Region:Global

Author(s):Dev

Product Code:KRAA2545

Pages:100

Published On:August 2025

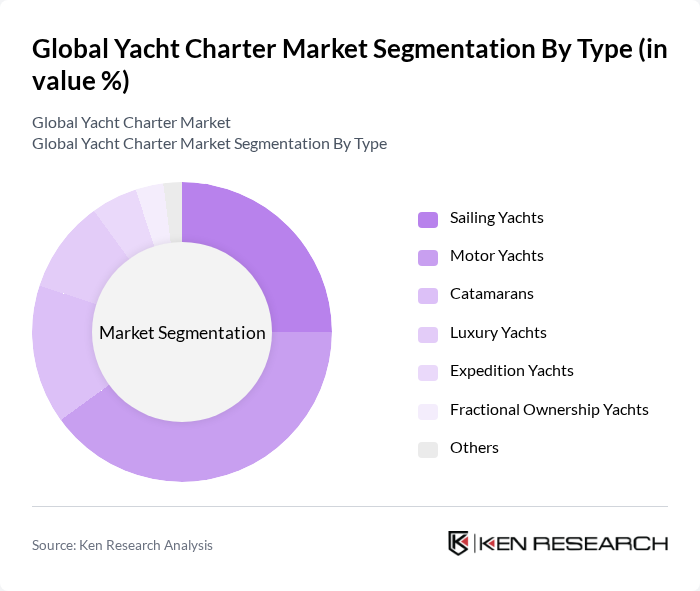

By Type:The yacht charter market is segmented into Sailing Yachts, Motor Yachts, Catamarans, Luxury Yachts, Expedition Yachts, Fractional Ownership Yachts, and Others. Motor Yachts currently dominate the market due to their speed, comfort, and luxury features, appealing to a wide range of consumers seeking premium amenities such as spacious cabins, gourmet kitchens, and advanced entertainment systems. The trend toward luxury and adventure travel has led to increased demand for high-end motor yachts and expedition yachts, with the latter catering to travelers interested in remote destinations and unique exploration experiences. Sailing Yachts maintain a significant share, especially among eco-conscious consumers and those preferring traditional sailing experiences. Fractional ownership and membership models are expanding the market's reach, making yacht chartering more accessible .

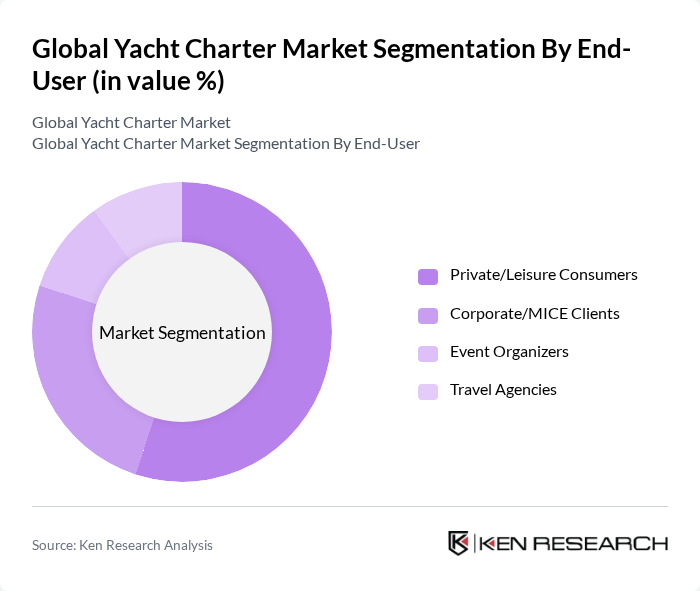

By End-User:The yacht charter market is segmented by end-user into Private/Leisure Consumers, Corporate/MICE Clients, Event Organizers, and Travel Agencies. Private/Leisure Consumers represent the largest segment, driven by the increasing trend of luxury vacations, personalized travel experiences, and the rise of high-net-worth individuals seeking exclusive leisure options. Corporate clients are utilizing yacht charters for team-building events and executive retreats, while event organizers leverage yachts for distinctive venues. Travel agencies are expanding their offerings to include yacht charter services, catering to the growing demand for luxury and experiential travel .

The Global Yacht Charter Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sunseeker International Ltd., Ferretti Group, Azimut-Benetti Group, Princess Yachts, Lagoon Catamarans, Jeanneau, Bavaria Yachts, Sea Ray Boats, Nautique Boat Company, Beneteau, Dream Yacht Charter, Sailo, Click&Boat, Boatsetter, GetMyBoat, Burgess, Northrop & Johnson, Camper & Nicholsons International, Fraser Yachts, Yachtico contribute to innovation, geographic expansion, and service delivery in this space.

The yacht charter market is poised for continued growth, driven by increasing consumer interest in unique travel experiences and luxury offerings. As technology advances, the integration of smart features in yachts will enhance customer experiences, while sustainability initiatives will attract environmentally conscious travelers. The market is expected to adapt to changing consumer preferences, with a focus on personalized services and innovative charter options, ensuring its relevance in the evolving travel landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Sailing Yachts Motor Yachts Catamarans Luxury Yachts Expedition Yachts Fractional Ownership Yachts Others |

| By End-User | Private/Leisure Consumers Corporate/MICE Clients Event Organizers Travel Agencies |

| By Duration of Charter | Daily Charters Weekly Charters Monthly/Seasonal Charters |

| By Destination | Mediterranean Caribbean South Pacific North America Asia-Pacific Middle East |

| By Service Type | Bareboat Charters Crewed Charters Luxury Charters Membership/Fractional Programs |

| By Customer Segment | Families Couples Groups High-Net-Worth Individuals (HNWIs) Ultra-High-Net-Worth Individuals (UHNWIs) |

| By Price Range | Budget Mid-Range Luxury |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Yacht Charter Clients | 100 | Affluent Individuals, Travel Planners |

| Charter Company Executives | 60 | CEOs, Operations Managers |

| Marina Operators | 50 | Marina Managers, Dockmasters |

| Tourism Board Representatives | 40 | Tourism Directors, Marketing Managers |

| Yacht Maintenance and Service Providers | 40 | Service Managers, Technicians |

The Global Yacht Charter Market is valued at approximately USD 20 billion, driven by increasing disposable incomes, luxury tourism growth, and a rising interest in experiential vacations among affluent consumers.