Region:Europe

Author(s):Shubham

Product Code:KRAB6155

Pages:83

Published On:October 2025

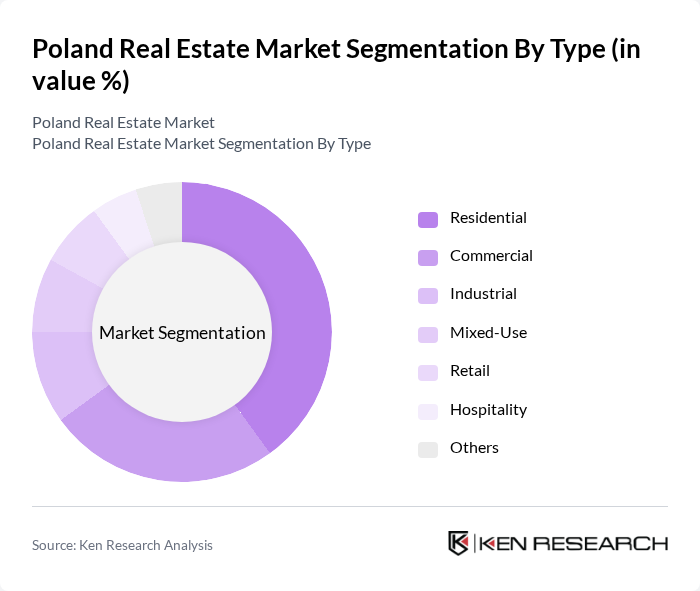

By Type:The real estate market in Poland can be segmented into various types, including residential, commercial, industrial, mixed-use, retail, hospitality, and others. Each of these segments caters to different consumer needs and investment strategies. The residential segment is particularly dominant due to the increasing population and urban migration, while commercial properties are gaining traction due to the growth of businesses and foreign investments.

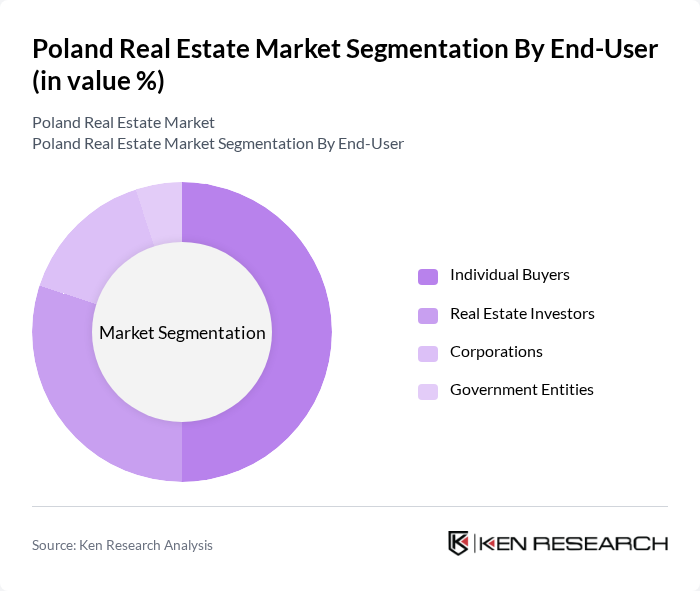

By End-User:The end-user segmentation of the real estate market in Poland includes individual buyers, real estate investors, corporations, and government entities. Individual buyers dominate the market, driven by the increasing demand for housing and favorable mortgage conditions. Real estate investors are also significant players, focusing on both residential and commercial properties for rental income and capital appreciation.

The Poland Real Estate Market is characterized by a dynamic mix of regional and international players. Leading participants such as Echo Investment S.A., Ghelamco Poland, Skanska Property Poland, Budimex Nieruchomo?ci, JLL Poland, CBRE Poland, Atal S.A., Dom Development S.A., Robyg S.A., TriGranit Development Corporation, Hines Poland, Vastint Poland, Penta Investments, Immofinanz AG, Globalworth Poland contribute to innovation, geographic expansion, and service delivery in this space.

The Poland real estate market is poised for continued growth, driven by urbanization, foreign investment, and government infrastructure initiatives. As cities expand and modernize, demand for residential and commercial properties will likely increase. Additionally, the focus on sustainability and smart city developments will shape future projects. However, challenges such as regulatory hurdles and rising construction costs may temper growth. Overall, the market is expected to adapt and evolve, presenting opportunities for innovative solutions and investment strategies.

| Segment | Sub-Segments |

|---|---|

| By Type | Residential Commercial Industrial Mixed-Use Retail Hospitality Others |

| By End-User | Individual Buyers Real Estate Investors Corporations Government Entities |

| By Region | Warsaw Krakow Wroclaw Gdansk Poznan Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Application | Residential Development Commercial Development Infrastructure Projects Urban Redevelopment |

| By Financing Type | Equity Financing Debt Financing Crowdfunding |

| By Policy Support | Subsidies Tax Exemptions Grants |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Property Buyers | 150 | First-time Homebuyers, Investors |

| Commercial Real Estate Investors | 100 | Real Estate Fund Managers, Corporate Investors |

| Property Management Firms | 80 | Property Managers, Asset Managers |

| Real Estate Agents and Brokers | 120 | Real Estate Agents, Market Analysts |

| Urban Development Planners | 70 | City Planners, Urban Development Consultants |

The Poland real estate market is valued at approximately USD 60 billion, reflecting significant growth driven by urbanization, a robust economy, and increasing demand for residential and commercial properties.