Region:Asia

Author(s):Dev

Product Code:KRAB0405

Pages:87

Published On:August 2025

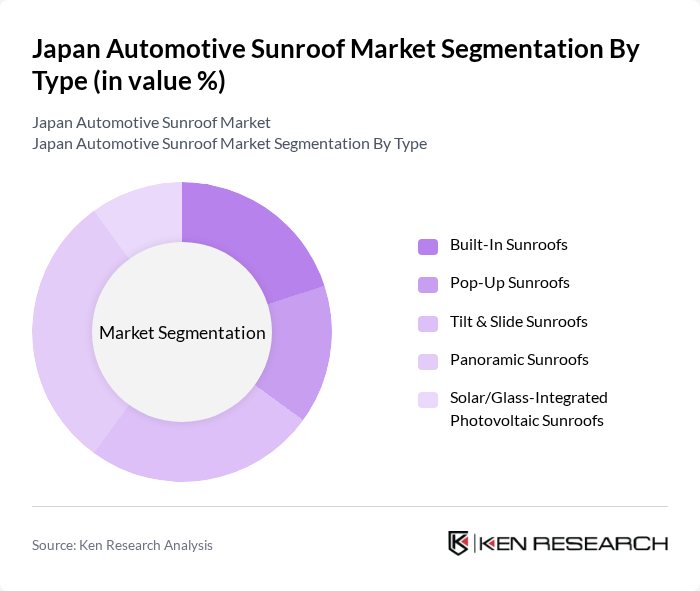

By Type:The market is segmented into various types of sunroofs, each catering to different consumer preferences and vehicle designs. The primary types include Built-In Sunroofs, Pop-Up Sunroofs, Tilt & Slide Sunroofs, Panoramic Sunroofs, and Solar/Glass-Integrated Photovoltaic Sunroofs. Among these, Panoramic Sunroofs have gained significant popularity due to their ability to provide an expansive view and enhance the overall driving experience. This segment appeals particularly to consumers seeking luxury and spaciousness in their vehicles.

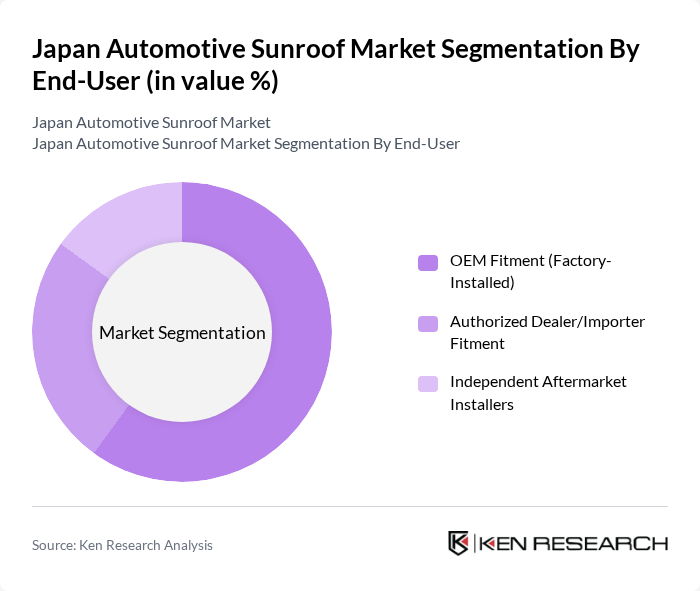

By End-User:The market is also segmented based on end-user categories, which include OEM Fitment (Factory-Installed), Authorized Dealer/Importer Fitment, and Independent Aftermarket Installers. The OEM Fitment segment is the largest, driven by the increasing trend of manufacturers offering sunroofs as standard or optional features in new vehicles. This segment benefits from the growing demand for premium vehicles that often come equipped with advanced sunroof options.

The Japan Automotive Sunroof Market is characterized by a dynamic mix of regional and international players. Leading participants such as Webasto SE, Inalfa Roof Systems, Yachiyo Industry Co., Ltd., Aisin Corporation, Inteva Products, Magna International Inc., CIE Automotive, AGC Inc. (AGC Automotive), Saint-Gobain Sekurit, Fuyao Glass Industry Group Co., Ltd., Donghee Co., Ltd., BOS Group, Nippon Sheet Glass Co., Ltd. (NSG Pilkington), Koito Manufacturing Co., Ltd., DENSO Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the automotive sunroof market in Japan appears promising, driven by ongoing trends in vehicle electrification and consumer preferences for innovative features. As electric vehicle sales are projected to reach 1.2 million units in future, manufacturers are likely to integrate sunroofs as standard features. Additionally, the increasing focus on sustainability will push for eco-friendly materials in sunroof production, aligning with consumer demand for greener automotive solutions. This evolving landscape presents significant opportunities for growth and innovation in the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Built-In Sunroofs Pop-Up Sunroofs Tilt & Slide Sunroofs Panoramic Sunroofs Solar/Glass-Integrated Photovoltaic Sunroofs |

| By End-User | OEM Fitment (Factory-Installed) Authorized Dealer/Importer Fitment Independent Aftermarket Installers |

| By Vehicle Type | Hatchbacks Sedans SUVs and Crossovers Luxury/Premium Vehicles |

| By Material | Glass Fabric Other Materials (e.g., Polycarbonate/Composites) |

| By Distribution Channel | Direct to OEM (Tier-1 Supply) Dealer/Distributor Network E-commerce and Online Retail |

| By Price Range | Entry/Budget Mid-Range Premium |

| By Region | Kanto Kansai Chubu Hokkaido/Tohoku Chugoku/Shikoku Kyushu/Okinawa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| OEMs in Automotive Manufacturing | 90 | Product Managers, R&D Engineers |

| Suppliers of Sunroof Components | 80 | Supply Chain Managers, Quality Assurance Leads |

| Automotive Design Firms | 60 | Design Engineers, Innovation Managers |

| Aftermarket Sunroof Installers | 50 | Business Owners, Installation Technicians |

| Consumer Insights on Sunroof Preferences | 120 | Car Owners, Automotive Enthusiasts |

The Japan Automotive Sunroof Market is valued at approximately USD 900 million, reflecting a five-year historical analysis. This growth is driven by increasing consumer demand for vehicle aesthetics and comfort, particularly in the context of rising electric vehicle popularity.