Region:Europe

Author(s):Rebecca

Product Code:KRAB2867

Pages:92

Published On:October 2025

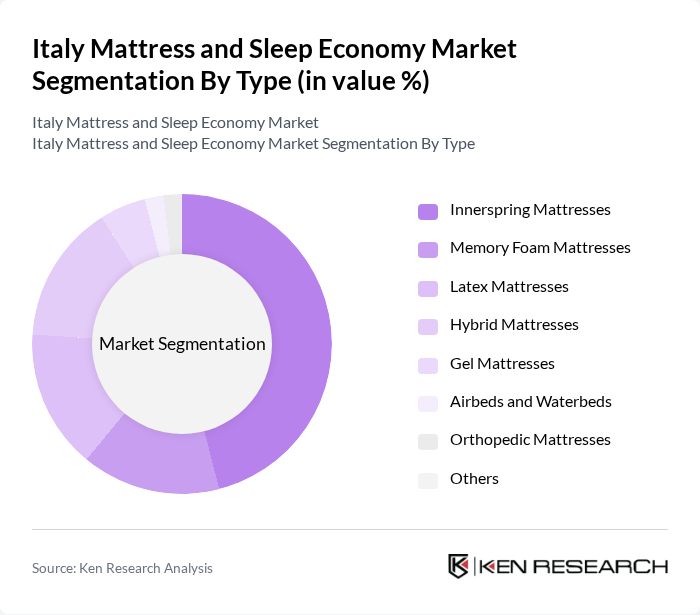

By Type:The mattress market is segmented into innerspring, memory foam, latex, hybrid, gel, airbeds and waterbeds, orthopedic mattresses, and others. Innerspring mattresses currently hold the largest market share due to their affordability and widespread availability, particularly in the hospitality sector. Memory foam mattresses have gained significant popularity for their comfort, support, and ability to cater to personalized sleep solutions, with foam-based mattresses registering the fastest growth. Hybrid mattresses are increasingly favored for combining support and comfort, while latex mattresses are sought after for their durability and eco-friendly attributes.

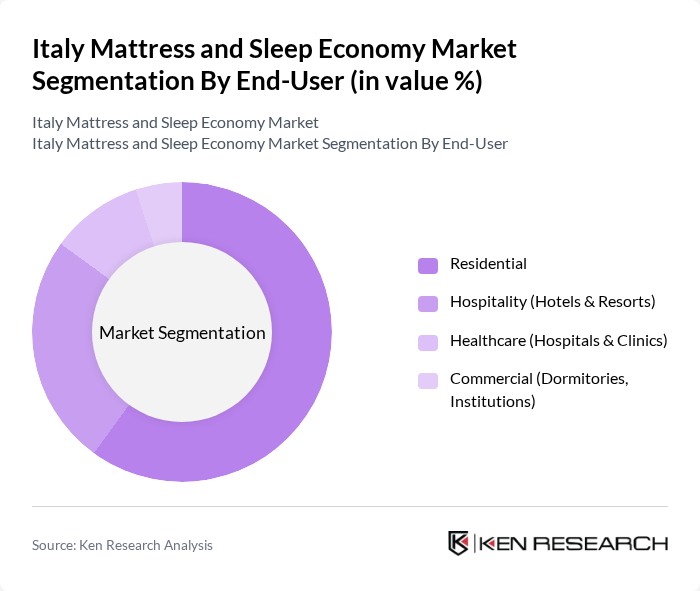

By End-User:The end-user segmentation includes residential, hospitality (hotels & resorts), healthcare (hospitals & clinics), and commercial (dormitories, institutions). The residential segment dominates the market, driven by increasing consumer spending on home comfort and wellness, as well as rising home ownership rates. The hospitality sector remains significant, as hotels and resorts seek to enhance guest experiences through high-quality mattresses. The healthcare segment is expanding due to the rising demand for specialized mattresses that support patient comfort and recovery.

The Italy Mattress and Sleep Economy Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tempur Sealy International, Inc., IKEA, Simmons Bedding Company, Emma – The Sleep Company, Dorelan (B&T S.p.A.), Magniflex (Giovanni Magni S.r.l.), Sealy, Materassi.com (Baldiflex S.r.l.), Mondo Convenienza, PerDormire (Materassificio Montalese S.p.A.), Serta Simmons Bedding, Hilding Anders, Flex Bedding Group, Ennerev S.r.l., Manifattura Falomo S.r.l. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Italy mattress and sleep economy market appears promising, driven by evolving consumer preferences and technological advancements. As awareness of sleep health continues to rise, manufacturers are likely to innovate with smart mattresses that integrate sleep tracking technology. Additionally, the demand for eco-friendly products is expected to grow, prompting companies to invest in sustainable materials and practices. This shift will not only enhance product offerings but also align with consumer values, fostering brand loyalty and market growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Innerspring Mattresses Memory Foam Mattresses Latex Mattresses Hybrid Mattresses Gel Mattresses Airbeds and Waterbeds Orthopedic Mattresses Others |

| By End-User | Residential Hospitality (Hotels & Resorts) Healthcare (Hospitals & Clinics) Commercial (Dormitories, Institutions) |

| By Sales Channel | Specialized Mattress Stores Furniture Retail Chains Online Retail/E-commerce Direct-to-Consumer Distributors/Wholesale |

| By Price Range | Budget Mid-Range Premium/Luxury |

| By Material | Polyurethane Foam Latex Metal Springs Natural Fibers (Cotton, Wool, etc.) Others |

| By Distribution Mode | Direct-to-Consumer Retail Partnerships E-commerce Platforms |

| By Brand Positioning | Luxury Brands Value Brands Eco-Friendly Brands Technology-Integrated Brands |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Mattress Purchases | 120 | Homeowners, Renters aged 25-55 |

| Healthcare Professional Insights | 60 | Sleep Specialists, General Practitioners |

| Retailer Feedback on Sales Trends | 50 | Store Managers, Sales Representatives |

| Online Shopping Behavior | 90 | Frequent Online Shoppers, E-commerce Users |

| Market Trends and Innovations | 40 | Product Developers, Industry Analysts |

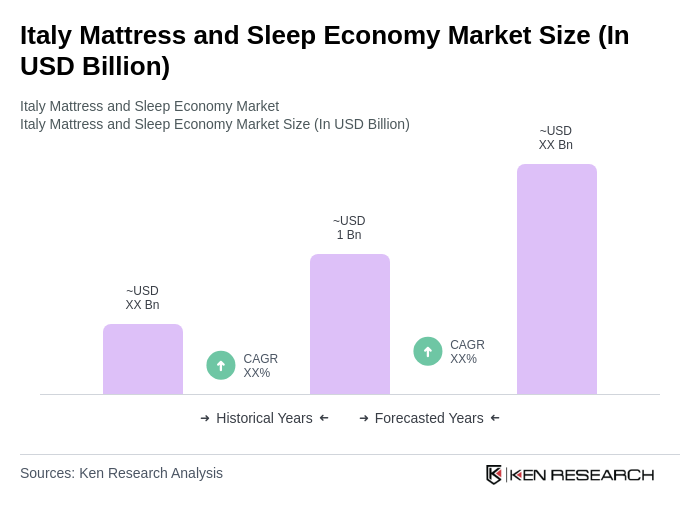

The Italy Mattress and Sleep Economy Market is valued at approximately USD 1 billion, reflecting a five-year historical analysis. This growth is attributed to increased consumer awareness of sleep health and rising disposable incomes.