Region:Europe

Author(s):Rebecca

Product Code:KRAB1855

Pages:94

Published On:October 2025

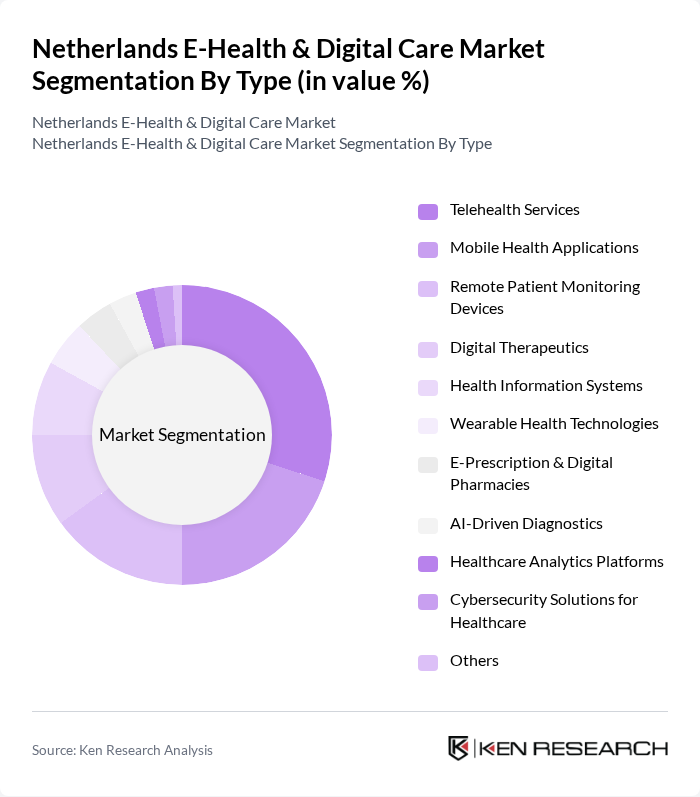

By Type:The market is segmented into various types, including Telehealth Services, Mobile Health Applications, Remote Patient Monitoring Devices, Digital Therapeutics, Health Information Systems, Wearable Health Technologies, E-Prescription & Digital Pharmacies, AI-Driven Diagnostics, Healthcare Analytics Platforms, Cybersecurity Solutions for Healthcare, and Others. Among these, Telehealth Services are leading due to their convenience and the growing acceptance of virtual consultations by both patients and healthcare providers.

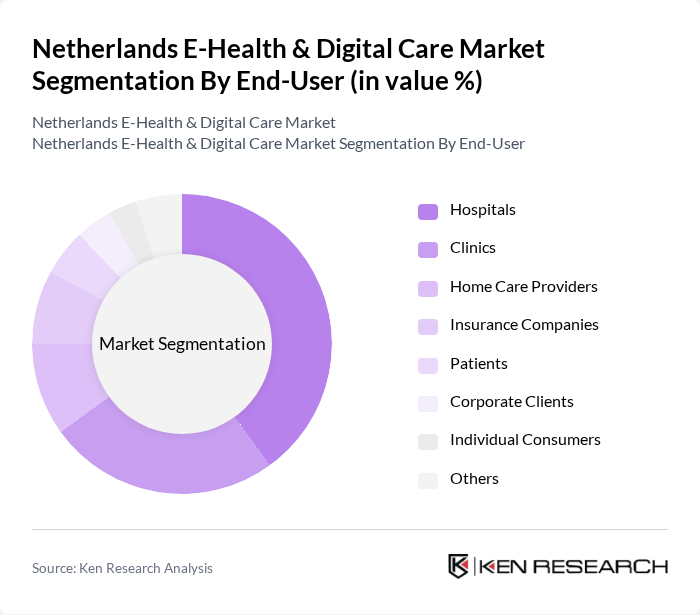

By End-User:The end-user segmentation includes Hospitals, Clinics, Home Care Providers, Insurance Companies, Patients, Corporate Clients, Individual Consumers, and Others. Hospitals are the dominant end-user segment, driven by their need for efficient patient management systems and the integration of digital health solutions to enhance service delivery.

The Netherlands E-Health & Digital Care Market is characterized by a dynamic mix of regional and international players. Leading participants such as Philips Healthcare, Luscii Healthtech, ZorgDomein, ChipSoft, Mediq, BeterDichtbij, Ksyos, Siilo, Nedap Healthcare, Thuisapotheek, MedApp, Pacmed, MyTomorrows, Qare, Teladoc Health contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Netherlands E-Health and Digital Care market appears promising, driven by technological advancements and increasing consumer acceptance. As the population ages, the demand for innovative healthcare solutions will continue to rise, particularly in telehealth and remote monitoring. Furthermore, the integration of artificial intelligence in health applications is expected to enhance diagnostic accuracy and patient engagement. With ongoing government support and investment, the market is poised for significant growth, fostering a more efficient and patient-centered healthcare system.

| Segment | Sub-Segments |

|---|---|

| By Type | Telehealth Services Mobile Health Applications Remote Patient Monitoring Devices Digital Therapeutics Health Information Systems Wearable Health Technologies E-Prescription & Digital Pharmacies AI-Driven Diagnostics Healthcare Analytics Platforms Cybersecurity Solutions for Healthcare Others |

| By End-User | Hospitals Clinics Home Care Providers Insurance Companies Patients Corporate Clients Individual Consumers Others |

| By Application | Chronic Disease Management Mental Health Support Preventive Healthcare Rehabilitation Services Wellness & Lifestyle Management Others |

| By Distribution Channel | Direct Sales Online Platforms Partnerships with Healthcare Providers Pharmacies (Physical & Digital) Others |

| By Pricing Model | Subscription-Based Pay-Per-Use Freemium Models Insurance Reimbursement Others |

| By Technology | Cloud-Based Solutions AI and Machine Learning Blockchain Technology Virtual Reality (VR) Health Healthcare Cybersecurity Others |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telemedicine Services | 120 | Healthcare Providers, Telehealth Coordinators |

| Remote Patient Monitoring | 120 | Nurses, Care Managers |

| Health Apps Usage | 120 | Patients, App Developers |

| Digital Health Policy Impact | 80 | Healthcare Policy Makers, Regulatory Experts |

| Integration of EHR Systems | 90 | IT Managers, Health Information Officers |

The Netherlands E-Health & Digital Care Market is valued at approximately USD 4.5 billion, driven by the increasing adoption of digital health solutions, the rising prevalence of chronic diseases, and the demand for remote healthcare services, especially post-COVID-19.