Region:Europe

Author(s):Dev

Product Code:KRAB3028

Pages:95

Published On:October 2025

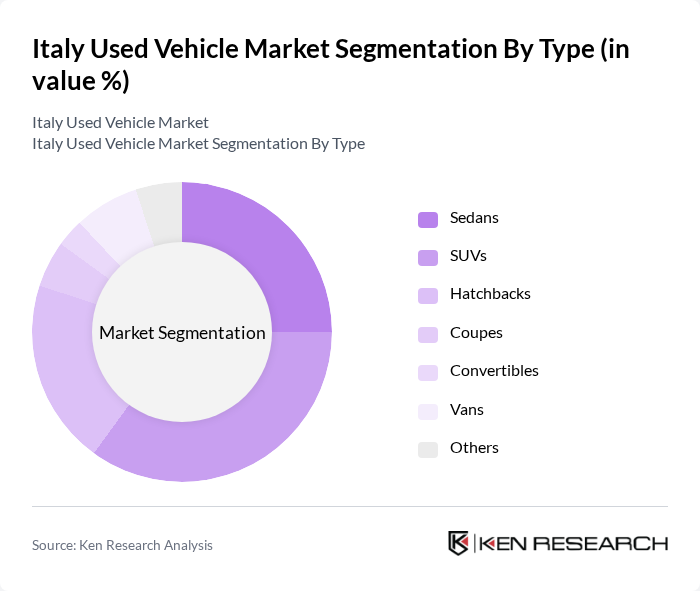

By Type:The used vehicle market in Italy is segmented into various types, including Sedans, SUVs, Hatchbacks, Coupes, Convertibles, Vans, and Others. Among these, SUVs have gained significant popularity due to their versatility and spaciousness, appealing to families and adventure-seekers alike. Sedans remain a strong contender, favored for their fuel efficiency and comfort. The demand for Hatchbacks is also notable, particularly among urban dwellers seeking compact vehicles for city driving.

By Age of Vehicle:The segmentation by age of vehicle includes categories such as 0-3 Years, 4-7 Years, 8-10 Years, and 10+ Years. The 4-7 Years category dominates the market, as these vehicles often strike a balance between affordability and reliability. Consumers are increasingly inclined to purchase slightly older vehicles that have already depreciated in value, making them a cost-effective choice. The 0-3 Years segment is also growing, driven by the availability of certified pre-owned options.

The Italy Used Vehicle Market is characterized by a dynamic mix of regional and international players. Leading participants such as AutoScout24, Subito.it, eBay Annunci, CarNext, DriveK, Vroom, AutoTrader, BCA Italy, CarGurus, Motori.it, Quattroruote, SitoAuto, FindMyCar, CarWow, AutoPal contribute to innovation, geographic expansion, and service delivery in this space.

The future of the used vehicle market in Italy appears promising, driven by ongoing digitalization and changing consumer preferences. As online platforms continue to evolve, they will likely enhance the buying experience, making it more convenient for consumers. Additionally, the increasing focus on sustainability will further boost the demand for used electric and hybrid vehicles, aligning with government policies aimed at promoting eco-friendly transportation solutions. Overall, the market is poised for steady growth, adapting to emerging trends and consumer needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Sedans SUVs Hatchbacks Coupes Convertibles Vans Others |

| By Age of Vehicle | 3 Years 7 Years 10 Years + Years |

| By Condition | Certified Pre-Owned Non-Certified |

| By Sales Channel | Online Marketplaces Dealerships Auctions Private Sales |

| By Financing Options | Cash Purchases Loans Leases |

| By Geographic Distribution | Northern Italy Central Italy Southern Italy |

| By Brand | Domestic Brands European Brands Asian Brands American Brands |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Used Car Dealerships | 150 | Dealership Owners, Sales Managers |

| Consumer Vehicle Purchases | 200 | Recent Used Vehicle Buyers, Automotive Enthusiasts |

| Automotive Financing Institutions | 100 | Loan Officers, Financial Advisors |

| Vehicle Inspection Services | 80 | Inspection Technicians, Service Managers |

| Automotive Aftermarket Suppliers | 70 | Product Managers, Sales Representatives |

The Italy Used Vehicle Market is valued at approximately USD 15 billion, reflecting a significant increase in consumer demand for affordable transportation options and a growing trend towards sustainability in vehicle ownership.