Region:Asia

Author(s):Geetanshi

Product Code:KRAB6381

Pages:97

Published On:October 2025

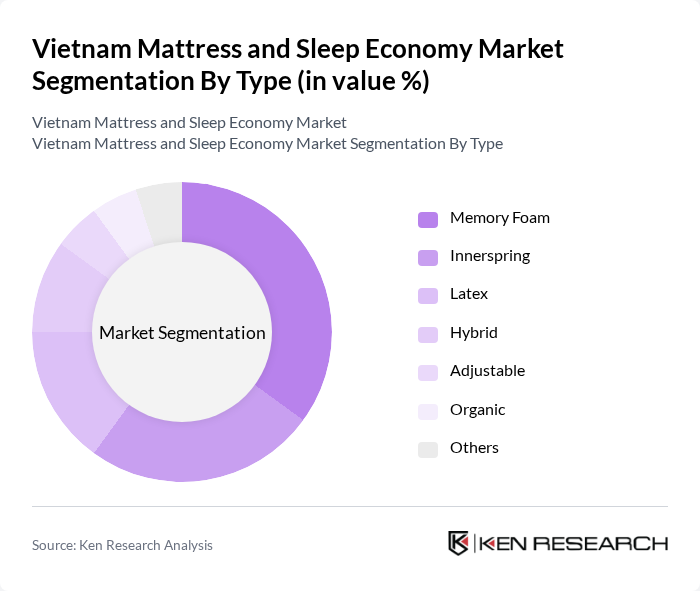

By Type:The mattress market can be segmented into various types, including Memory Foam, Innerspring, Latex, Hybrid, Adjustable, Organic, and Others. Among these, Memory Foam mattresses are currently dominating the market due to their superior comfort and support, which cater to the growing consumer awareness regarding sleep quality. The increasing trend of online shopping has also facilitated the accessibility of these products, further driving their popularity.

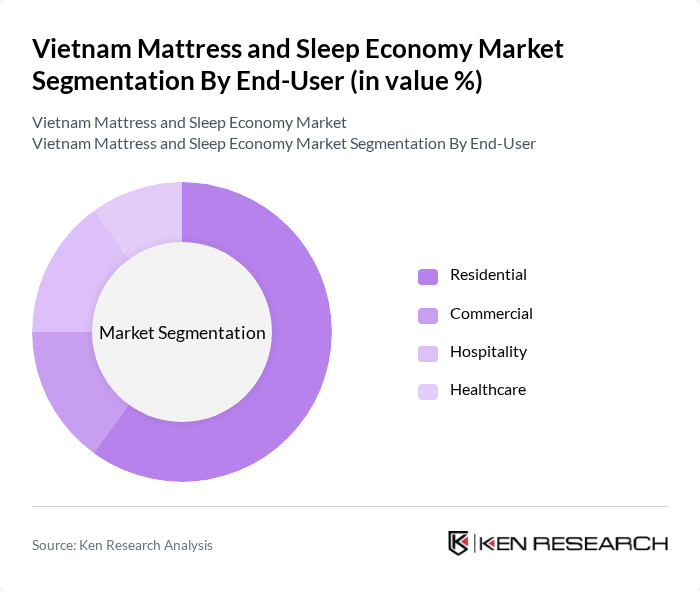

By End-User:The end-user segmentation includes Residential, Commercial, Hospitality, and Healthcare. The Residential segment is the largest, driven by the increasing number of households and the rising awareness of the importance of sleep health. The growing trend of home improvement and interior design also contributes to the demand for quality mattresses in residential settings.

The Vietnam Mattress and Sleep Economy Market is characterized by a dynamic mix of regional and international players. Leading participants such as Vinafoam, Hanvico, Everon, Liên Á, Dunlopillo, Kymdan, Tempur, Sleep Center, Mattress Firm, IKEA, Zinus, Sealy, Serta, Simmons, King Koil contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam mattress market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As smart mattress technology gains traction, manufacturers are likely to innovate with features that enhance sleep quality. Additionally, the trend towards eco-friendly products will shape consumer choices, with a growing segment prioritizing sustainability. The expansion into tier 2 and tier 3 cities will further broaden market reach, presenting opportunities for brands to tap into previously underserved demographics, thus enhancing overall market potential.

| Segment | Sub-Segments |

|---|---|

| By Type | Memory Foam Innerspring Latex Hybrid Adjustable Organic Others |

| By End-User | Residential Commercial Hospitality Healthcare |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Wholesale |

| By Price Range | Budget Mid-range Premium |

| By Material | Foam Fabric Metal Wood |

| By Brand Positioning | Luxury Value-for-Money Budget |

| By Consumer Demographics | Age Group Income Level Lifestyle Preferences |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Mattress Purchases | 150 | Homeowners, Renters aged 25-55 |

| Retail Mattress Sales Insights | 100 | Store Managers, Sales Representatives |

| Health and Sleep Quality Perspectives | 80 | Sleep Specialists, Health Practitioners |

| Online Mattress Shopping Behavior | 120 | eCommerce Shoppers, Digital Marketing Experts |

| Trends in Sleep Accessories | 90 | Product Designers, Retail Buyers |

The Vietnam Mattress and Sleep Economy Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by rising disposable incomes, urbanization, and an increasing focus on health and wellness among consumers.