Region:Europe

Author(s):Geetanshi

Product Code:KRAB3375

Pages:90

Published On:October 2025

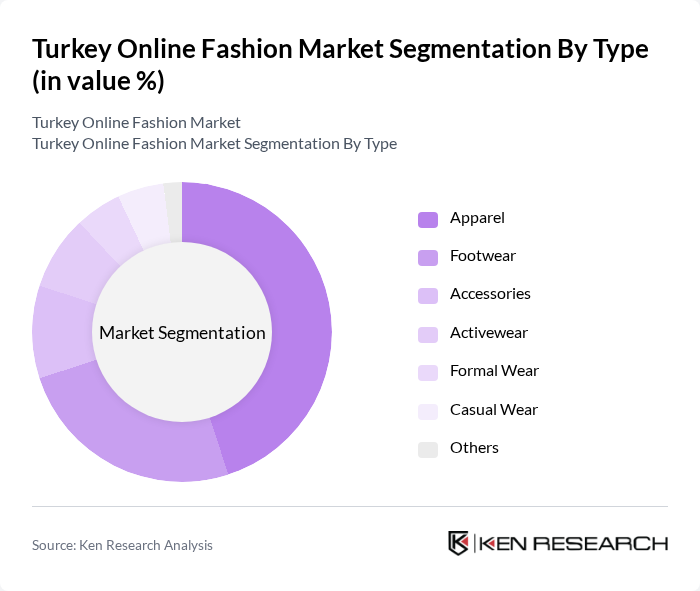

By Type:The online fashion market is segmented into Apparel, Footwear, Accessories, Activewear, Formal Wear, Casual Wear, and Others. Among these, Apparel is the leading sub-segment, driven by the broad range of clothing options available online and the increasing trend of shopping for both everyday wear and special occasions. The rise of athleisure, fast fashion, and influencer-driven trends has further accelerated demand for apparel. Footwear and Accessories also contribute to the market, but Apparel remains dominant due to its essential role in consumers' wardrobes and the rapid adoption of new styles .

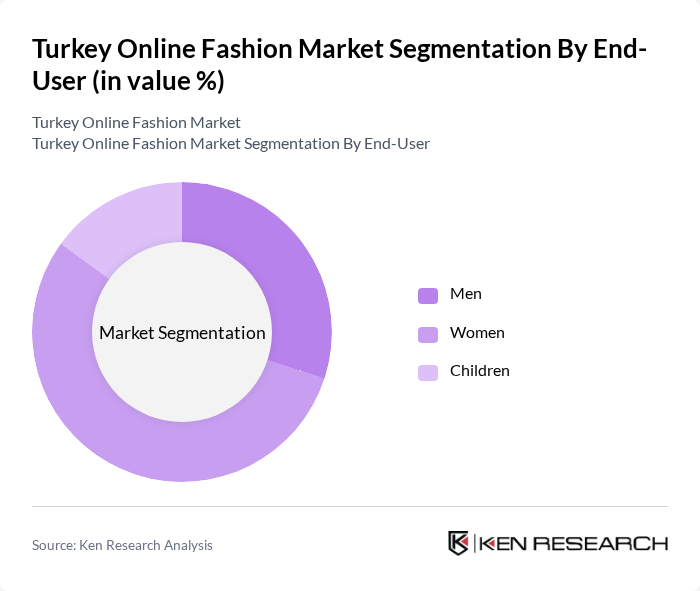

By End-User:The market is segmented by end-user into Men, Women, and Children. Women represent the largest segment, reflecting a higher propensity to shop online for fashion items and a greater focus on fashion trends. The wide variety of products tailored for women, combined with targeted marketing and the influence of digital platforms, drives this dominance. Men’s fashion is also experiencing growth, but the women’s segment remains the most significant due to diverse offerings and strong engagement with online channels .

The Turkey Online Fashion Market is characterized by a dynamic mix of regional and international players. Leading participants such as Trendyol, Hepsiburada, N11, Modanisa, Zizigo, Koton, LC Waikiki, Mavi, Boyner, Penti, Defacto, Adidas Türkiye, Nike Türkiye, H&M Türkiye, and Zara Türkiye contribute to innovation, geographic expansion, and service delivery in this space.

The future of Turkey's online fashion market appears promising, driven by technological advancements and evolving consumer preferences. As internet penetration continues to rise, more consumers are expected to embrace online shopping, particularly through mobile platforms. Additionally, the increasing focus on sustainability and ethical fashion will likely shape purchasing decisions, prompting brands to adapt their offerings. Companies that leverage data analytics for personalized marketing and enhance their logistics capabilities will be well-positioned to thrive in this dynamic environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Apparel Footwear Accessories Activewear Formal Wear Casual Wear Others |

| By End-User | Men Women Children |

| By Sales Channel | Online Marketplaces Brand Websites Social Media Platforms |

| By Price Range | Budget Mid-Range Premium |

| By Brand Loyalty | Brand Loyal Customers Price-Sensitive Customers |

| By Shopping Frequency | Frequent Shoppers Occasional Shoppers |

| By Occasion | Casual Outings Formal Events Sports Activities Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Online Fashion Retailers | 100 | E-commerce Managers, Marketing Directors |

| Consumer Shopping Behavior | 120 | Online Shoppers, Fashion Enthusiasts |

| Logistics and Supply Chain | 60 | Logistics Coordinators, Supply Chain Analysts |

| Fashion Influencers and Bloggers | 50 | Fashion Influencers, Content Creators |

| Market Analysts and Experts | 40 | Industry Analysts, Market Researchers |

The Turkey Online Fashion Market is valued at approximately USD 7.2 billion, reflecting significant growth driven by increased internet penetration, the rise of e-commerce platforms, and changing consumer preferences towards online shopping.