Philippines Retail Deposit Market Outlook to 2027

Driven by the Financial Inclusion Initiatives by the Government and rising digital penetration

Region:Asia

Author(s):Vrinda Garg

Product Code:KR1341

July 2023

85

About the Report

Market Overview:

A moderately fragmented market with immense growth potential Philippines’s Retail Deposit Market has a high growth potential. The retail deposit industry is in its growth stage and is projected to expand in future. The market has been growing steadily at a CAGR of ~10% with digital penetration and convenience banking being major growth drivers.

Number of Depositors in the Philippines Banking System has been growing steadily as the financial inclusion rises and the penetration of direct accounts sharply rose. No. of depositors in 2020 had a slow growth due to the lack of income, multiple accounts were closed down as individuals were unable to maintain the deposit requirements of the account but the market started registering a decent growth rate afterwards & is expected to continue doing so during the forecasted period.

Philippines Retail Deposit Market Analysis

- Philippine retail deposit market has been growing steadily at a CAGR of ~10% with digital penetration and convenience banking being major growth drivers

- Number of Depositors in the Banking System has been growing steadily as the financial inclusion rises and the penetration of direct accounts sharply rose.

- Retail deposits account for ~45% of the total value of Deposits in the Philippine Banking System; Wholesale Deposits encompass a varied type of depositors with different purposes.

- NCR accounts for the highest penetration for the total deposit Market although only 12.4% of the population resides in this region.

Key Trends by Market Segment:

