Region:Africa

Author(s):Geetanshi

Product Code:KRAA3219

Pages:95

Published On:September 2025

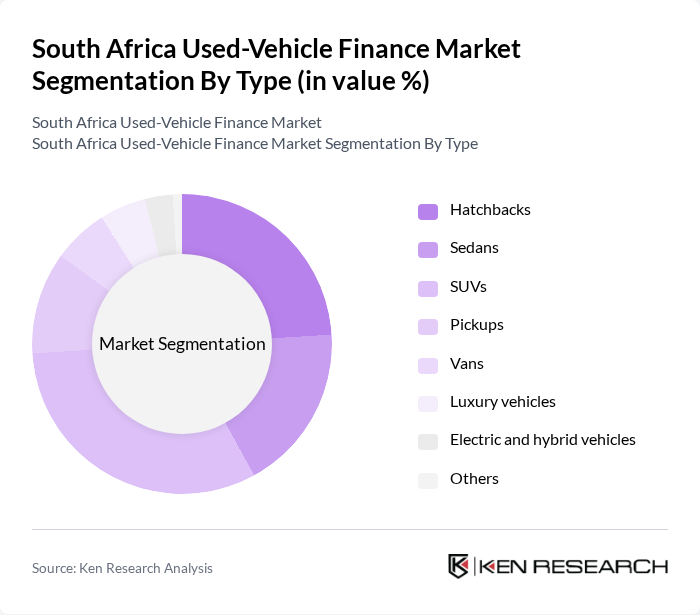

By Type:The used-vehicle finance market is segmented into hatchbacks, sedans, SUVs, pickups, vans, luxury vehicles, electric and hybrid vehicles, and others. Each type addresses distinct consumer needs, with preferences shaped by lifestyle, family requirements, and economic factors. SUVs have become increasingly popular due to their versatility, while hatchbacks and sedans remain staples for urban and budget-conscious buyers. The electric and hybrid segment, though still emerging, is gaining traction as environmental awareness and government incentives grow .

The SUV segment is currently dominating the market due to its versatility and rising popularity among consumers seeking both comfort and utility. The shift toward larger vehicles is driven by evolving consumer preferences, with many buyers choosing SUVs for family and recreational use. Increased availability of financing products tailored for SUVs, along with the growing supply of certified pre-owned models, has further strengthened their market position .

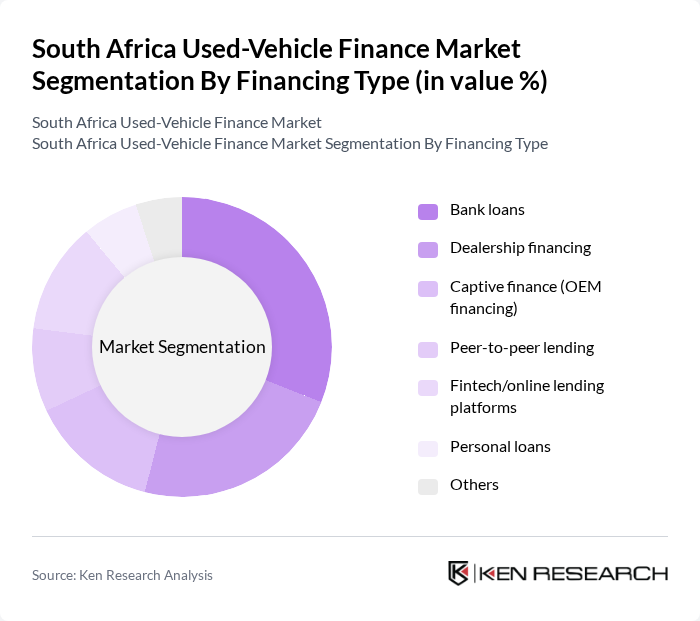

By Financing Type:The financing options available in the used-vehicle finance market include bank loans, dealership financing, captive finance (OEM financing), peer-to-peer lending, fintech/online lending platforms, personal loans, and others. Each financing type offers distinct advantages and targets specific consumer segments. Bank loans remain the preferred option due to their competitive rates and established processes, while fintech platforms and peer-to-peer models are gaining traction among tech-savvy and underserved consumers .

Bank loans are the leading financing type in the market, largely due to their established reputation, competitive interest rates, and structured repayment terms. Many consumers prefer traditional bank loans for their reliability and the comprehensive financial guidance provided. The rapid growth of digital banking and online loan application processes has further increased accessibility, while fintech and peer-to-peer lending platforms are expanding the market to new consumer segments .

The South Africa Used-Vehicle Finance Market is characterized by a dynamic mix of regional and international players. Leading participants such as ABSA Vehicle and Asset Finance, Standard Bank Vehicle and Asset Finance, Nedbank Vehicle Finance, First National Bank (FNB) WesBank, WesBank (a division of FirstRand Bank), MFC (a division of Nedbank), Toyota Financial Services South Africa, Volkswagen Financial Services South Africa, Mercedes-Benz Financial Services South Africa, BMW Financial Services South Africa, Renault Financial Services South Africa, Hyundai Finance South Africa, Kia Finance South Africa, Isuzu Finance South Africa, Suzuki Finance South Africa, WeBuyCars, AutoTrader South Africa, Motus Group (including Imperial Auto), CMH Group (Combined Motor Holdings), InspectaCar contribute to innovation, geographic expansion, and service delivery in this space.

The South African used-vehicle finance market is poised for transformation, driven by technological advancements and changing consumer preferences. As digital financing solutions become more prevalent, the ease of accessing loans will likely increase, attracting a broader customer base. Additionally, the growing interest in electric and hybrid vehicles will shape financing products, catering to environmentally conscious consumers. These trends indicate a dynamic market landscape, where innovation and sustainability will play pivotal roles in shaping future growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Hatchbacks Sedans SUVs Pickups Vans Luxury vehicles Electric and hybrid vehicles Others |

| By Financing Type | Bank loans Dealership financing Captive finance (OEM financing) Peer-to-peer lending Fintech/online lending platforms Personal loans Others |

| By Customer Segment | Individual buyers Small businesses Corporate clients Government agencies Fleet operators Others |

| By Age of Vehicle | 3 years 7 years 10 years + years |

| By Purchase Method | Online purchases In-person dealership purchases Auctions Private sales |

| By Payment Plan | Short-term financing Long-term financing Balloon payment plans Lease-to-own options |

| By Vendor Type | Organized (dealerships, certified pre-owned, online platforms) Unorganized (independent dealers, private sellers) |

| By Region | Gauteng Western Cape KwaZulu-Natal Eastern Cape Northern Cape Free State Mpumalanga Limpopo |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Used Vehicle Dealerships | 100 | Dealership Owners, Sales Managers |

| Financial Institutions | 60 | Loan Officers, Risk Managers |

| Consumers Financing Used Vehicles | 120 | Recent Buyers |

| Automotive Industry Experts | 40 | Market Analysts, Economic Consultants |

| Regulatory Bodies | 20 | Policy Makers, Compliance Officers |

The South Africa Used-Vehicle Finance Market is valued at approximately ZAR 400 billion, driven by increasing consumer demand for affordable mobility and the rising costs of new vehicles. This market has seen significant growth in transaction volumes as consumers seek cost-effective alternatives.