Region:Middle East

Author(s):Geetanshi

Product Code:KRAA1947

Pages:86

Published On:August 2025

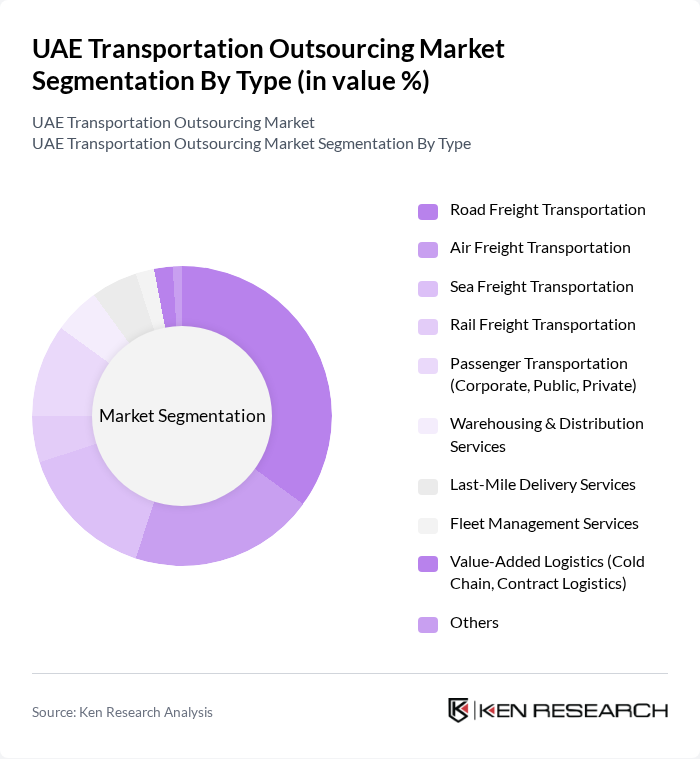

By Type:The market is segmented into various types, including Road Freight Transportation, Air Freight Transportation, Sea Freight Transportation, Rail Freight Transportation, Passenger Transportation (Corporate, Public, Private), Warehousing & Distribution Services, Last-Mile Delivery Services, Fleet Management Services, Value-Added Logistics (Cold Chain, Contract Logistics), and Others. Among these,Road Freight Transportationis the most dominant segment due to its extensive use in the distribution of goods across the UAE's well-developed road network. The increasing demand for timely deliveries, the rise of e-commerce, and the integration of digital fleet management solutions have further propelled this segment's growth.

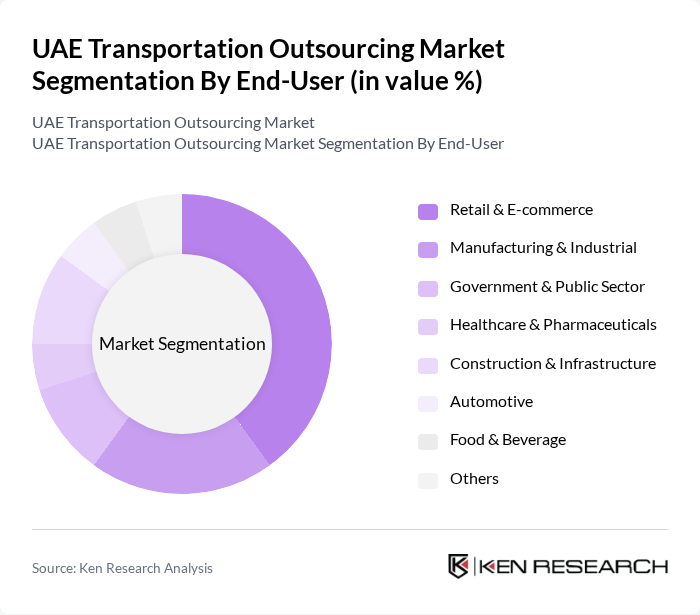

By End-User:The end-user segmentation includes Retail & E-commerce, Manufacturing & Industrial, Government & Public Sector, Healthcare & Pharmaceuticals, Construction & Infrastructure, Automotive, Food & Beverage, and Others. TheRetail & E-commercesegment is leading the market, driven by the exponential growth of online shopping, omnichannel retail strategies, and the need for efficient logistics solutions to meet consumer demands. This segment's growth is further supported by the increasing reliance on technology, digital platforms for order fulfillment, and the adoption of value-added logistics services such as real-time tracking and flexible delivery options.

The UAE Transportation Outsourcing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Emirates Logistics LLC, Aramex PJSC, DHL Supply Chain UAE, Agility Logistics UAE, Abu Dhabi Ports Group, DP World UAE Region, FedEx Express UAE, UPS Supply Chain Solutions UAE, Al-Futtaim Logistics, Al Naboodah Group Enterprises, Gulf Agency Company (GAC) UAE, Kuehne + Nagel UAE, DB Schenker UAE, CEVA Logistics UAE, and MENA Transport LLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE transportation outsourcing market appears promising, driven by technological advancements and increasing demand for integrated logistics solutions. As businesses seek to enhance operational efficiency, the adoption of digital platforms and automation will likely accelerate. Furthermore, the focus on sustainability will push companies to innovate in green logistics, aligning with global trends. Overall, the market is poised for growth, supported by ongoing government initiatives and evolving consumer preferences.

| Segment | Sub-Segments |

|---|---|

| By Type | Road Freight Transportation Air Freight Transportation Sea Freight Transportation Rail Freight Transportation Passenger Transportation (Corporate, Public, Private) Warehousing & Distribution Services Last-Mile Delivery Services Fleet Management Services Value-Added Logistics (Cold Chain, Contract Logistics) Others |

| By End-User | Retail & E-commerce Manufacturing & Industrial Government & Public Sector Healthcare & Pharmaceuticals Construction & Infrastructure Automotive Food & Beverage Others |

| By Service Model | Third-Party Logistics (3PL) Fourth-Party Logistics (4PL) Dedicated Contract Carriage Freight Forwarding Warehousing & Distribution Others |

| By Delivery Mode | Road Transportation Rail Transportation Air Transportation Sea Transportation Multimodal Transportation Others |

| By Geographic Coverage | Urban Areas Suburban Areas Rural Areas Cross-Border Transportation Free Zones & Industrial Parks Others |

| By Customer Type | B2B B2C Government Contracts Others |

| By Pricing Model | Fixed Pricing Variable Pricing Subscription-Based Pricing Performance-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Road Freight Outsourcing | 70 | Logistics Managers, Fleet Operations Directors |

| Air Cargo Services | 50 | Air Freight Managers, Supply Chain Coordinators |

| Maritime Logistics | 40 | Port Operations Managers, Shipping Coordinators |

| Public Transport Outsourcing | 40 | Transport Planners, Public Sector Officials |

| Last-Mile Delivery Services | 50 | Last-Mile Operations Managers, E-commerce Logistics Heads |

The UAE Transportation Outsourcing Market is valued at approximately USD 2.1 billion, driven by the growth of e-commerce, demand for integrated logistics solutions, and investments in transportation infrastructure.