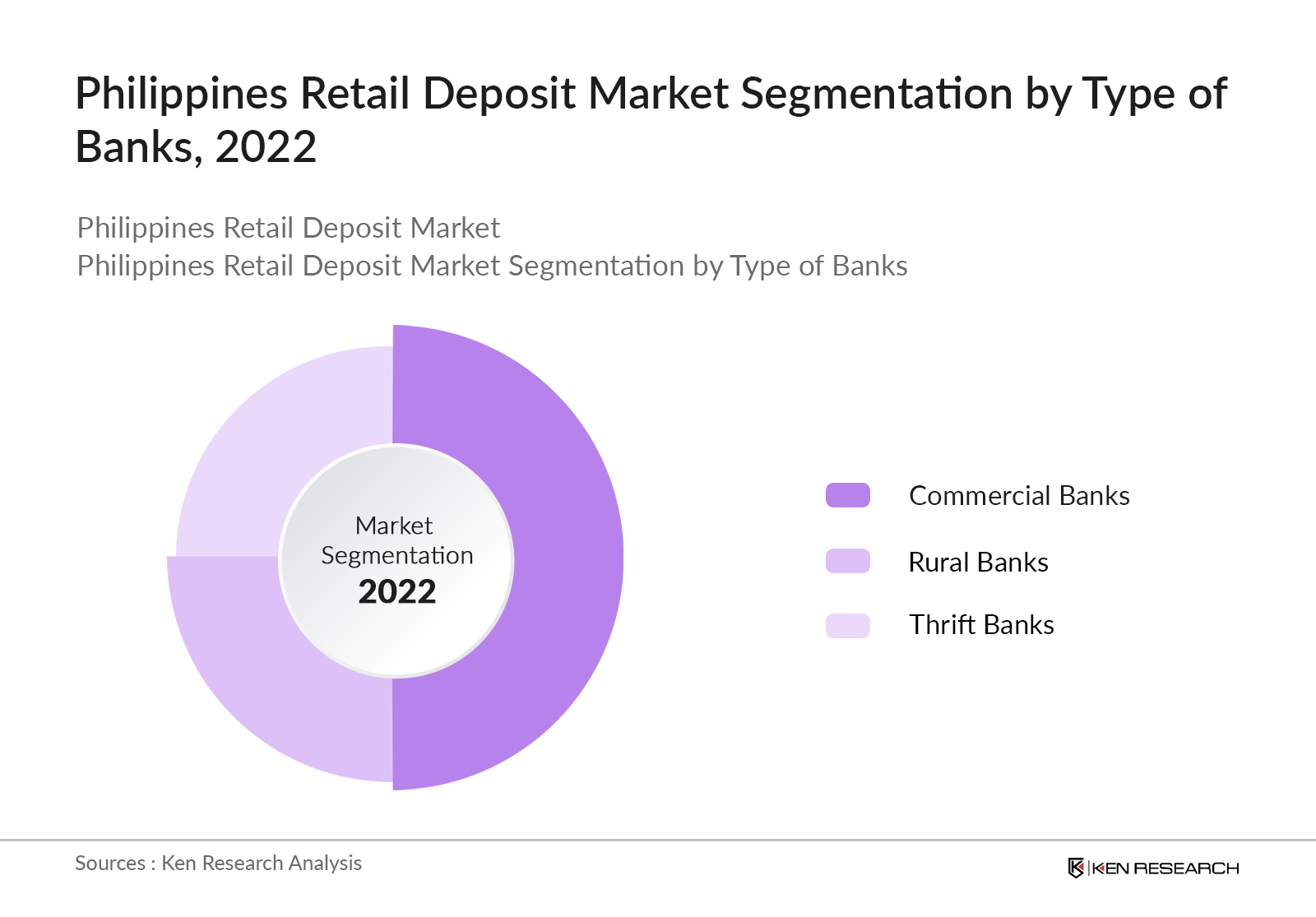

By Banks: Commercial banks captured the largest part of the segment & are expected to grow at a fast pace during the forecasted period. Thrift Banks had a major decline in terms of accounts as well as amount deposited till 2019. But after covid-19, Even during the crisis, the industry continued to provide financing, mostly catered to individuals for household consumption, real estate, and wholesale and retail trade.

By Product: In Retail Deposits, Savings Deposit Accounts are the most widely used type of accounts and account for ~66% of the total deposit value. ~80% of all deposits by value are not insured, and insured/ partially insured deposits have a very low penetration as of now. There are 76 banks that were granted FCDU authority by the central bank as of May 2021, and are expected to adopt a risk management framework that will be commensurate to the scope and risk profile of their foreign exchange activities.

Competitive Landscape:

- BDO and LandBank are the market leaders in terms of total deposits as well as retail deposits whereas the market is moderately fragmented as there are >400 players in the market.

- BDO Union & BDO Network Bark has the largest share in commercial deposits & rural deposits respectively.

- CASA is a cheaper source of funds for banks and Banks like BDO, PNB & Landbank has share more than the market average ratio.

- Landbank is the market leader in terms of demand & saving deposits whereas, it doesn’t focus much on Time Deposits.

Recent Developments:

- Raffle promotion for the Upcoming FIFA Women's World Cup in 2023 to encourage people to spend to increase their chances of winning.

- LBP has a tie-up with popular food chain Jolibee which provides customers free food on minimum spends with their debit cards.

- Philippine government has been actively promoting the use of digital payments and e-wallets as part of its efforts to promote financial inclusion. This includes the launch of the national ID system (PhilSys), which is expected to facilitate easier and more secure financial transactions. The government has also encouraged the adoption of cashless payments in various government transactions, including tax payments; all these efforts are expected to increase deposits.

Future Outlook:

- The Philippines as well as the retail deposits segment are both expected to grow steadily in the upcoming years, with projects suggesting it will reach double digit PHP Tr.

- Philippines retail deposit Market will grow largely due to saving deposits and rural banks within Mindanao & Visayas.

- Both the total deposits, as well as the retail deposits are projected to rise steadily with financial awareness and literacy increasing in the Philippines due to Financial Inclusion methods and initiatives adopted by the Government.

- BSP will accept the digital banks application again in the near future and this can allow banks to penetrate in the market.

- Local private lenders RCBC and PNB were also eyeing a license.

Scope of the Report

|

Philippines Retail Deposit Market Segmentation |

|

|

By Banks |

Commercial Banks Thrift banks Rural banks |

|

By Product |

Demand Deposit Savings Deposit Time Deposit LTNCD |

|

By type of depositors |

Residents Government Banks Private Corporations Individuals Trust Department Non-Residents |

|

By Account |

PESO FCDU |

|

By Insurance |

Fully Insured Partly Insured Non-Insured |

|

By Major Regions |

Luzon Visayas Mindanao |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report:

Investors

Risk-Averse Individuals

Fixed Income Seekers

Small Business Owners

Non-Profit Organizations

Fixed-Time Investors

Time Period Captured in the Report:

- Historical Period: 2016-2022

- Base Year: 2022

- Forecast Period: 2022-2027

Companies

Major Players Mentioned in the Report:

Philippines Retail Deposit Market (Commercial Banks)

Land Bank

Union Bank

Metro bank

Security Bank

DBP

Philippines Retail Deposit Market ((Rural Banks)

