Region:Middle East

Author(s):Rebecca

Product Code:KRAC8614

Pages:82

Published On:November 2025

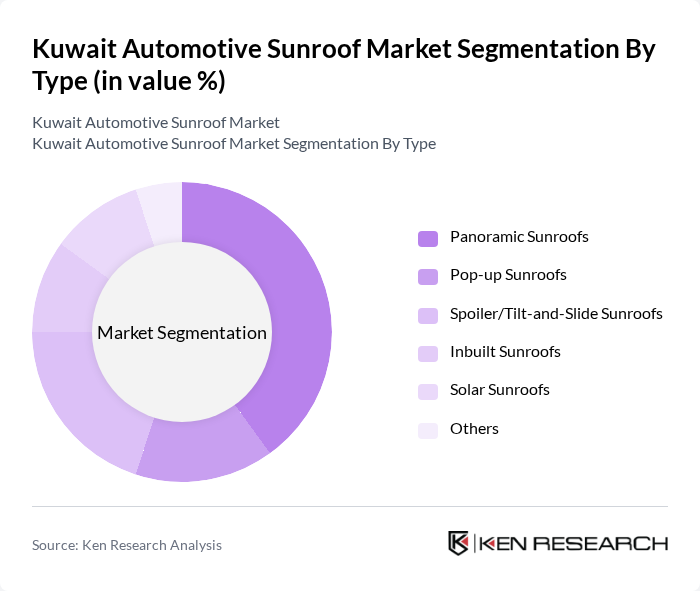

By Type:The market is segmented into various types of sunroofs, including Panoramic Sunroofs, Pop-up Sunroofs, Spoiler/Tilt-and-Slide Sunroofs, Inbuilt Sunroofs, Solar Sunroofs, and Others. Among these,Panoramic Sunroofsare gaining significant traction due to their aesthetic appeal and ability to enhance the driving experience by providing a larger view of the sky. The trend towards luxury and spacious interiors in vehicles, as well as the integration of solar panels for auxiliary power and improved energy efficiency, is driving demand for this sub-segment .

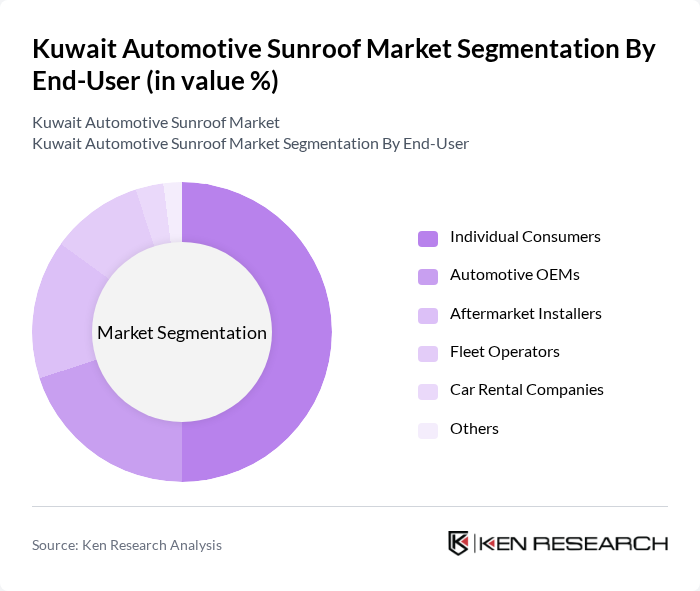

By End-User:The end-user segmentation includes Individual Consumers, Automotive OEMs, Aftermarket Installers, Fleet Operators, Car Rental Companies, and Others.Individual Consumersare the leading segment, driven by the growing preference for personalized vehicle features and luxury options. The increasing disposable income among consumers in Kuwait, along with a strong demand for advanced sunroof technologies in new and premium vehicles, has led to a rise in purchases equipped with sunroof systems .

The Kuwait Automotive Sunroof Market is characterized by a dynamic mix of regional and international players. Leading participants such as Webasto Group, Inalfa Roof Systems Group B.V., Yachiyo Industry Co., Ltd., Aisin Corporation, Magna International Inc., CIE Automotive S.A., Inteva Products, LLC, Johnan Manufacturing Inc., BOS Group, Signature Automotive Products, Mobitech Industries, Saint-Gobain Sekurit, AGC Inc. (Asahi Glass Co.), Fuyao Glass Industry Group Co., Ltd., Pilkington Group Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait automotive sunroof market appears promising, driven by increasing consumer interest in luxury features and technological advancements. As the automotive industry shifts towards electric vehicles, the integration of sunroofs in these models is expected to rise. Additionally, the growing trend of customization among consumers will likely lead to more tailored sunroof options, enhancing their appeal. Overall, the market is poised for growth as awareness and demand for sunroofs continue to expand.

| Segment | Sub-Segments |

|---|---|

| By Type | Panoramic Sunroofs Pop-up Sunroofs Spoiler/Tilt-and-Slide Sunroofs Inbuilt Sunroofs Solar Sunroofs Others |

| By End-User | Individual Consumers Automotive OEMs Aftermarket Installers Fleet Operators Car Rental Companies Others |

| By Vehicle Type | Sedans SUVs Hatchbacks Luxury Vehicles Electric Vehicles Others |

| By Material | Glass Sunroofs Polycarbonate Sunroofs Fabric Sunroofs Others |

| By Distribution Channel | Direct Sales Online Retail Automotive Dealerships Aftermarket Stores Others |

| By Price Range | Budget Mid-Range Premium Luxury Others |

| By Policy Support | Subsidies for automotive enhancements Tax incentives for eco-friendly vehicles Grants for research and development Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Manufacturers | 50 | Product Managers, R&D Engineers |

| Automotive Dealers | 60 | Sales Managers, Marketing Directors |

| Aftermarket Suppliers | 40 | Procurement Managers, Business Development Executives |

| Consumer Insights | 100 | Car Owners, Potential Buyers |

| Automotive Technology Experts | 40 | Automotive Engineers, Technology Consultants |

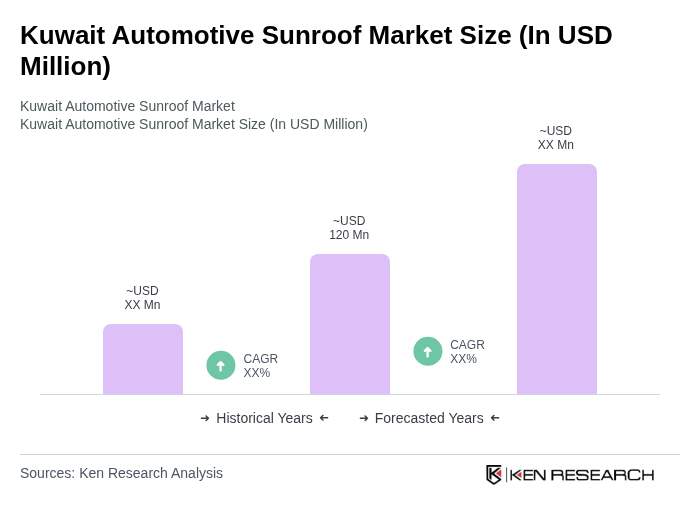

The Kuwait Automotive Sunroof Market is valued at approximately USD 120 million, reflecting a growing consumer demand for luxury vehicles and advanced sunroof technologies, including solar-powered and panoramic options.