Region:North America

Author(s):Dev

Product Code:KRAA5407

Pages:99

Published On:September 2025

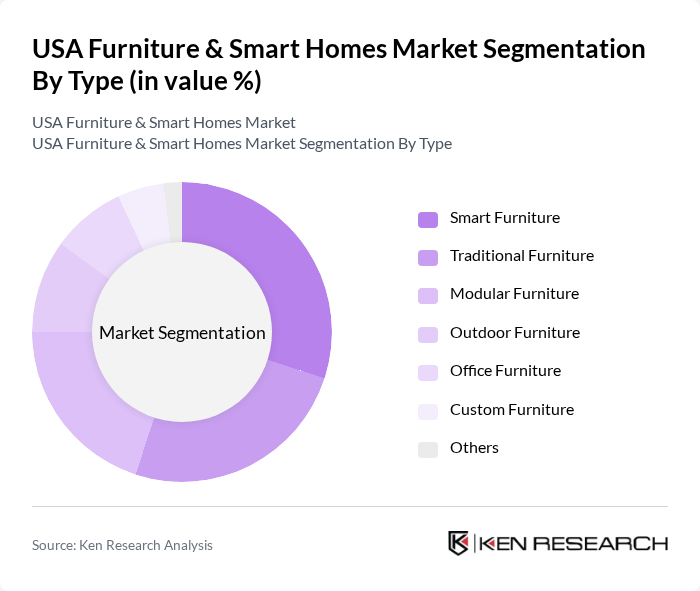

By Type:The market is segmented into various types of furniture, including Smart Furniture, Traditional Furniture, Modular Furniture, Outdoor Furniture, Office Furniture, Custom Furniture, and Others. Among these, Smart Furniture is gaining significant traction due to the increasing integration of technology in home furnishings, appealing to tech-savvy consumers who prioritize convenience and functionality. Traditional Furniture remains popular for its classic appeal, while Modular Furniture is favored for its adaptability in modern living spaces.

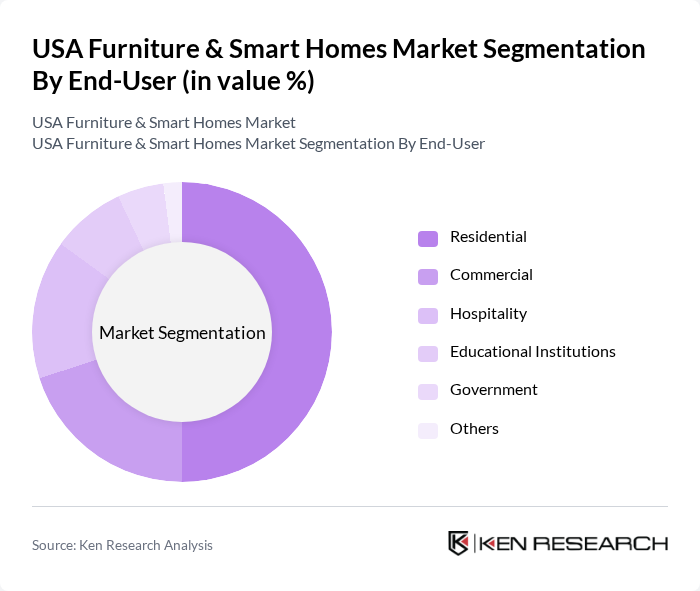

By End-User:The end-user segmentation includes Residential, Commercial, Hospitality, Educational Institutions, Government, and Others. The Residential segment dominates the market, driven by the increasing trend of home renovations and the desire for personalized living spaces. The Commercial segment is also significant, as businesses invest in quality furniture to enhance their work environments. The Hospitality sector is witnessing growth due to the demand for stylish and functional furniture in hotels and restaurants.

The USA Furniture & Smart Homes Market is characterized by a dynamic mix of regional and international players. Leading participants such as IKEA, Ashley Furniture Industries, La-Z-Boy Incorporated, Steelcase Inc., Herman Miller, Inc., Wayfair Inc., Tempur Sealy International, Inc., Sleep Number Corporation, Hooker Furniture Corporation, Flexsteel Industries, Inc., Knoll, Inc., Sauder Woodworking Co., Bassett Furniture Industries, Inc., Modloft, Blu Dot contribute to innovation, geographic expansion, and service delivery in this space.

The USA Furniture & Smart Homes market is poised for transformative growth, driven by technological advancements and evolving consumer preferences. As smart home integration becomes more prevalent, furniture manufacturers will increasingly focus on creating products that enhance connectivity and functionality. Additionally, the emphasis on sustainability will push companies to innovate with eco-friendly materials. The rise of urbanization and changing lifestyles will further shape the market, leading to increased demand for adaptable and multifunctional furniture solutions that cater to modern living spaces.

| Segment | Sub-Segments |

|---|---|

| By Type | Smart Furniture Traditional Furniture Modular Furniture Outdoor Furniture Office Furniture Custom Furniture Others |

| By End-User | Residential Commercial Hospitality Educational Institutions Government Others |

| By Sales Channel | Online Retail Brick-and-Mortar Stores Wholesale Distributors Direct Sales Others |

| By Material | Wood Metal Plastic Fabric Glass Others |

| By Price Range | Budget Mid-Range Premium Luxury Others |

| By Functionality | Smart Home Integration Ergonomic Design Multi-functional Use Aesthetic Appeal Others |

| By Brand | Established Brands Emerging Brands Private Labels Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Smart Furniture Adoption | 150 | Homeowners, Interior Designers |

| Consumer Preferences in Smart Homes | 120 | Tech-savvy Consumers, Home Automation Enthusiasts |

| Market Trends in Furniture Retail | 100 | Retail Managers, Product Development Teams |

| Impact of IoT on Furniture Design | 80 | Furniture Designers, Technology Innovators |

| Consumer Spending on Smart Home Products | 90 | Household Decision Makers, Financial Planners |

The USA Furniture & Smart Homes Market is valued at approximately USD 200 billion, driven by consumer demand for innovative furniture solutions and the integration of smart home technologies, alongside a robust real estate sector and a focus on home improvement.