Card RBI

FICO Bank

Welcome Bank

Philippines Retail Deposit Market (Thrift Banks)

- BankOf Makati

- Sterling Bank of Asia

- Pen Bank

- UCPB

- Business Bank

Table of Contents

1. Executive Summary

1.1 Overview, Competition Scenario 2017-2027

1.2 Market Segmentation, 2022-2027

1.3 Analyst Recommendations

2. Philippines Deposit Market

2.1 Market Overview & Number of Accounts, 2016- Sept,2022

2.3 Number of Depositors, 2016- Sept, 2022 & Market Size, 2016-2022

2.4 Retail Deposits and Wholesale Deposits, 2022

2.5 Regional Penetration, 2022

2.6 Total Deposit Market by type of accounts, products & insurance, 2022

2.7 Total Deposit Market by account size, 2022

3. Philippines Retail Deposit Market

3.1 Market Overview

3.2 Ecosystem

3.3 Value Chain

4. Size & Segmentation of Philippines Retail Deposit Market

4.1 Market Size, 2016-2022

4.2 Market Segmentation by type of account & Bank, 2022

4.3 Retail Deposit By Type of Banks, 2018-2022

4.4 Retail Deposit By Type of Accounts & Age, 2022

4.5 Retail Deposit By Type of Account, 2018-2022

4.6 Market Segmentation by Regions, 2022

4.7 Retail Deposit By Income Group, 2022

5. Philippines Competition Analyses

5.1 Market share on Basis of Retail and Total Deposits, 2022

5.2 Market share on Basis of type of banks, 2022

5.3 CASA Analysis of banks, 2022

5.4 Competition Analysis in terms of type of deposits, 2022

5.5 Interest Expenses, 2022

5.6 Advertising Expenses, 2022

5.7 Cost of customer acquisition analysis

5.8 Bank Account Comparison

5.9 Value offered to customer

5.10 Promotional technique

6. Philippines Industry Analyses

6.1 Recent Government Initiatives Impacting Retail Deposits

6.2 Philippine’s Central Bank push for financial inclusion amid COVID-19

6.3 Trends and Growth Drivers

6.4 Trends in Digital and Traditional Banking

6.5 Issues and Challenges

6.6 What Customers Look for in Retail Deposit Banking

6.7 Banked and unbanked population

6.8 Customer Analysis on Channel type and touch points

6.9 Customer Analysis

6.10 Customer Analysis on Channel Preferences

6.11 Customer Analysis on frequency of channel usage

6.12 Top Channel of Transaction

6.13 Customer Analysis by Primary bank

6.14 Customer Analysis on Net promotor score

6.15 Customer Analysis on Customer Loyalty Reward

6.16 Digital banking, 2022

7. Philippines Fintech Overview

7.1 BSP’s Digital Payments Transformation Roadmap 2020-2023

7.2 Philippines Fintech map

7.3 Philippines Digital Banking Key Players, 2022

7.4 Philippines Digital Banks, 2022

8. Philippines Retail Deposit Market Future Analyses

8.1 Future Outlook, 2023-2027

8.2 Market Segmentation on basis of banks, accounts & regions, 2027

9. Philippines Retail Deposit Market Analyst Recommendation

9.1 Target Group Analysis

9.2 Income Group Analysis

9.3 Zero Balance Account

9.4 Case Study: BDO Pay

9.5 Digital Banks

10. Research Methodology

Research Methodology

step : 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

step : 2 Market Building:

Collating statistics on Philippines retail deposit market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for Philippines retail deposit market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

step : 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry exerts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

step : 4 Research output:

Our team will approach multiple retail deposit providing channels and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from retail deposit service providers.

Frequently Asked Questions

01 What is the Study Period of this Market Report?

The Philippines Logistics Market is covered from 2016–2022 in this report, including a forecast for 2022-2027.

02 What is the Future Growth Rate of the Philippines Logistics Market?

The Philippines Logistics Market is expected to witness a CAGR of ~11.5 % over the next years.

03 What are the Key Factors Driving the Philippines Logistics Market?

Financial Inclusion Initiatives by the Government and rising digital penetrationare likely to fuel the growth in the Philippines Logistics Market.

04 Which is the Largest Bank Type Segment within the Philippines Logistics Market?

The Commercial bank type segment held the largest share of the Philippines Logistics Market in 2022.

05 Who are the Key Players in the Philippines Logistics Market?

Land bank, Union bank, Metro bank Express are some of the key players in the Market

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.