Region:Global

Author(s):Geetanshi

Product Code:KRAA2296

Pages:99

Published On:August 2025

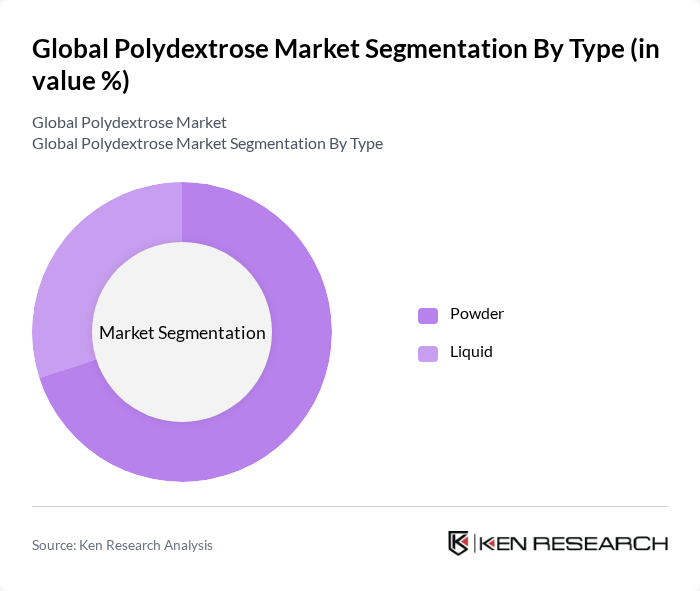

By Type:The market is segmented into two main types: Powder and Liquid. The Powder segment is currently dominating the market due to its versatility, stability, and ease of incorporation in a wide range of food and beverage applications, including bakery, confectionery, and dairy products. The Liquid segment, while growing, is primarily used in applications where solubility and texture are critical, such as beverages and certain processed foods. The preference for powdered forms in baking, snacks, and functional food applications continues to drive demand in this segment .

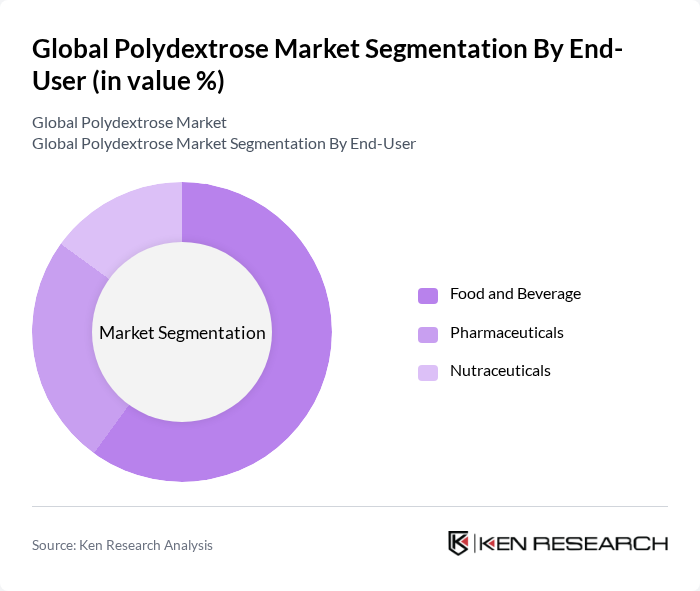

By End-User:The market is segmented into Food and Beverage, Pharmaceuticals, and Nutraceuticals. The Food and Beverage segment holds the largest share, driven by the increasing demand for low-calorie, high-fiber, and functional products. The Pharmaceuticals segment is significant, as polydextrose is used as an excipient and bulking agent in drug formulations. Nutraceuticals are gaining traction due to rising health awareness, with polydextrose being incorporated in dietary supplements and products targeting digestive health and weight management .

The Global Polydextrose Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tate & Lyle PLC, DuPont de Nemours, Inc. (IFF/Danisco), Ingredion Incorporated, Roquette Frères, Ajinomoto Co., Inc., and DSM Nutritional Products contribute to innovation, geographic expansion, and service delivery in this space.

The future of the polydextrose market appears promising, driven by increasing consumer awareness regarding health and nutrition. As the demand for low-calorie and functional ingredients continues to rise, manufacturers are likely to invest in innovative product formulations. Additionally, the expansion of e-commerce platforms is expected to facilitate greater accessibility to polydextrose-containing products, further enhancing market penetration. Companies that adapt to these trends and focus on sustainability will likely gain a competitive edge in the evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Powder Liquid |

| By End-User | Food and Beverage Pharmaceuticals Nutraceuticals |

| By Application | Bakery and Confectionery Beverages Cultured Dairy Products Nutritional Foods Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Specialty Stores |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Economy Mid-Range Premium |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Manufacturers | 120 | Product Development Managers, R&D Directors |

| Health and Nutrition Experts | 60 | Registered Dietitians, Nutrition Consultants |

| Pharmaceutical Companies | 40 | Formulation Scientists, Regulatory Affairs Managers |

| Consumer Packaged Goods (CPG) Brands | 50 | Marketing Managers, Brand Strategists |

| Retail Sector Insights | 45 | Category Managers, Supply Chain Analysts |

The Global Polydextrose Market is valued at approximately USD 300 million, driven by the increasing demand for low-calorie sweeteners and dietary fibers in food and beverage applications.