Region:Europe

Author(s):Dev

Product Code:KRAA5652

Pages:85

Published On:September 2025

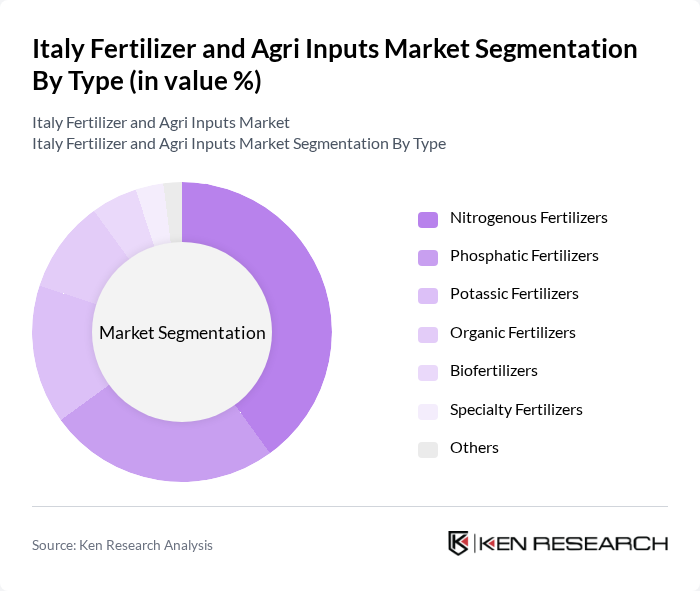

By Type:The market is segmented into various types of fertilizers, including nitrogenous, phosphatic, potassic, organic, biofertilizers, specialty fertilizers, and others. Among these, nitrogenous fertilizers are the most widely used due to their essential role in crop growth and yield enhancement. Organic fertilizers are gaining traction as farmers increasingly seek sustainable alternatives to chemical inputs.

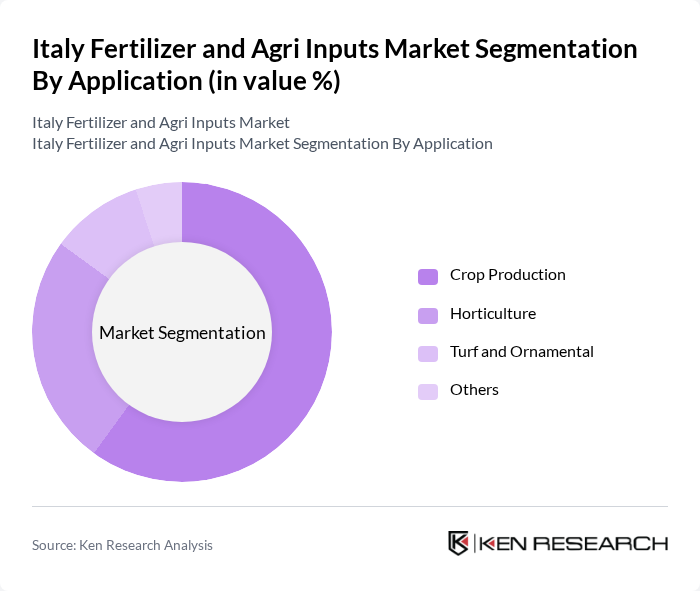

By Application:The market is segmented based on applications, including crop production, horticulture, turf and ornamental, and others. Crop production is the leading application segment, driven by the need for increased food production to meet the demands of a growing population. Horticulture is also significant, particularly in regions known for fruit and vegetable cultivation.

The Italy Fertilizer and Agri Inputs Market is characterized by a dynamic mix of regional and international players. Leading participants such as Yara International ASA, BASF SE, Nutrien Ltd., Syngenta AG, Haifa Group, ICL Group Ltd., K+S AG, EuroChem Group AG, CF Industries Holdings, Inc., Solvay S.A., FMC Corporation, UPL Limited, Adama Agricultural Solutions Ltd., Corteva Agriscience, Nufarm Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Italy fertilizer and agri inputs market appears promising, driven by the increasing adoption of sustainable practices and technological innovations. As farmers seek to enhance productivity while adhering to environmental regulations, the demand for eco-friendly fertilizers and precision agriculture solutions is expected to rise. Additionally, the expansion of digital farming technologies will likely facilitate better resource management, further supporting growth in this sector. Overall, the market is poised for transformation, aligning with global sustainability trends.

| Segment | Sub-Segments |

|---|---|

| By Type | Nitrogenous Fertilizers Phosphatic Fertilizers Potassic Fertilizers Organic Fertilizers Biofertilizers Specialty Fertilizers Others |

| By Application | Crop Production Horticulture Turf and Ornamental Others |

| By End-User | Farmers Agricultural Cooperatives Distributors Others |

| By Distribution Channel | Direct Sales Retail Outlets Online Sales Others |

| By Region | Northern Italy Central Italy Southern Italy Islands |

| By Price Range | Low Price Mid Price High Price |

| By Policy Support | Subsidies Tax Exemptions Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fertilizer Retailers | 150 | Store Managers, Sales Representatives |

| Agrochemical Distributors | 100 | Distribution Managers, Logistics Coordinators |

| Farmers (Various Crop Types) | 200 | Crop Farmers, Agricultural Cooperatives |

| Agri-input Manufacturers | 80 | Product Managers, R&D Specialists |

| Agricultural Consultants | 60 | Agronomists, Farm Advisors |

The Italy Fertilizer and Agri Inputs Market is valued at approximately USD 5 billion, reflecting a significant growth driven by increasing food production demands, advancements in agricultural technology, and a shift towards sustainable farming practices.