intelligent lighting solutions. This trend will drive demand for advanced lighting control systems that enhance urban infrastructure and improve energy efficiency.

- Expansion of IoT in Lighting Solutions:The increasing integration of IoT technologies in lighting solutions offers substantial market opportunities. In future, the IoT in lighting market is projected to reach $10 billion, driven by the demand for connected devices that enable real-time monitoring and control. This growth will facilitate the development of innovative lighting control systems that enhance user experience and operational efficiency.