Region:Asia

Author(s):Dev

Product Code:KRAC8876

Pages:91

Published On:November 2025

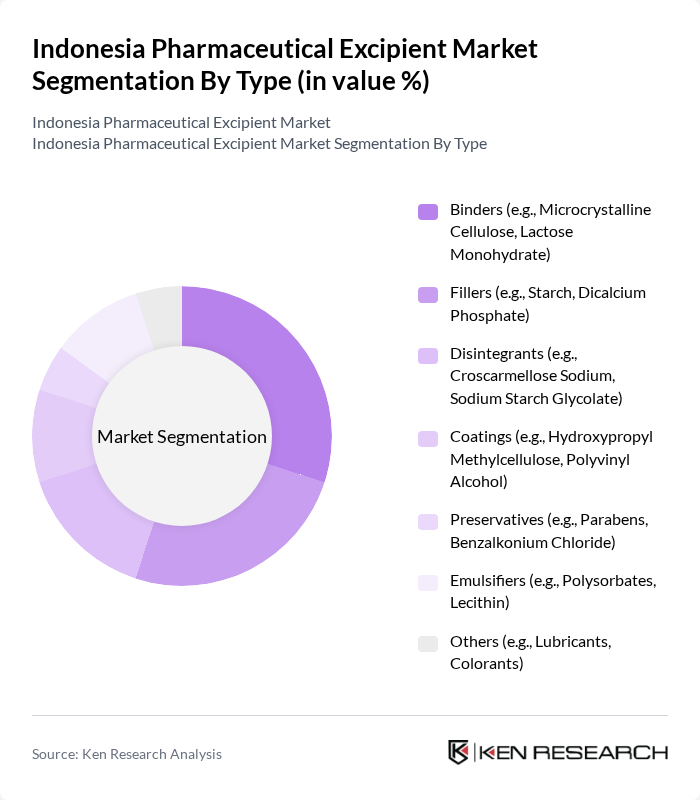

By Type:The market is segmented into various types of excipients, including binders, fillers, disintegrants, coatings, preservatives, emulsifiers, and others. Binders, such as microcrystalline cellulose and lactose monohydrate, are essential for tablet formulation, providing cohesion and mechanical strength. Fillers like starch and dicalcium phosphate are used to increase bulk and ensure dosage uniformity. Disintegrants, including croscarmellose sodium and sodium starch glycolate, facilitate the breakdown of tablets in the digestive system for improved bioavailability. Coatings, preservatives, and emulsifiers play significant roles in enhancing the efficacy, stability, and shelf-life of pharmaceutical products. The market is witnessing a rising preference for natural and multifunctional excipients, reflecting consumer demand for clean label products and improved drug delivery performance.

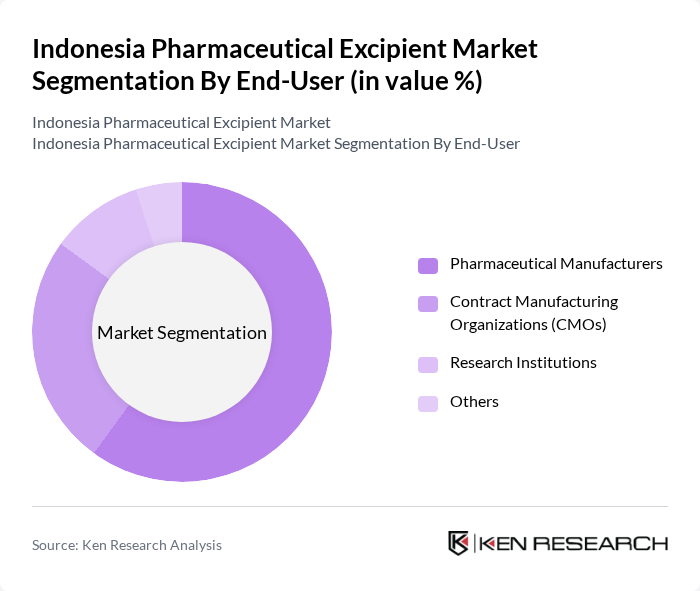

By End-User:The excipient market serves various end-users, including pharmaceutical manufacturers, contract manufacturing organizations (CMOs), and research institutions. Pharmaceutical manufacturers are the primary consumers, utilizing excipients in drug formulation to enhance stability, bioavailability, and patient compliance. CMOs require a diverse range of excipients to meet the specific needs of their clients, supporting outsourced production and formulation services. Research institutions contribute to the market by developing new formulations and conducting studies on excipient efficacy, driving innovation and quality improvements.

The Indonesia Pharmaceutical Excipient Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT. Hasil Pangan Mandiri (HPM), PT. Indofarma Tbk, PT. Kimia Farma Tbk, PT. Dexa Medica, PT. Sanbe Farma, PT. Novell Pharmaceutical Laboratories, PT. Merck Sharp & Dohme Pharma, PT. Sido Muncul Tbk, PT. Kalbe Farma Tbk, PT. Soho Global Health, PT. Bio Farma (Persero), PT. Darya-Varia Laboratoria Tbk, PT. Phapros Tbk, Roquette Indonesia, Dow Indonesia, Ashland Indonesia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indonesian pharmaceutical excipient market appears promising, driven by increasing investments in research and development, which are projected to reach IDR 18 trillion in future. Additionally, the expansion of biopharmaceuticals is expected to create new opportunities for excipient manufacturers, as the demand for specialized excipients rises. Furthermore, the trend towards sustainable and natural excipients will likely gain momentum, aligning with global environmental standards and consumer preferences for eco-friendly products.

| Segment | Sub-Segments |

|---|---|

| By Type | Binders (e.g., Microcrystalline Cellulose, Lactose Monohydrate) Fillers (e.g., Starch, Dicalcium Phosphate) Disintegrants (e.g., Croscarmellose Sodium, Sodium Starch Glycolate) Coatings (e.g., Hydroxypropyl Methylcellulose, Polyvinyl Alcohol) Preservatives (e.g., Parabens, Benzalkonium Chloride) Emulsifiers (e.g., Polysorbates, Lecithin) Others (e.g., Lubricants, Colorants) |

| By End-User | Pharmaceutical Manufacturers Contract Manufacturing Organizations (CMOs) Research Institutions Others |

| By Application | Oral Dosage Forms (Tablets, Capsules) Injectable Forms Topical Applications Others (e.g., Ophthalmic, Transdermal) |

| By Source | Natural Excipients (Plant-based, Animal-based) Synthetic Excipients (Petrochemical-derived, Chemically synthesized) Others (e.g., Mineral-based) |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | Java Sumatra Bali Kalimantan Sulawesi Others |

| By Regulatory Compliance | GMP Compliance ISO Certification BPOM Approval (Indonesian FDA) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Manufacturers | 120 | Production Managers, Quality Assurance Heads |

| Excipient Suppliers | 90 | Sales Directors, Product Managers |

| Regulatory Bodies | 40 | Regulatory Affairs Specialists, Compliance Officers |

| Research Institutions | 60 | Pharmaceutical Researchers, Academic Professors |

| Healthcare Professionals | 70 | Pharmacists, Clinical Researchers |

The Indonesia Pharmaceutical Excipient Market is valued at approximately USD 110 million, reflecting growth driven by increased pharmaceutical demand, particularly post-COVID-19, and advancements in drug formulation and delivery systems.