Region:Europe

Author(s):Rebecca

Product Code:KRAA0350

Pages:82

Published On:August 2025

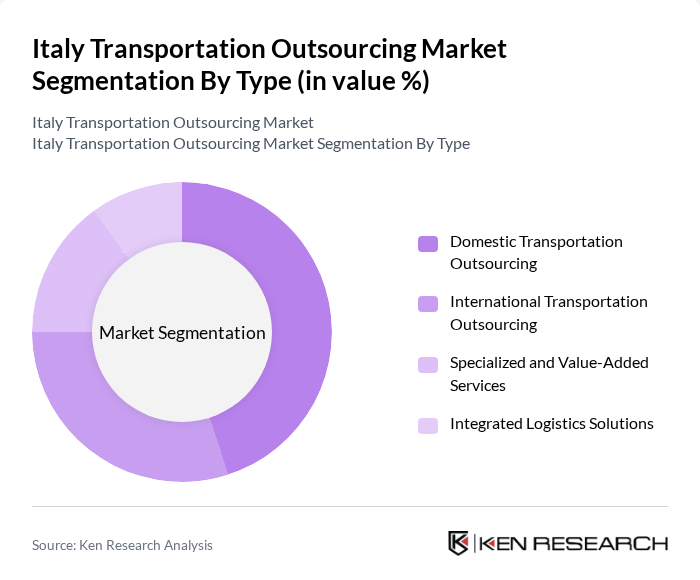

By Type:The transportation outsourcing market can be segmented into four main types: Domestic Transportation Outsourcing, International Transportation Outsourcing, Specialized and Value-Added Services, and Integrated Logistics Solutions. Domestic Transportation Outsourcing is currently the leading segment, driven by the increasing demand for local deliveries, robust internal logistics networks, and the rapid growth of e-commerce. Companies are focusing on optimizing their supply chains, leading to a higher reliance on domestic logistics providers. International Transportation Outsourcing is also significant, as businesses expand their global reach and require efficient cross-border logistics solutions. The growth of cross-border e-commerce and Italy’s strategic location as a European logistics hub further support this segment .

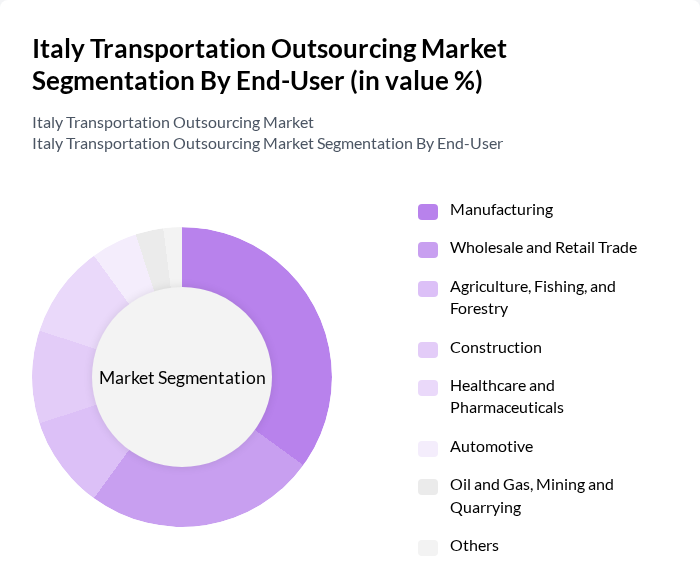

By End-User:The end-user segmentation includes Manufacturing, Wholesale and Retail Trade, Agriculture, Fishing, and Forestry, Construction, Healthcare and Pharmaceuticals, Automotive, Oil and Gas, Mining and Quarrying, and Others. The Manufacturing sector is the dominant end-user, requiring extensive logistics support for raw materials and finished goods, and is supported by Italy's position as the second-largest manufacturing base in Europe. The growth of e-commerce has significantly impacted the Wholesale and Retail Trade segment, increasing demand for efficient transportation solutions. Healthcare and Pharmaceuticals is an emerging area due to the need for timely and secure delivery of medical supplies, especially in response to heightened regulatory and safety requirements .

The Italy Transportation Outsourcing Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, Kuehne + Nagel, XPO Logistics, Geodis, DB Schenker, DSV, CEVA Logistics (CMA CGM Group), UPS Supply Chain Solutions, FedEx Logistics, Poste Italiane, Fercam, Arcese Trasporti, Rhenus Logistics, Savino Del Bene, and Bolloré Logistics contribute to innovation, geographic expansion, and service delivery in this space.

The future of the transportation outsourcing market in Italy appears promising, driven by technological advancements and a growing emphasis on sustainability. As companies increasingly adopt digital platforms for logistics management, efficiency is expected to improve significantly. Additionally, the push for greener logistics solutions will likely reshape service offerings, with a focus on electric vehicles and reduced emissions. This evolving landscape presents opportunities for innovative logistics providers to capture market share and enhance service delivery.

| Segment | Sub-Segments |

|---|---|

| By Type | Domestic Transportation Outsourcing International Transportation Outsourcing Specialized and Value-Added Services Integrated Logistics Solutions |

| By End-User | Manufacturing Wholesale and Retail Trade Agriculture, Fishing, and Forestry Construction Healthcare and Pharmaceuticals Automotive Oil and Gas, Mining and Quarrying Others |

| By Mode of Transport | Road Transport Rail Transport Air Transport Sea Transport Intermodal Transport |

| By Service Type | Second-Party Logistics (2PL) Third-Party Logistics (3PL) Fourth-Party Logistics (4PL) Freight Forwarding Warehousing and Distribution Others |

| By Industry Vertical | Automotive Consumer Goods Electronics Food and Beverage Chemicals Others |

| By Geographic Coverage | Northern Italy Central Italy Southern Italy Islands (Sicily, Sardinia) Others |

| By Customer Type | B2B B2C Government/Public Sector Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Road Transportation Outsourcing | 100 | Logistics Managers, Fleet Operations Directors |

| Rail Freight Services | 60 | Operations Managers, Supply Chain Analysts |

| Air Cargo Management | 40 | Airline Logistics Coordinators, Freight Forwarding Managers |

| Maritime Shipping Outsourcing | 50 | Port Operations Managers, Shipping Line Executives |

| Integrated Logistics Solutions | 70 | Business Development Managers, Contract Logistics Specialists |

The Italy Transportation Outsourcing Market is valued at approximately USD 5 billion, driven by the increasing demand for efficient logistics solutions, the rise of e-commerce, and the need for cost-effective transportation services.