Region:Middle East

Author(s):Dev

Product Code:KRAA3513

Pages:90

Published On:September 2025

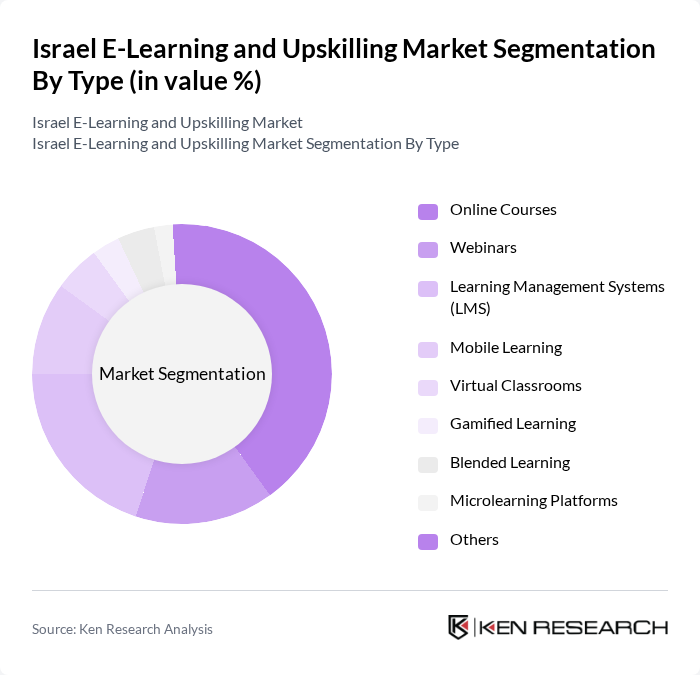

By Type:The segmentation by type includes Online Courses, Webinars, Learning Management Systems (LMS), Mobile Learning, Virtual Classrooms, Gamified Learning, Blended Learning, Microlearning Platforms, and Others. Among these, Online Courses remain the dominant subsegment, driven by the widespread preference for self-paced learning and the convenience of accessing educational content remotely. The flexibility and breadth of offerings in online courses appeal to a broad spectrum of learners, from individuals seeking personal development to organizations focused on workforce upskilling .

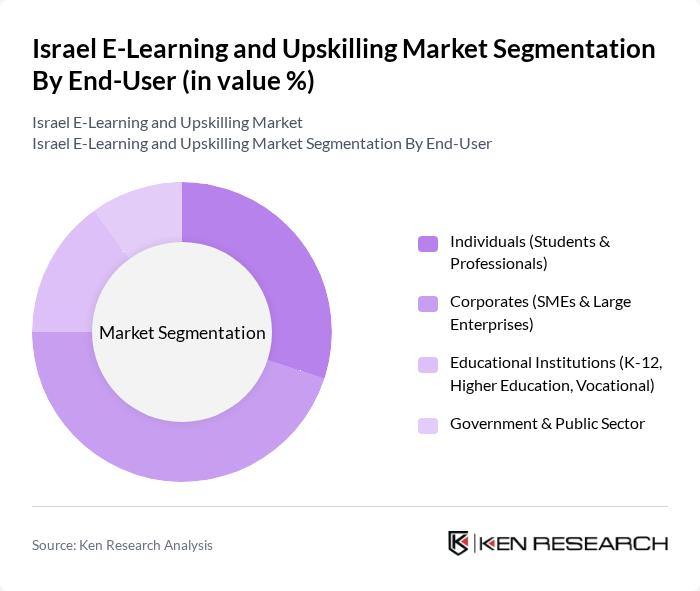

By End-User:The end-user segmentation includes Individuals (Students & Professionals), Corporates (SMEs & Large Enterprises), Educational Institutions (K-12, Higher Education, Vocational), and Government & Public Sector. The Corporates segment leads the market, as businesses increasingly prioritize upskilling to maintain competitiveness amid rapid technological change. This is reinforced by the adoption of digital training solutions, enabling organizations to efficiently deliver scalable, personalized learning experiences to their workforce .

The Israel E-Learning and Upskilling Market is characterized by a dynamic mix of regional and international players. Leading participants such as Jolt, Udemy, Coursera, edX, MindCET, Compedia, Time To Know, CodeValue, Simlat, Kaltura, Open University of Israel (Digital Campus), CodeMonkey, eTeacher Group, Appleseeds Academy, and Babbel contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Israel e-learning and upskilling market appears promising, driven by ongoing technological advancements and increasing acceptance of digital education. As more organizations recognize the importance of continuous learning, the demand for innovative e-learning solutions is expected to rise. Furthermore, the integration of artificial intelligence and personalized learning experiences will likely enhance engagement and effectiveness, positioning the market for sustained growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Online Courses Webinars Learning Management Systems (LMS) Mobile Learning Virtual Classrooms Gamified Learning Blended Learning Microlearning Platforms Others |

| By End-User | Individuals (Students & Professionals) Corporates (SMEs & Large Enterprises) Educational Institutions (K-12, Higher Education, Vocational) Government & Public Sector |

| By Application | Professional Development & Upskilling Compliance & Regulatory Training Skill Enhancement & Technical Training Certification & Exam Preparation Language & Soft Skills Training |

| By Delivery Mode | Synchronous Learning Asynchronous Learning Hybrid/Blended Learning |

| By Content Type | Video Content Text-Based Content Interactive Content Simulation-Based Content |

| By Pricing Model | Subscription-Based Pay-Per-Course Freemium Enterprise Licensing |

| By Certification Type | Accredited Certifications Non-Accredited Certifications Micro-Credentials |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| K-12 E-Learning Programs | 100 | School Administrators, Curriculum Developers |

| Higher Education Online Courses | 70 | University Lecturers, Academic Deans |

| Corporate Upskilling Initiatives | 110 | HR Managers, Training Coordinators |

| Freelance and Independent Learning | 60 | Freelancers, Independent Educators |

| Government E-Learning Programs | 50 | Policy Makers, Educational Program Directors |

The Israel E-Learning and Upskilling Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by the demand for flexible learning solutions and the rapid adoption of digital technologies in education and corporate training.