Region:Middle East

Author(s):Geetanshi

Product Code:KRAB6375

Pages:93

Published On:October 2025

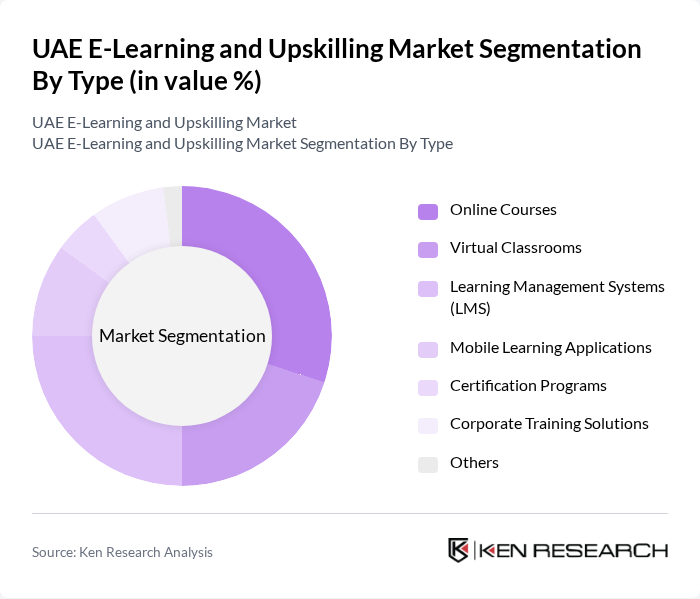

By Type:The market can be segmented into various types, including Online Courses, Virtual Classrooms, Learning Management Systems (LMS), Mobile Learning Applications, Certification Programs, Corporate Training Solutions, and Others. Among these, Online Courses and Learning Management Systems (LMS) are particularly prominent due to their accessibility and effectiveness in delivering educational content to a diverse audience.

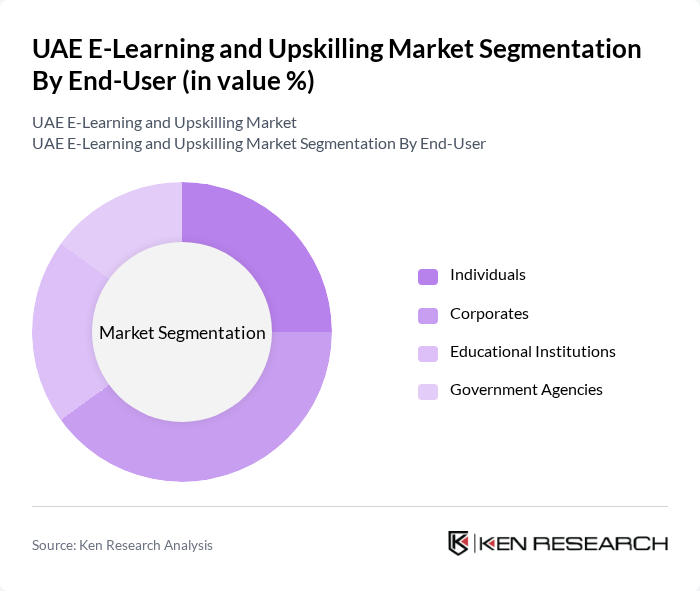

By End-User:The end-users of the market include Individuals, Corporates, Educational Institutions, and Government Agencies. Corporates are the leading end-users, driven by the need for employee training and development to keep pace with industry changes and technological advancements.

The UAE E-Learning and Upskilling Market is characterized by a dynamic mix of regional and international players. Leading participants such as Coursera, Udacity, Edraak, Skillshare, LinkedIn Learning, FutureLearn, Khan Academy, Pluralsight, Alison, Udemy, LearnSmart, TalentLMS, Simplilearn, Teachable, EdX contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE e-learning and upskilling market appears promising, driven by technological advancements and increasing acceptance of digital education. As institutions continue to integrate AI and machine learning into their platforms, personalized learning experiences will become more prevalent. Additionally, the rise of mobile learning solutions will cater to the growing demand for flexible education options. With ongoing government support and investment in educational technology, the market is poised for significant growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Online Courses Virtual Classrooms Learning Management Systems (LMS) Mobile Learning Applications Certification Programs Corporate Training Solutions Others |

| By End-User | Individuals Corporates Educational Institutions Government Agencies |

| By Application | Professional Development Academic Learning Compliance Training Skill Enhancement |

| By Delivery Mode | Synchronous Learning Asynchronous Learning Blended Learning |

| By Pricing Model | Subscription-Based Pay-Per-Course Freemium |

| By Content Type | Video-Based Learning Text-Based Learning Interactive Learning Modules |

| By Region | Abu Dhabi Dubai Sharjah Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate E-Learning Programs | 150 | HR Managers, Learning and Development Specialists |

| Higher Education Institutions | 100 | University Administrators, Faculty Members |

| Vocational Training Providers | 80 | Training Coordinators, Program Directors |

| Freelance E-Learning Developers | 70 | Content Creators, Instructional Designers |

| End-User Learners | 120 | Working Professionals, Students |

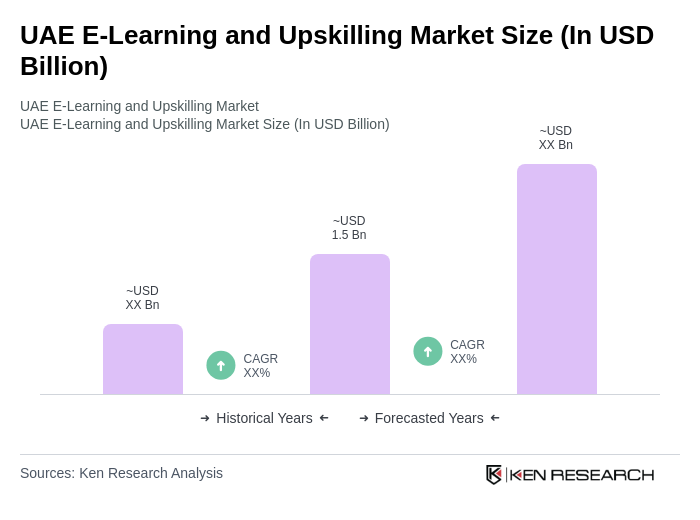

The UAE E-Learning and Upskilling Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by the demand for flexible learning solutions and the rise of digital technologies in education.